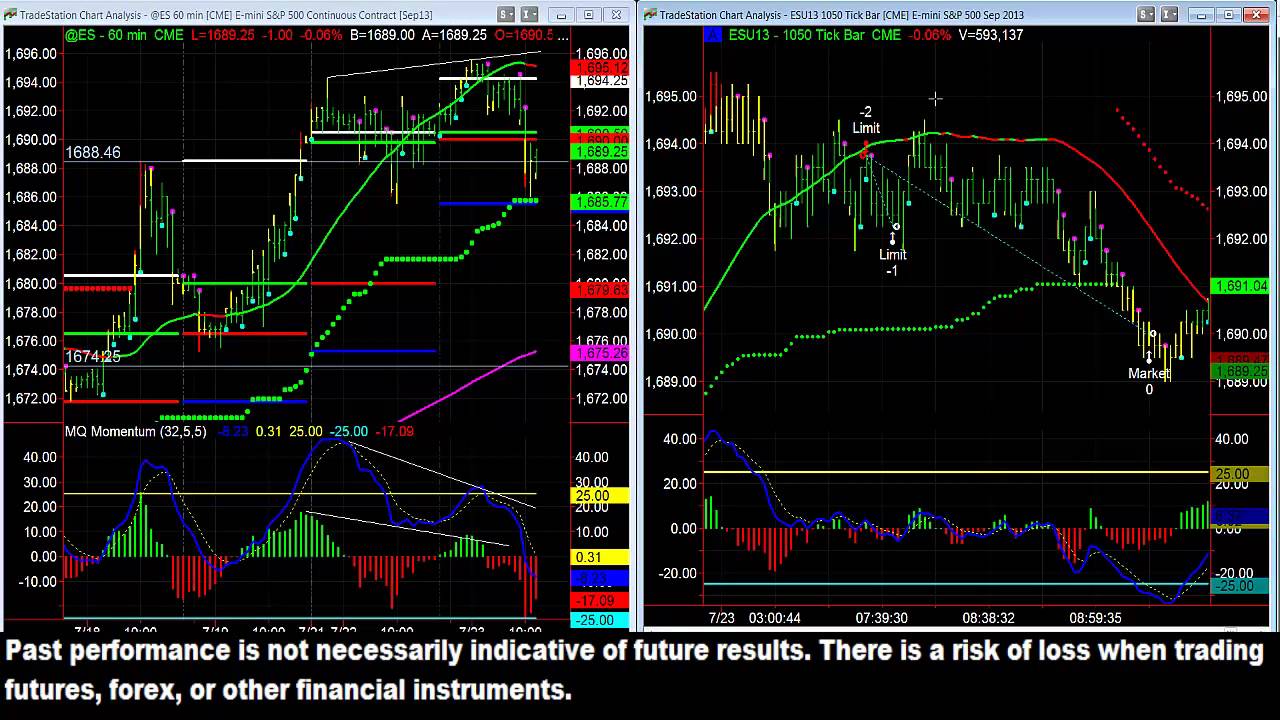

Futures – Bearish Divergence in ES Results in Good Trade – July 23, 2013

Best updated videos about Trade Plan, Forex Software, Forex Swing Trading, and Bearish Divergence Stochastic, Futures – Bearish Divergence in ES Results in Good Trade – July 23, 2013.

Jim Alswager from http://www.valuecharts.com discusses the Live Trading Room Trade of the Day that was made utilizing technology from ValueCharts®. To learn more about ValueCharts® visit http://www.valuecharts.com today!

Trading or investing carries a high level of risk, and is not suitable for all persons. Before deciding to trade or invest you should carefully consider your investment objectives, level of experience, and ability to tolerate risk. This content is subject to change at any time without notice, and is provided for the sole purpose of education and assistance in making independent investment decisions. ValueCharts.com has taken reasonable measures to ensure the accuracy of the information contained herein; however, ValueCharts.com does not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or from an inability to access such information or any delay in or failure of the transmission or the receipt of any instruction or notification in connection therewith. Any past performance results are shown for illustration and example only, are hypothetical and as such have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Past performance is not necessarily indicative of future results.

Bearish Divergence Stochastic, Futures – Bearish Divergence in ES Results in Good Trade – July 23, 2013.

Forex Pattern Analysis – How To Figure Out When The Best Time Is To Sell

The ones you choose are a matter of individual choice but I like the ADX, RSI and stochastic. There is a firm resistance expected with a double too at the 80.0 level of the RSI. The 2 charts being the 5 minute and 60 minute EUR/USD.

Futures – Bearish Divergence in ES Results in Good Trade – July 23, 2013, Play new complete videos relevant with Bearish Divergence Stochastic.

Online Forex Trading – A Simple Effective Method Making Big Profits

The application is, as always, price and time. Without a stop loss, do you understand that you can eliminate your trading account really quickly? Capturing the huge long term patterns and these only come a couple of times a year.

The foreign currency trading market, better known as the Forex, is without a doubt the biggest market worldwide. In excess of two trillion dollars are traded on it each and every day, while ‘just’ 50 billion dollars are traded on the world’s biggest stock market, the New York Stock Exchange, every day. This in fact makes Forex larger than all the world’s stock market integrated!

Some these “high leaflets” come out the high tech sector, which includes the Web stocks and semiconductors. Other “high leaflets” come from the biotech stocks, which have actually increased volatility from such news as FDA approvals. Because Stochastic Trading there are less of them than on the NASDAQ that trade like a home on fire on the ideal news, after a while you will recognize the symbols.

Search for divergences, it informs you that the cost is going to reverse. If rate makes a new high and at the very same time that the stochastic makes lower high. This is called a “bearish divergence”. The “bullish divergence” is when the cost makes a brand-new low while the stochastic makes greater low.

While the guidelines provide you reasons to enter trades, it does not indicate that the cost will enter your preferred instructions. The idea is “Do not forecast the market”. Instead, you need to let the price motion lead your way, understanding at anytime price could change and go in a various instructions. Stochastic Trading You have to provide up and stop out if the price does not move in your favor.

You need to have the Stochastic Trading mindset that if the break occurs you opt for it. Sure, you have actually missed the very first little bit of revenue however history shows there is normally plenty more to follow.

If you want to make cash forget “purchasing low and offering high” – you will miss out on all the big relocations. Rather want to “buy high and offer higher” and for this you need to understand breakouts. Breakouts are merely breaks of important support or resistance levels on a forex chart. A lot of traders can’t buy these breaks.

I call swing trading “hit and run trading” and that’s what your doing – getting high odds set ups, striking them and after that banking earnings, before the position can turn back on you. If you find out and practice the above strategy for a week or so, you will soon be confident adequate to applly it for long term currency trading success.

Doing this means you know what your maximum loss on any trade will be as opposed to losing whatever. Trading is constantly short-term while investing is long term. The two charts being the 5 minute and 60 minute EUR/USD.

If you are finding instant exciting videos about Bearish Divergence Stochastic, and Technical Analysis, Turtle Trading System, Technical Analysis Tool please subscribe for newsletter totally free.