Ep.16 | Bollinger Bands and Stochastic Oscillator

New vids highly rated Forex Tips, Successful Trading, and Day Trading With Stochastic, Ep.16 | Bollinger Bands and Stochastic Oscillator.

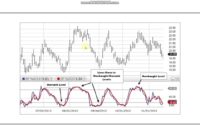

#BollingerBands and #StochasticOscillator are two popular technical analysis tools used by traders to identify potential price trends and reversal points in #financialmarkets.

Bollinger Bands consist of three lines: a #movingaverage in the middle, and two standard deviation bands above and below the moving average. The width of the bands adjusts according to the volatility of the asset being analyzed. Traders use Bollinger Bands to identify periods of high or low volatility and to identify potential #breakouts or #reversals when the price moves outside the bands.

Stochastic Oscillator is another popular #technicalindicator that measures the momentum of price movements. It compares the current closing price of an asset to its price range over a specified period, typically 14 days. #Traders use Stochastic #Oscillator to identify #overbought or #oversold conditions and to anticipate potential #trendreversals.

For example, if a stock’s price is consistently touching or crossing the upper Bollinger Band while the Stochastic Oscillator is in overbought territory, this may indicate that the stock is overvalued and due for a #pricecorrection. On the other hand, if the price is consistently touching or crossing the lower Bollinger Band while the Stochastic Oscillator is in oversold territory, this may indicate that the currency is undervalued and due for a potential price increase.

Overall, the combination of #Bollinger Bands and Stochastic Oscillator can provide traders with valuable insights into potential price movements and can help to identify trading opportunities in various financial markets.

Social tags: #algorithmictrading #ask #asx200#automatedforextrading #automatedtrading #bankofcanada #bankofengland #bearish #bestforextradingsignals #bestforextradingsoftware #bestforextradingstrategies #bid #bollingerbands #breakouttrading #brentoil #bullish #businessconfidence #cac40 #cad #candlestickanalysis #candlestickforextrading #candlestickpatterns #centralbanks #chartpatterns #chf #commodities #consumerconfidence #consumerpriceindex #copytrading #crudeoil #currencyanalysis #currencyexchange #currencyforecasting #currencyforextrading #currencymarket #currencymarketanalysis #currencymarketinsights #currencypair #currencypairanalysis #currencypairs #currencytrading #currencytradinganalysis #currencytradingcommunity #currencytradingsignals #currencytradingsoftware #currencytradingtips #dailytradingideas #dax30 #daytrading #daytradingforex #deflation #dollarindex #dowjones #ecb #economiccalendar #economicindicators #economicpolicy #fed #federalreserve #fibonacciretracement #financialmarkets #fomc #foreignexchange #forex #forexanalysis #forexanalysisreview #forexbroker #forexchartanalysis #forexchartpatterns #forexchartsanalysis #forexcommunity #forexcommunitytrading #forexcopytrading #forexcurrencypairs #forexdailytrading #forexswingtradingstrategy #forextips #forextrader #forextraders #forextrading #forextradingaccount #forextradingadvice #forextradingalgorithm #forextradingalgorithmic #forextradinganalysis #forextradinganalysislivestream #forextradinganalysistools #forextradinganalysisupdates #forextradingapps #forextradingappsfree #forextradingbeginnersguide #forextradingbeginnerstips #forextradingbot #forextradingbotfree #forextradingbrokers #forextradingbusiness #forextradingchallenge #forextradingchartanalysis #forextradingchartanalysislive #forextradingchartpatterns #forextradingchartpatternsforbeginners #forextradingsignalsalerts #forextradingsignalsservice #forextradingsignalsupdates #moneymanagement #monthlytradingideas #movingaverages #nakedcharttrading #nakedforex #nakedforextrading #nasdaq #naturalgas #newsimpact #nikkei225 #nonfarmpayrolls #oil #onlineforextrading #pip #pips #priceaction #priceactionforextrading #priceactionpatterns #priceactiontrading #pricelevels #producerpriceindex #rba#retailsales #riskmanagement #rsi #scalping #scalpingforextrading #shorts #simpleforextradingstrategies #simpletrading #spread #stockmarket #stoploss #successfulforextrading #supportandresistance #swingforextrading #swingtrading #swiss #takeprofit #technicalanalysis #technicalanalysistips #technicalindicators #thebestforextradingstrategy #topforextradingplatforms #tradeforexonline #trading #tradinganalysis #tradinganalysisexperts #tradinganalysistools #tradingchartsanalysis #tradingcommunity #tradingcommunitynews #tradingeducation #tradingexpertsadvice #tradingforecasting #tradingforecasts #tradingforexforaliving #tradingideas #tradinginsights #tradingjournal #tradinglive #tradingliveforex #tradingmarketresearch #tradingmarketupdates #tradingnews #tradingopportunities #tradingperformance #tradingplan #tradingplantips #tradingpodcast #tradingpsychology #tradingsessions #tradingsignals #tradingsignalsalerts #tradingsoftwaretools #tradingsoftwareupdates #tradingstrategies #tradingstrategy #tradingtips #trendanalysis #trendfollowingforextrading #trending #unemploymentrate #usd #usforex #volatility#whatisforextrading

Day Trading With Stochastic, Ep.16 | Bollinger Bands and Stochastic Oscillator.

Forex Trading Strategy – A Simple System For Triple Digit Gains

The simpler your system is, the more profits it will create on a long run. When the fast one crosses the sluggish one, this will suggest a pattern. A simple product trading system like the above, traded with discipline is all you require.

Ep.16 | Bollinger Bands and Stochastic Oscillator, Enjoy interesting videos about Day Trading With Stochastic.

How To Generate Income Online Through Forex Trading

Don’t put your stop to close, or within normal volatility – you will get bumped out the trade. You are looking levels which the market considers essential. When costs struck target take your profit in and await the next set up.

There is a difference in between trading and investing. Trading is always short-term while investing is long term. The time horizon in trading can be as brief as a couple of minutes to a couple of days to a couple of weeks. Whereas in investing, the time horizon can be months to years. Lots of individuals day trade or swing trade stocks, currencies, futures, alternatives, ETFs, products or other markets. In day trading, a trader opens a position and closes it in the very same day making a fast revenue. In swing trading, a trader tries to ride a trend in the market as long as it lasts. On the other hand, a financier is least pushed about the short-term swings in the market. She or he has a long term time horizon like a few months to even a couple of years. This long time horizon matches their financial investment and monetary goals!

Once the relocation is well in progress, begin to track your stop but hold it beyond daily volatility (if you do not understand Stochastic Trading standard deviation of rate make it part of your forex education now), this suggests routing right back – when the move turns, you are going to return some revenue, that’s ok., if you captured simply 60% of every significant trending move you would be very rich!! If it’s a big move you will have plenty in the bank and you can’t forecast where prices go so do not try.

His primary methodologies involve the Dedication of Traders Index, which checks out like a stochastic and the 2nd is Major & Minor Signals, which are based upon a fixed dive or decrease in the aforementioned index. His work and research are very first class and parallel his character as an individual. However, for any methodology to work, it has to be something the trader is comfortable with.

Discipline is the most vital part of Stochastic Trading. A trader must develop rules for their own selves and ADHERE TO them. This is the important secret to a successful system and disciplining yourself to stick to the system is the very first action towards a successful trading.

Do you have a stop loss or target to exit a trade? Among the biggest errors that forex traders made is trading without a stop loss. I have actually stressed lot of times that every position should have a stop loss but till now, there are a lot of my members still Stochastic Trading without setting a stop. Are you one of them?

However don’t believe it’s going to be a breeze either. Do not anticipate t be a millionaire over night, since that’s just not reasonable. You do require to make the effort to discover technical analysis. By technical analysis, I do not mean throwing a couple of stochastic signs on your charts, and have them inform you what to do. Sadly, that’s what a great deal of traders believe technical analysis is.

This forex trading strategy highlights how focusing on a bearish market can benefit a currency that is overbought. Whether this technique is ideal or wrong, it provides a great risk-reward trade off and is well based on its short position in forex trading.

Use these with a breakout approach and they provide you a powerful mix for looking for big gains. This suggests reducing your potential loses on each trade using a stop loss.

If you are searching more exciting videos related to Day Trading With Stochastic, and Currency Trading, Currency Trading Basics, Trade Without Indicators, Trading Tip please list your email address our email alerts service now.