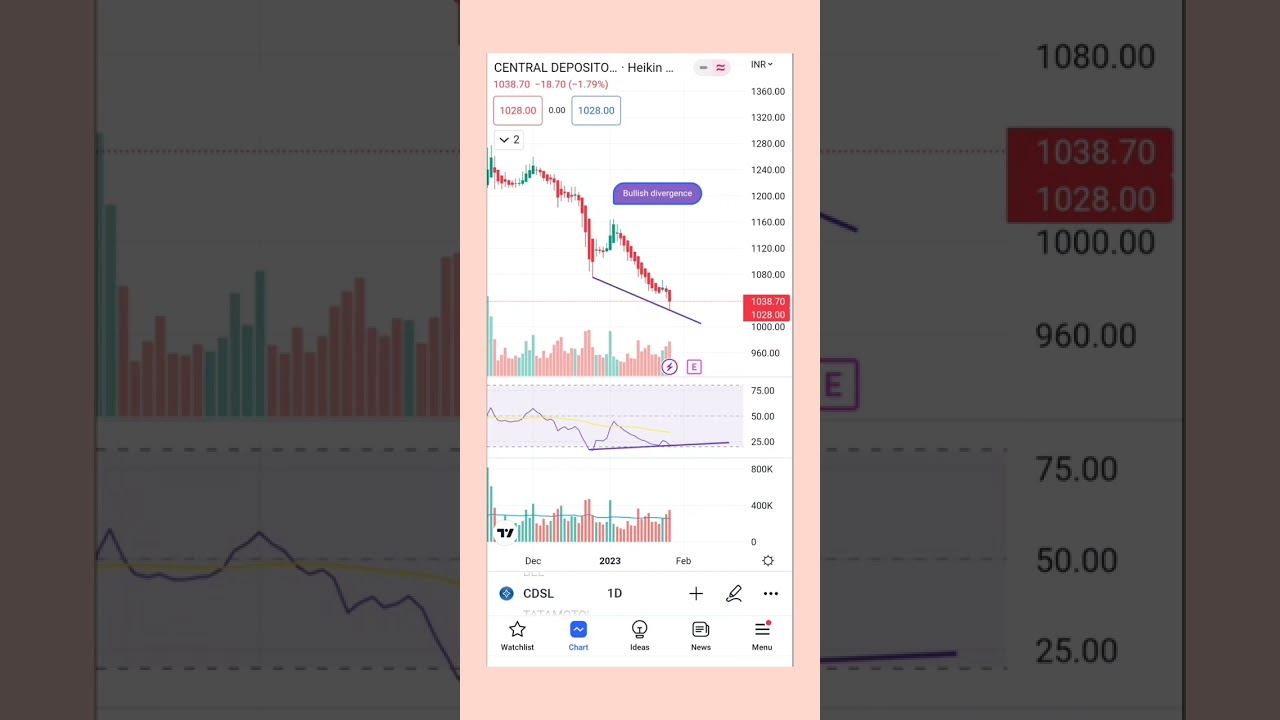

CDSL – Share Divergence trading strategy

Popular updated videos about Automatic Trading System, Trade Without Indicators, Stock Market Trend, and Divergence In Stochastic, CDSL – Share Divergence trading strategy.

CDSL – Share Divergence trading strategy

#cdsl

#sharemarket

#divergence

Divergence In Stochastic, CDSL – Share Divergence trading strategy.

Best Forex Trading Strategy

Candlestick charts were invented by Japanese rice traders in the 16th century. This is genuinely the very best method to offer a beginner the self-confidence you require to succeed. They are placed side by side (tiled vertically).

CDSL – Share Divergence trading strategy, Enjoy popular updated videos related to Divergence In Stochastic.

Get The Very Best Currency Trading Education By Studying Price Action Patterns

Doing this indicates you understand what your optimum loss on any trade will be rather than losing everything. When analysing a stock’s chart, moving averages are important. The majority of traders can’t purchase these breaks.

Here we are going to take a look at currency trading basics from the viewpoint of getting a currency trading system for revenues. The one enclosed is easy to comprehend and will enable you to look for huge gains.

Use another sign to validate your conclusions. If the support and the resistancelines are touching, then, there is likely to have a breakout. And if this is the Stochastic Trading scenario, you will not be able to presume that the cost will turn again. So, you may simply wish to set your orders beyond the stretch ofthe support and the resistance lines in order for you to catch a taking place breakout. However, you must use another indication so you can verify your conclusions.

You then need to see if the chances are on your side with the breakout so you examine price momentum. There are lots of momentum indicators to help you time your move and get the speed of price in your corner. The ones you pick are a matter of individual choice but I like the ADX, RSI and stochastic. , if my momentum calculation includes up I go with the break..

Discipline is the most crucial part of Stochastic Trading. A trader ought to establish rules for their own selves and STICK to them. This is the necessary secret to an effective system and disciplining yourself to adhere to the system is the very first action towards an effective trading.

The secret to utilizing this easy system is not simply to look for overbought markets however markets are very Stochastic Trading overbought – the more a market is overbought, the bigger the move down will be, so be selective in your trades.

To see how overbought the currency is you can use some momentum signs which will provide you this info. We don’t have time to explain them here but there all simple to find out and apply. We like the MACD, the stochastic and the RSI however there are much more, just choose a couple you like and utilize them.

Position the trade at a stop loss of approximately 35 pips and you ought to use any of these two strategies for the function of making earnings. The very first is use an excellent risk to a rewarding ratio of 1:2 while the next is to use assistance and resistance.

I do the exact same thing with my existing customers. Your ability to get the best from this method depends upon the way you efficaciously use the technique. There are numerous types of charts that a person can utilize in TA.

If you are looking rare and entertaining videos about Divergence In Stochastic, and Technical Indicators, Forex Online, Currency Trading Basics, Successful Trading you are requested to signup in email alerts service now.