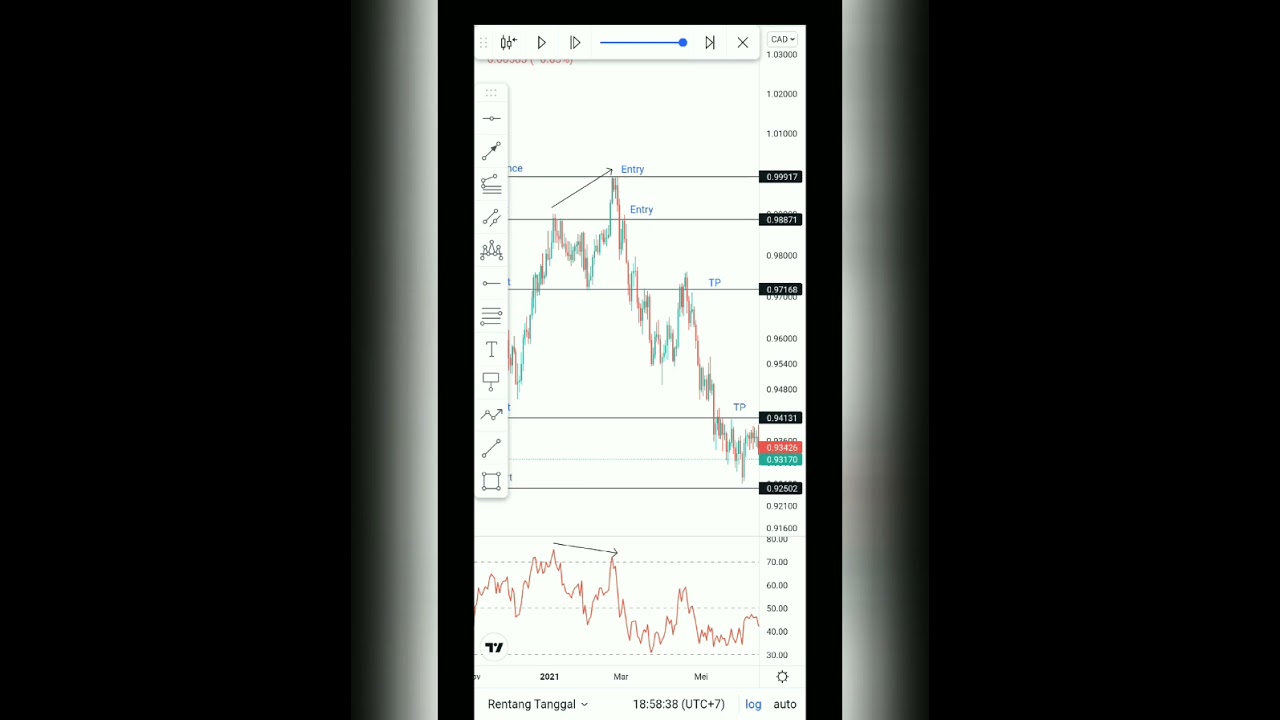

Entry Bearish Divergence #shorts #forex #divergence

Top high defination online streaming related to Currency Trading Education, Momentum Trading, How to Trade Support and Resistance, and Divergence In Stochastic, Entry Bearish Divergence #shorts #forex #divergence.

Divergence In Stochastic, Entry Bearish Divergence #shorts #forex #divergence.

Forex Swing Trading Method – A Simple One For Substantial Gains Anybody Can Use

Remember that the Forex system trades $2 trillion each and every single day. This identifies whether the time frame needed is hourly, daily or annual. The upper and lower limit needs to be clear in the trade.

Entry Bearish Divergence #shorts #forex #divergence, Search more full length videos about Divergence In Stochastic.

4 Pointers To Efficiently Trade Forex In An Unforeseeable Market

Doing this implies you understand what your maximum loss on any trade will be instead of losing everything. When analysing a stock’s chart, moving averages are important. A lot of traders can’t purchase these breaks.

Here we are going to look at how to utilize forex charts with a live example in the markets and how you can use them to find high chances probability trades and the chance we are going to look at remains in dollar yen.

When I initially began to start to trade the forex market, I can remember. I was under the wrongful impression (like a lot of other brand-new traders) that I had no choice. If I was going to trade the marketplace, I was going to NEED TO trade with indications. So, like lots of others I started to utilize Stochastic Trading.

Tonight we are trading around 1.7330, our first area of resistance is in the 1,7380 range, and a 2nd area around 1.7420. Strong support exits From 1.7310 to 1.7280 levels.

No problem you say. Next time when you see the profits, you are going to click out and that is what you do. You were in a long position, a red candle light reveals up and you click out. Whoops. The marketplace continues in your direction. You stand there with 15 pips and now the marketplace is up 60. Frustrated, you decide you are going to either let the trade play out to your Stochastic Trading revenue target or let your stop get set off. You do your homework. You enter the trade. Boom. Stopped out. Bruised, battered and deflated.

Do you have a stop loss or target to exit a trade? Among the biggest errors that forex traders made is trading without a stop loss. I have stressed often times that every position should have a stop loss but till now, there are numerous of my members still Stochastic Trading without setting a stop. Are you one of them?

How do you draw trendlines? In an up trend, link two lower highs with a line. That’s it! And in a drop, link 2 greater lows with a straight line. Now, the slope of a trendline can tell you a lot about the strength of a trend. For example, a high trendline reveals severe bullish mindset of the buyers.

Energy markets are unpredictable and can make any trader look stupid however they offer some great profit opportunities at present which traders can benefit from.

They do this by getting the ideal answers to these million dollar questions. This analysis strategy depends on recognizing numerous levels on the graph. This is something that you are not visiting on an easy backtest.

If you are finding updated and engaging reviews related to Divergence In Stochastic, and Swing Trading Ranges, Trading Success, Trend Detection in Forex Trading you should signup our email subscription DB for free.