Crypto Trading 101: Indicators Tutorial

Interesting videos highly rated Win at Forex, Best Forex Trading, and Divergence In Stochastic, Crypto Trading 101: Indicators Tutorial.

Welcome to today’s tutorial, where we demystify the world of trading indicators on TradingView, tailored exclusively for the crypto trading community!

WHAT YOU’LL LEARN:

🔹 Introduction to the vast array of indicators available on TradingView.

🔹 Deep dive into popular indicators like Moving Averages, MACD (Moving Average Convergence Divergence), RSI (Relative Strength Index), Bollinger Bands, Stochastic Oscillator, and Volume.

🔹 Step-by-step guidance on how to apply, customize, and interpret these indicators for crypto trading.

WHY INDICATORS ARE CRUCIAL FOR CRYPTO TRADERS:

Informed Decisions: Indicators provide quantitative data, allowing traders to make decisions based on statistical evidence rather than gut feeling.

Spotting Trends: Tools like Moving Averages help identify and confirm ongoing market trends.

Identifying Overbought or Oversold Conditions: RSI and Stochastic Oscillator can signal potential market reversals.

Understanding Market Volatility: Bollinger Bands give insights into market volatility and potential breakout scenarios.

Confirming Price Movements: MACD can highlight the strength, direction, momentum, and duration of a trend in a stock’s price.

In the volatile world of crypto trading, having access to and understanding various indicators becomes paramount. These tools offer a structured way to gauge market sentiment, anticipate potential price movements, and build a robust trading strategy.

Whether you’re a newbie trying to understand the basics or an experienced trader seeking to enhance your analytical toolkit, this video will equip you with the knowledge to navigate the intricate world of crypto indicators seamlessly.

🌐 Join the Community:

Share your favorite indicators and how you utilize them in the comments below!

👍 Did you find this tutorial insightful? Please give it a thumbs up, subscribe for more enlightening content, and hit that notification bell to never miss an update!

Try TradingView: https://tradingview.com

Get up to $30 in TradingView Coins for you and a friend: https://www.tradingview.com/share-your-love/

Follow us on Twitter: https://twitter.com/tradingview/

Follow us on Facebook: https://www.facebook.com/tradingview

#cryptocurrencies #cryptotrader #cryptoinvestor #crypto

Divergence In Stochastic, Crypto Trading 101: Indicators Tutorial.

Using Bollinger Bands For Trading Large Cap Stocks

This depends upon how frequently one refers the trade charts. There are different sort of currency trading charts that you can use. All the top traders utilize essentially easy currency trading systems and you should to.

Crypto Trading 101: Indicators Tutorial, Watch trending explained videos relevant with Divergence In Stochastic.

Daily Charts Technique That Pulls 100-500+ Pips Per Trade

The one enclosed is simple to comprehend and will allow you to look for big gains. Utilize the technical signs you find out and test them with historic information. Bollinger bands are based upon basic discrepancy.

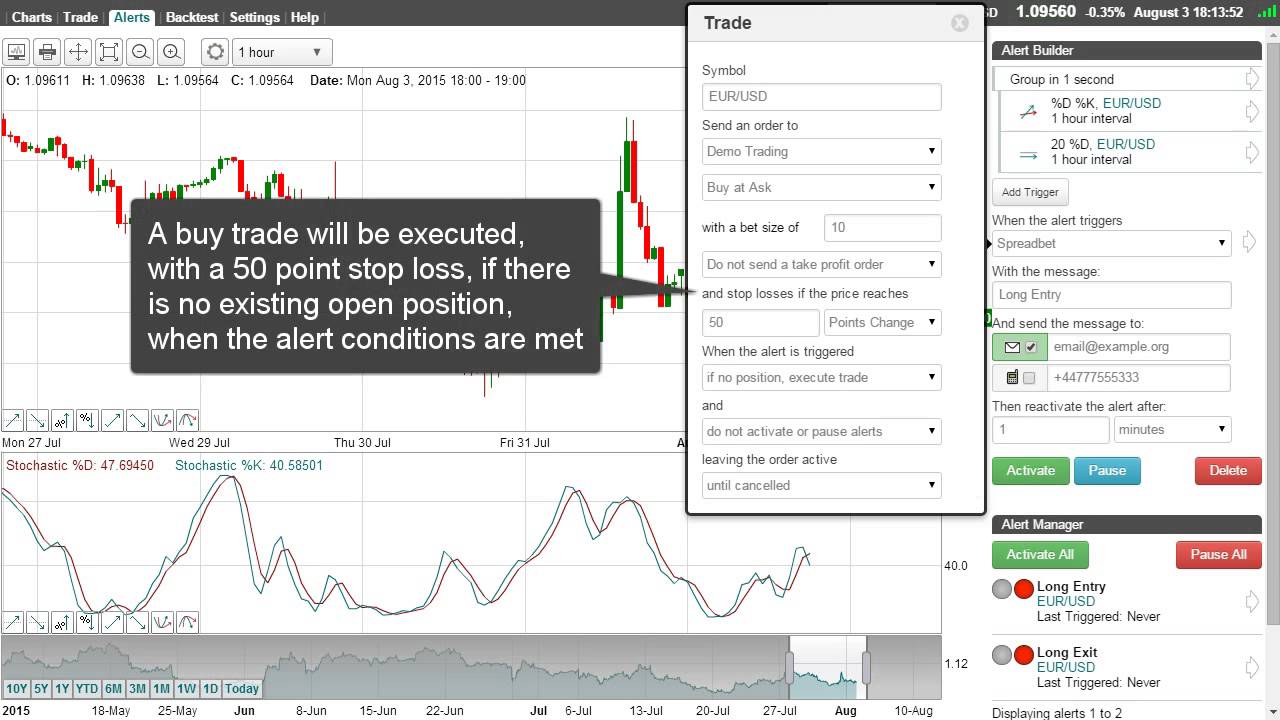

The Stochastic Oscillator is an overbought/oversold sign established by Dr. George Lane. The stochastic is a typical indication that is integrated into every charting software application including MetaStock.

When I initially began to begin to trade the forex market, I can remember. I was under the wrongful impression (like a great deal of other new traders) that I had no choice. If I was going to trade the market, I was going to NEED TO trade with indications. So, like lots of others I started to use Stochastic Trading.

The fact is you don’t have actually to be frightened with the concept of day trading. The appeal of day trading is that you don’t need to have a Masters degree in Service from Harvard to generate income doing this. Effective day traders consist of a great deal of “Typical Joes” like you and me. There are lots of effective day traders out there who had an actually bumpy ride just graduating high school.

Now I’m not going to get into the information as to why cycles exist and how they are associated to cost action. There is much written on this to fill all your quiet nights in checking out for decades. If you spend simply a bit of time seeing a MACD or Stochastic Trading indication on a rate chart, you should currently be encouraged that cycles are at work behind the scenes. Just view as they swing up and down between extremes (overbought and oversold zones) to get a ‘feel’ for the cycle ups and downs of price action.

It is necessary to discover a forex robotic that comes with a 100% money back warranty. If there is a cash back guarantee this implies that it is among the finest forex Stochastic Trading robotics out there.

Two of the very best are the stochastic indication and Bollinger band. Utilize these with a breakout method and they provide you a powerful mix for seeking huge gains.

Energy markets are unpredictable and can make any trader appearance stupid however they provide some great profit chances at present which traders can take benefit of.

This suggests you do not have to be smart and have a college education. Doing this implies you know what your maximum loss on any trade will be as opposed to losing everything. In an up trend, connect two lower highs with a line.

If you are finding exclusive engaging videos about Divergence In Stochastic, and Forex Trading Strategy, Technical Analysis Question, Forex Trading Signals dont forget to join in email alerts service now.