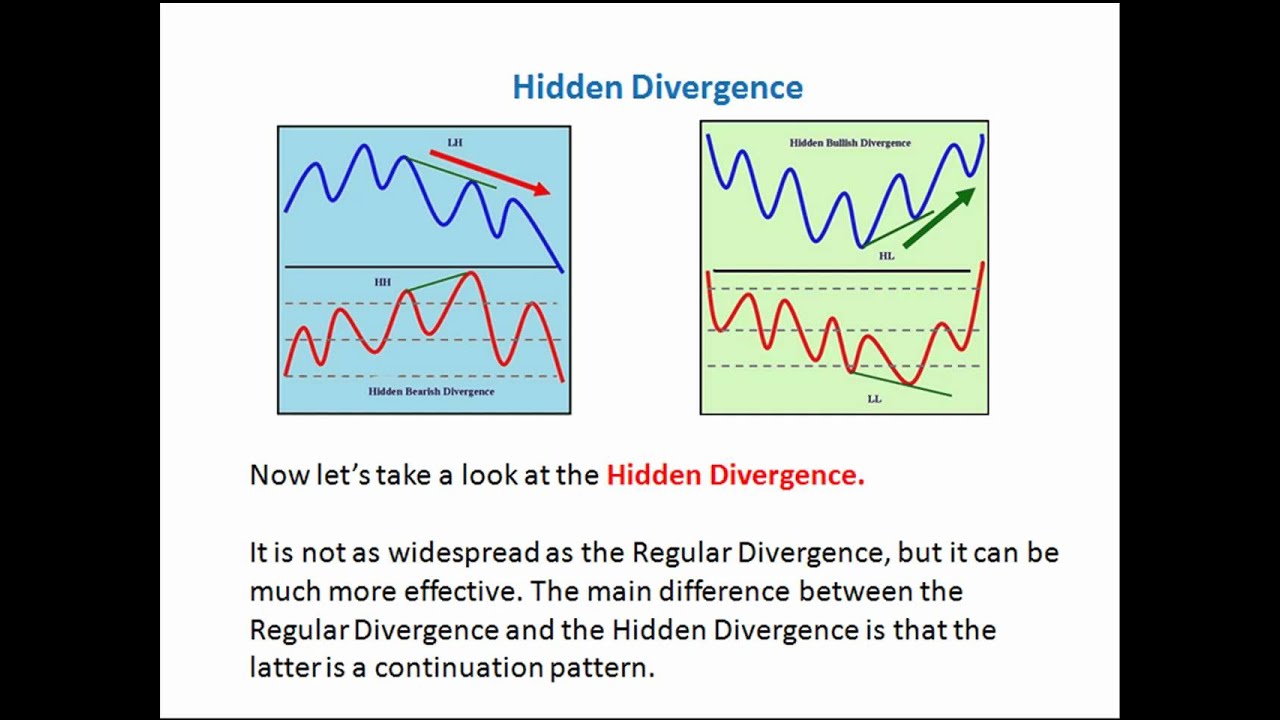

Forex Divergence and Hidden Divergence Explanation

Popular updated videos relevant with Forex Trend Following, Swing Traders, Trend Follow Forex, Forex Basics, and Hidden Divergence Stochastic, Forex Divergence and Hidden Divergence Explanation.

http://iticsoftware.com/divergence

Hidden Divergence Stochastic, Forex Divergence and Hidden Divergence Explanation.

Basics Of Technical Analysis In Stock Trading

As we talked about in Part 1 of this series, by now you need to have a determined patterns for the stocks you are viewing.

You may prefer orders outside the assembling line range to acquire a breakout as it occurs.

Forex Divergence and Hidden Divergence Explanation, Watch most searched full length videos about Hidden Divergence Stochastic.

Helpful Pointers On How To Excel At Stock Trading

You were in a long position, a red candle reveals up and you click out. It is also crucial that the trade is as detailed as possible. The second half of this summertime saw index readings of 100 in falling markets.

Here we are going to take a look at 2 trading chances recently we banked a fantastic revenue in the British Pound. Today we are going to look at the US Dollar V British Pound and Japanese Yen.

As soon as the move is well in progress, begin to track your stop however hold it beyond everyday volatility (if you do not comprehend Stochastic Trading standard deviation of price make it part of your forex education now), this means routing right back – when the move turns, you are going to return some profit, that’s ok., if you captured simply 60% of every significant trending move you would be very rich!! If it’s a huge move you will have plenty in the bank and you can’t anticipate where rates go so do not attempt.

Do not anticipate – you must only act on verification of price modifications and this always means trading with cost momentum in your corner – when applying your forex trading strategy.

Recognize when to exit: you need to also specify the exit point in you forex Stochastic Trading system. You can monitor if the price goes above the breakout point if you use breakout on your system and got in a trade. , if it does it will turn into revenues.. If it goes listed below do not exit listed below the breakout level at the exact same time. You can await one day and exit if it reaches after one day presuming you are working with weekly chart.

Throughout my career in the forex industry, mentor thousands of traders how to benefit, I have actually always suggested to start with a pattern following technique to Stochastic Trading currencies. I do the exact same thing with my existing clients. Naturally, I’m going to share a trend following method with you.

While these breaks can in some cases be difficult to take, if the support or resistance is valid, the chances favour a big relocation – but not all breakouts are produced equal.

I call swing trading “hit and run trading” and that’s what your doing – getting high odds set ups, hitting them and after that banking profits, before the position can turn back on you. If you learn and practice the above technique for a week approximately, you will soon be positive sufficient to applly it for long term currency trading success.

When the cost touches the lower band, the marketplace is thought about to be oversold. 2 of the best are the stochastic indication and Bollinger band. The larger the bands are apart the greater the volatility of the currency studied.

If you are finding more engaging comparisons about Hidden Divergence Stochastic, and Forex Trading Ways, Simple Forex Trading you should join in newsletter now.