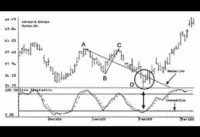

Crazy Fibonacci Retracement Trick

Interesting clips top searched Successful Swing Trading, Forex Robots, and Day Trading Stochastic Settings, Crazy Fibonacci Retracement Trick.

I found a crazy good trick to use with the Fibonacci Retracement tool. It works insanely well!

If you learned something new, leave a like!

🔥 My private Indicator: https://tradinglab.ai/

📈 See all of my trades live (Entries/Exits): https://tradinglab.ai/premium/

💵 HankoTrade (Where I Trade Forex): https://login.hankotrade.com/register?franchiseLead=MjQxNg==

🚀 Webull (Where I Trade Stocks): https://a.webull.com/i/TradingLab

💬 My Trading Discord: https://discord.gg/5MGeeCWa

⚡ Bybit (Where I Buy Crypto) Up To $30,000 in Rewards: https://partner.bybit.com/b/TradingLab

📊 TradingView (Chart Software I Use): https://www.tradingview.com/?offer_id=10&aff_id=28566

📰 Benzinga (News Scanner I Use): https://benzinga.grsm.io/TradingLab

🔴 Subscribe for more videos just like this: https://www.youtube.com/channel/UCCbv0qixG-cyokxEY3kELtg?sub_confirmation=1

Follow TradingLab:

===============================

📸 – IG: https://www.instagram.com/tradinglabofficial/?hl=en

📱 – TikTok: https://www.tiktok.com/@thetradinglab

*None of this is meant to be construed as investment advice, it’s for entertainment purposes only. The links above include affiliate commissions or referrals. I’m part of an affiliate network and I receive compensation from partnering websites. The video is accurate as of the posting date but may not be accurate in the future.

Day Trading Stochastic Settings, Crazy Fibonacci Retracement Trick.

3 Methods To Use Technical Analysis As Part Of Your Trading Technique.

If one need to understand anything about the stock exchange, it is this. It is ruled by feelings.

Trade the odds and this suggests price momentum ought to support your view and validate the trade prior to you enter.

Crazy Fibonacci Retracement Trick, Find interesting updated videos relevant with Day Trading Stochastic Settings.

The Advantages Of Using Technical Analysis In Forex Trading

EMA-stands for Exponential Moving Average.When a stock closes above its 13 and 50 day EMAs this is a bullish signal. The outer bands can be used for contrary positions or to bank revenues. I will cover the short term trading first off.

There is a distinction in between trading and investing. Trading is constantly short term while investing is long term. The time horizon in trading can be as brief as a few minutes to a couple of days to a couple of weeks. Whereas in investing, the time horizon can be months to years. Lots of people day trade or swing trade stocks, currencies, futures, options, ETFs, commodities or other markets. In day trading, a trader opens a position and closes it in the same day making a fast earnings. In swing trading, a trader tries to ride a pattern in the market as long as it lasts. On the other hand, an investor is least pressed about the short-term swings in the market. She or he has a long term time horizon like a couple of months to even a couple of years. This very long time horizon matches their investment and monetary objectives!

When swing Stochastic Trading, try to find really overbought or extremely oversold conditions to increase the odds of success and do not trade unless the price is at an extreme.

The first indicate make is if you like action and desire to trade all the time don’t continue reading – this is all about trading very high chances trades for big revenues not trading for enjoyable or messing about for a few pips.

Resistance is the area of the chart where the price stops increasing. No brand-new highs have been fulfilled in the last few Stochastic Trading sessions and the cost is in a sideways instructions.

Technical experts try to find a pattern, and ride that pattern until the trend has actually confirmed a turnaround. If a great company’s stock is in a sag according to its chart, a trader or financier utilizing Technical Analysis will not Stochastic Trading purchase the stock up until its trend has reversed and it has been validated according to other crucial technical signs.

This has definitely been the case for my own trading. My trading successes leapt leaps and bounds when I came to realize the power of trading based on cycles. In any given month I balance a high percentage of winning trades against losing trades, with the couple of losing trades leading to unbelievably little capital loss. Timing trades with identify precision is empowering, only leaving ones internal mental and psychological luggage to be the only thing that can undermine success. The approach itself is pure.

Currency trading is a way of earning money however it also depends upon the luck element. But all is not lost if the traders make guidelines on their own and follow them. This will not just ensure greater profits however also decrease the risk of higher losses in trade.

In an uptrend each new peak that is formed is greater than the previous ones. The Stochastic – is a very powerful trade indicator. His work and research study are very first class and parallel his character as an individual.

If you are looking rare and exciting comparisons about Day Trading Stochastic Settings, and Stock Market, Win Forex, Trade Without Indicators you are requested to list your email address our email list for free.