EXTREME RSI Trading Strategy – I tested 100 TIMES to see if it is better than the RSI Strategies

New un-edited videos highly rated Swing Trading, Trading Strategy, Forex Profits, Win Forex, and Trading Stochastic Divergence, EXTREME RSI Trading Strategy – I tested 100 TIMES to see if it is better than the RSI Strategies.

Is this the best Relative Strength Index trading strategy profitable for a Day Trader? Will the Connors RSI CRSI RSI 2 make more money than the RSI Strategies for Intraday Trading?

Official Trading Rush Website: https://tradingrush.net

Download Official Trading Rush APP (Thanks): https://bit.ly/tradingrushapp

Support the Channel on Patreon (Thanks): https://www.patreon.com/tradingrush

Trading Merch for Best Traders: https://teespring.com/stores/trading-rush

Watch More Videos:

MACD Trading Strategy tested 100 times : https://youtu.be/nmffSjdZbWQ

Trading Strategies Tested 100 Times : https://www.youtube.com/playlist?list=PLuBdu9GKAoP4shAZd6QnM5BJUy1-IcnyD

Trading Strategies : https://www.youtube.com/playlist?list=PLuBdu9GKAoP6MEtX7stfzTGx62M5r3F4Z

Trading Tips and Mistakes : https://www.youtube.com/playlist?list=PLuBdu9GKAoP6lPl2txSXE8AlkhiwgWU2O

Download Excel Sheet for Day Trading : https://youtu.be/fLKd7uKZOvA

Subscribe For More Videos.

Does the RSI Trading Strategy work? If yes, what is the win rate of the RSI Indicator? Well if you have been following the Trading Rush Channel for a while, you already know if the RSI Strategy works or not, that’s because we have tested it 100 times to find its win rate. But similar to the RSI indicator, there is a new and interesting indicator called the Connors RSI indicator. Does this Connors RSI indicator work? If yes, will it make you more money than the normal RSI trading strategy? In this video, I’m going to test the Connors RSI trading strategy 100 times to find it’s win rate. If you are watching the Trading Rush Channel for the first time, subscribe to the channel, because we test and have tested many different Trading Strategies 100 times to find their win rates. After all, you don’t want to risk your money on a Trading Strategy that doesn’t even work.

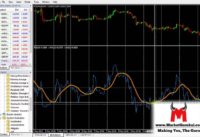

The original RSI indicator was developed by J. Welles Wilder, Connors RSI on the other hand is made by Larry Connors, but heavily relies on the work of J. Welles Wilder. On Trading View, this is how the Connors RSI indicator looks like. Unlike the RSI indicator, the Connors RSI has three components called the RSI, Up Down Length, and the Rate of Change. You can say that the Connors RSI is more of a tool, that is based on the RSI indicator. If it is a good thing or not, we will find that after we test it 100 times.

Just like the RSI indicator, the Connors RSI also ranges from 0 to 100, but in this indicator, the RSI line is called the CRSI line. Now the original RSI indicator came with the default over bought and over sold levels of 70 and 30 respectively. On Trading View, the Connors RSI also comes with the default levels of 70 and 30, but the creator of the Indicator Larry Connors, doesn’t recommend using those levels. Instead, Connors recommends using the 90 and 10 as the over bought and over sold levels. Furthermore, Conner also mentions that the higher the CRSI value goes above the 90 level, the higher is the chance of making a big profit. Similarly, the lower the CRSI value goes below 10, the higher is the probability of price making a big move in the entry direction.

Here’s how the Connors RSI Trading Strategy goes.

If you have watched other Trading strategy videos on the Trading Rush Channel, you know I always recommend using the 200 period moving average to find the long term trend. Well, guess what. Larry Connors also recommends using the 200 period moving average with the Connors RSI trading strategy. So in this video, we don’t have to modify the CRSI Trading Strategy at all, because it already uses the false signal filters just like we do on this channel.

So the buy signal, is when the price and the candle is completely above the 200 period moving average, and the CRSI is coming out of the over sold zone, which is 10 and below.

Similarly, the sell signal is when the price and the candle is completely below the 200 period moving average, and the CRSI is coming out of the over bought zone, which is 90 and above.

Now I have seen many people recommending not using a stoploss with this strategy. But if you have watched my video where I took 100 trades with stoploss and without stoploss, you know not using a stoploss is a very bad idea, especially if you are a new trader. If you haven’t watched that 100 trades Stoploss vs No Stoploss video, go watch now to see what can happen to your account balance if you don’t use a stoploss in trading.

Since the Connors RSI gives many signals in a shorter amount of time, while backtesting, In the long setup, I have set the stoploss slightly below the pullback. Similarly, in a short setup, I have set the stoploss slightly above the pullback.

With the default CRSI settings, I have tested the Connors RSI Trading Strategy 100 times, and here’s what happened.

SUBSCRIBE for more Trading Videos!

Like and Share the Video to see More Stock Market Intraday Trading Strategy and Forex Day Trading Strategies

Trading Stochastic Divergence, EXTREME RSI Trading Strategy – I tested 100 TIMES to see if it is better than the RSI Strategies.

Forex Swing Trading Strategy – An Easy One For Big Gains Anyone Can Use

This preparation could suggest the distinction between fantastic profit and terrific loss. If not updates are being made, then it’s buyer beware. The external bands can be utilized for contrary positions or to bank profits.

EXTREME RSI Trading Strategy – I tested 100 TIMES to see if it is better than the RSI Strategies, Explore most searched reviews relevant with Trading Stochastic Divergence.

How To Generate Income In The House – The Forex Trading Solution

Note that the previous indicators can be used in combination and not only one. Utilizing an automatic system will help you step up your portfolio or start creating an effective one. Let’s discuss this Daily Timeframe Method.

There is a difference in between trading and investing. Trading is constantly short-term while investing is long term. The time horizon in trading can be as brief as a few minutes to a couple of days to a few weeks. Whereas in investing, the time horizon can be months to years. Lots of people day trade or swing trade stocks, currencies, futures, choices, ETFs, products or other markets. In day trading, a trader opens a position and closes it in the same day making a fast profit. In swing trading, a trader attempts to ride a trend in the market as long as it lasts. On the other hand, a financier is least pressed about the brief term swings in the market. She or he has a long term time horizon like a few months to even a few years. This long time horizon matches their investment and monetary objectives!

These are the long term financial investments that you do not rush Stochastic Trading into. This is where you take your time examining an excellent spot with resistance and assistance to make a huge slide in profit.

Evaluating is a process and it is a good idea to evaluate various tools throughout the years. The goal in testing the tools is to discover the best trading tool the trader feels comfortable with in different market scenario however likewise to improve trading skills and revenue margin.

If you Stochastic Trading take a look at the weekly chart you can plainly see resistance to the dollar at 114. We also have a yen trade that is up with lower highs from the July in a strong pattern the mid Bollinger band will serve as resistance or support, in this case it acts as resistance and is simply above the 114.00 level. Momentum is up at present – will the resistance hold its time to take a look at the everyday chart.

Some of the stock signals traders look at are: volume, moving averages, MACD, and the Stochastic Trading. They also must try to find floors and ceilings in a stock chart. This can show a trader about where to get in and about where to go out. I say “about” since it is quite tough to guess an “precise” bottom or an “specific” top. That is why securing earnings is so so important. If you don’t lock in revenues you are truly risking of making a worthless trade. Some traders end up being actually greedy and it just hurts them.

If you follow the above 4 actions in building your forex trading technique, you will have the fundamentals of a system that’s simple to comprehend apply and makes big earnings.

I call swing trading “hit and run trading” and that’s what your doing – getting high odds set ups, hitting them and then banking revenues, prior to the position can turn back on you. If you learn and practice the above strategy for a week or so, you will soon be confident adequate to applly it for long term currency trading success.

It is one of the most traded market worldwide with about $3 trillion being traded every day. You can set your target simply above the mid band and take revenue. The traders most preferred currency pairs are the EURUSD, USDJYP and GPBUSD.

If you are searching most engaging reviews relevant with Trading Stochastic Divergence, and Trend Detection in Forex Trading, Forex Ambush Review please join our newsletter now.