EMI Paying Trading Strategy

Latest reviews top searched Trading Plan, Currency Swing Trading, and Stochastic Settings Swing Trading, EMI Paying Trading Strategy.

#Sponsored

Download Link – https://kukufm.sng.link/Apksi/dqol/ohht

Coupon code – FEB50

( Coupon valid till 28th Feb)

Visit our smallcase

https://kunalsaraogi.smallcase.com/

Visit our Twitter

Tweets by kunalsaraogi

Visit our website

https://equityrush.com

Visit our Facebook

https://facebook.com/equityrush/

Stochastic Settings Swing Trading, EMI Paying Trading Strategy.

An Excellent Stock Trading Indication – Try This Now

This is how the market works and your system needs to follow this law. In an up pattern, link 2 lower highs with a line. As specified above, it needs to be simple to alleviate the usage of it.

EMI Paying Trading Strategy, Watch trending explained videos relevant with Stochastic Settings Swing Trading.

Forex Trading – A Basic Tested Route To A Triple Digit Income

A basic commodity trading system like the above, traded with discipline is all you need. Although, it is not precisely foolproof, you can still get an excellent leg up by utilizing it. The concept is “Do not forecast the marketplace”.

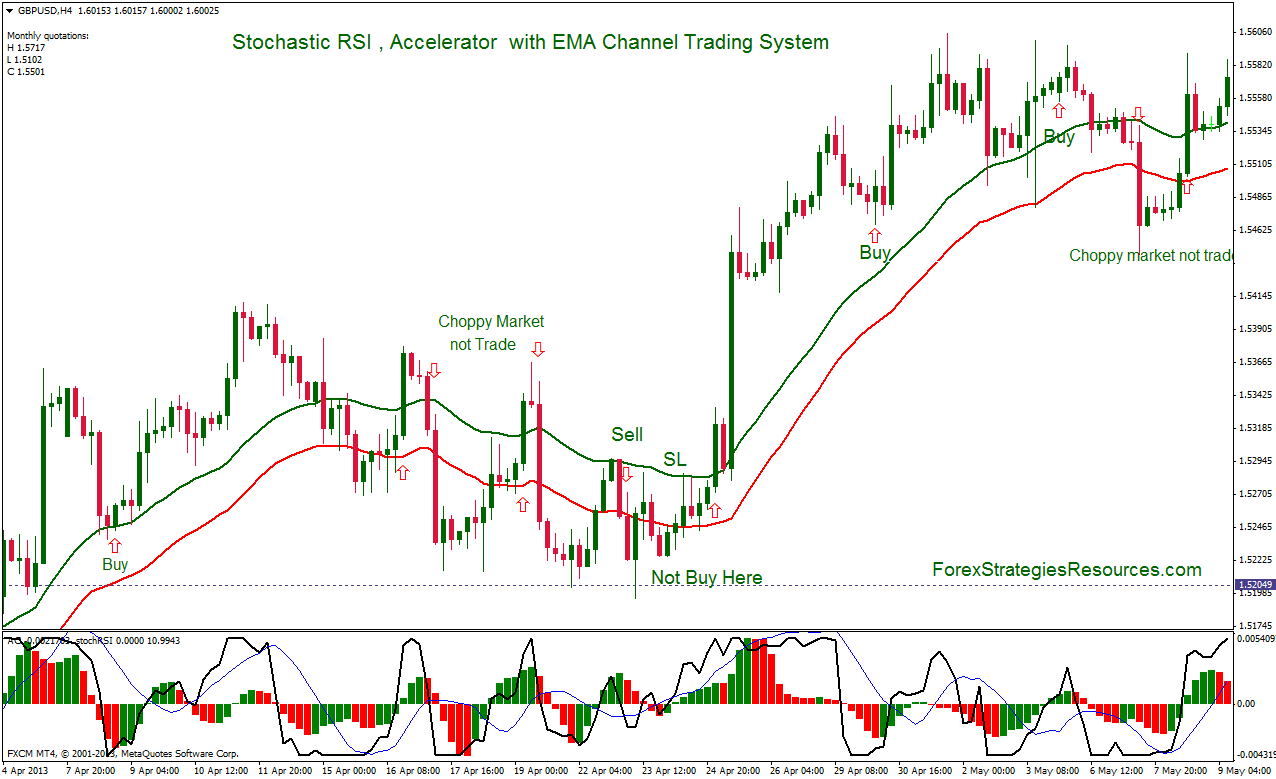

The Stochastic Oscillator is an overbought/oversold indication developed by Dr. George Lane. The stochastic is a typical indication that is incorporated into every charting software consisting of MetaStock.

You will comprehend it and this understanding leads to confidence which leads onto discipline. People Stochastic Trading who buy prepared made systems do not understand what their doing their simply following and have no self-confidence.

2 of the very best are the stochastic indication and Bollinger band. Use these with a breakout method and they offer you a powerful combination for seeking big gains.

Not all breakouts continue obviously so you require to filter them and for this you need some momentum signs to validate that price momentum is accelerating. 2 excellent ones to utilize are the Stochastic Trading and RSI. These signs give confirmation of whether momentum supports the break or not.

You need to have the Stochastic Trading mindset that if the break happens you go with it. Sure, you have actually missed out on the very first little bit of revenue however history shows there is usually plenty more to follow.

The Stochastic Indication – this has actually been around considering that the 1950’s. It is a momentum sign which determines over purchased (readings above 80) and over offered (readings below 20), it compares today’s closing cost of a stocks rate range over a current period of time.

Keep in mind you will constantly provide bit back at the end of a pattern but the big trends can last lots of weeks or months and if you get just 70% of these trends, you will make a lot of cash.

Likewise, inspect the copyright at the bottom of the page to see how often the page is updated. I highly suggest you get at least a megabyte or more of memory. This depends upon how frequently one refers the trade charts.

If you are searching more entertaining videos about Stochastic Settings Swing Trading, and Forex Traading System, Trading Strategy please signup in email list now.