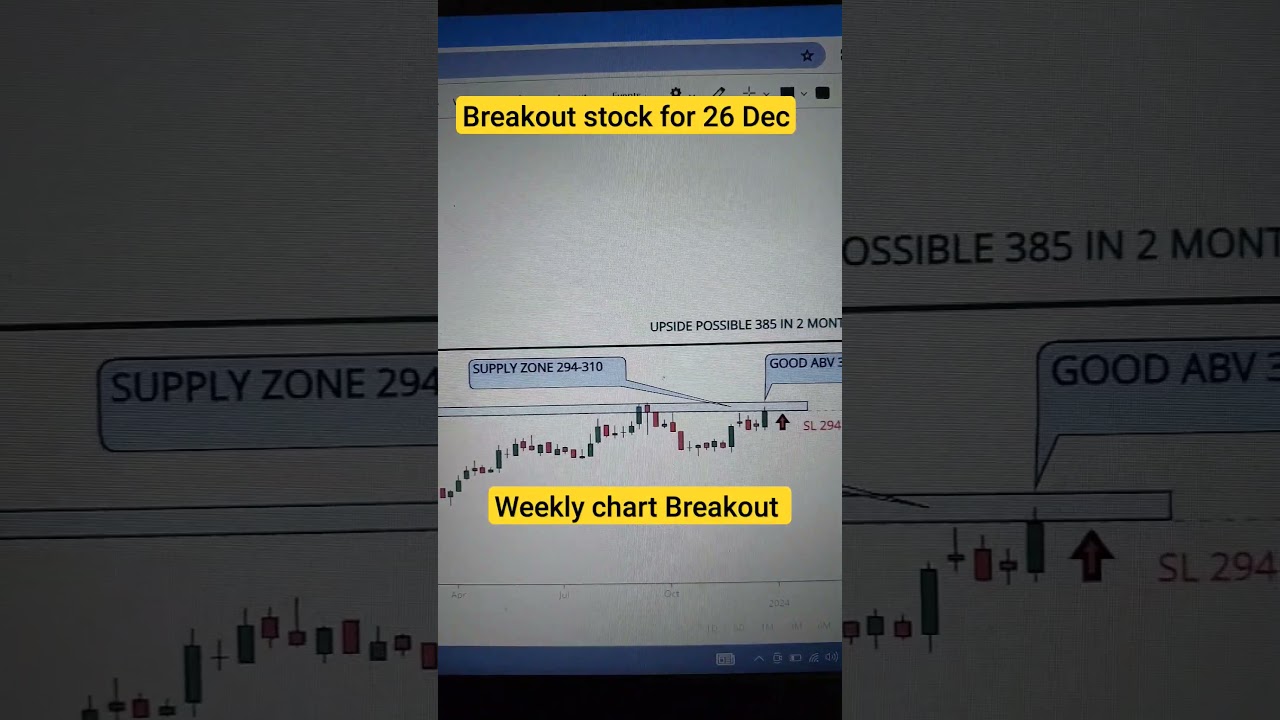

Breakout stock for tomorrow | 26/12/23 | weekly chart breakout stock | intraday stocks tomorrow

New YouTube videos top searched Trading Success, Forex Tip, and What’s Swing Trading, Breakout stock for tomorrow | 26/12/23 | weekly chart breakout stock | intraday stocks tomorrow.

Breakout stock for tomorrow | 26/12/23 | weekly chart breakout stock | intraday stocks tomorrow

intraday stocks for tomorrow | swing stocks to buy now |

✅Open your Life Time FREE DEMAT account now,Life time Free AMC charges:

https://upstox.com/open-account/?f=4V…

Social Media Handles:

Telegram : https://www.telegram.me/wealthexpress21

Instagram: https://www.instagram.com/wealthexpress21/

Twitter :https://twitter.com/wealthexpress21?s=08

For Business inquiry: 9974603016

STRATEGY VIDEOS:

BOLLINGER BAND STRATEGY

INTRADAY STOCKS SELECTION STRATEGY

SWING TRADING STRATEGY

SWING TRADING STOCKS SELECTION

CHOPINESS INDEX STRATEGY (Momentum stocks strategy)

MULTIBAGGER STRATEGY VIDEO

RSI STRATEGY

SWING TRADING STRATEGY

BUY ON DIP STRATEGY

ADX STRATEGY

In this video, we’re going to share with you our top 4 breakout stocks for tomorrow! These stocks are poised to make big moves in the coming days, so be sure to check them out!

And finally, in this video, we’ll give you some tips on how to invest in breakout stocks. We’ll share with you our tips on how to find breakout stocks, how to trade them, and how to find :-

1. Breakout Stock

2. Breakout Stocks for Next Week

3. Breakout Stocks for Tomorrow

4. Breakout Stocks of The Week

5. Breakout Stocks to Buy Now

6. Breakout Stocks Tomorrow

7. Best Breakout Stocks for Tomorrow

8. Positional Breakout Stocks

9. Positive Breakout Stocks for Swing Trading

10. Positive Breakout Stocks

11. Swing Breakout Stocks for Tomorrow

12. Tomorrow Breakout Stocks

13. Tomorrow Intraday Breakout Stocks

14. Top breakout Stocks for Today

15. Top Breakout Stocks

16. swing stocks for tomorrow

17. intraday stocks for tomorrow

18.smspharma share news

19.abb share news

20.gail share news

21.voltas share news

22.gail share news latest

23.adx strategy

23.symmetrical triangle breakout

24.intraday trading stocks selection

25.day trading stocks

26.marico chart analysis

27.bollinger band strategy explain

sip stock for 1 month

TAGS

wealth express

intraday stocks for tomorrow

daily intraday tips

daily intraday stocks

swing stocks for tomorrow

breakout stocks for tomorrow

swing stocks for next week

swing trading stock selection strategy

swing trading stock selection chartink

breakout n retest stocks

breakout trading strategy intraday

top breakout stocks

breakout screener tradingview

intraday stocks for tomorrow

day trading stocks

breakout stocks to buy now

stocks to buy now

momentum stocks for tomorrow

momentum stocks

daily intraday stocks

intraday stocks tips

intraday trading tips

stock market tips

4 breakout stocks for 02 aug 2023

What’s Swing Trading, Breakout stock for tomorrow | 26/12/23 | weekly chart breakout stock | intraday stocks tomorrow.

5 Pointers To Trade Forex Effectively

Luckily you do not need to get down to the nuts and bolts of ‘why’ cycles exist in order to make the most of them. MACD-stands for Moving Typical Convergence-Divergence. The two charts being the 5 minute and 60 minute EUR/USD.

Breakout stock for tomorrow | 26/12/23 | weekly chart breakout stock | intraday stocks tomorrow, Play new full videos relevant with What’s Swing Trading.

Online Currency Trading – An Easy Method To Develop Big Profits

An essential beginning point suffices cash to make it through the initial stages. The most risky period are the periods at which economy new are occurred. Then a new trade can be entered appropriately.

Trading on the daily charts is a much easier technique as compared to trading intraday. This everyday charts method can make you 100-500 pips per trade. When trading with this day-to-day charts strategy, you don’t need to sit in front of your computer for hours.

Usage another indication to validate your conclusions. If the resistance and the assistancelines are touching, then, there is most likely to have a breakout. And if this is the Stochastic Trading circumstance, you will not have the ability to presume that the rate will turn once more. So, you may simply wish to set your orders beyond the stretch ofthe assistance and the resistance lines in order for you to capture a happening breakout. Nevertheless, you must utilize another indication so you can validate your conclusions.

An excellent trader not only thinks about the heights of profits however likewise considers the risk involved. The trader ought to be prepared to acknowledge how much they are all set to lose. The upper and lower limit needs to be clear in the trade. The trader must decide just how much breathing time he is ready to offer to the trade and at the same time not risk too much likewise.

Stochastic Trading The swing trader purchases into worry and sells into greed, so lets appearance at how the effective swing trader does this and take a look at a bullish trend as an example.

Many traders make the error of believing they can use the swing trade method daily, however this is not a great concept and you can lose equity rapidly. Rather reserve forex swing trading for days when the market is simply right for swing trading. So, how do you know when the market is right? When the chart is low or high, watch for resistance or support that has been held numerous times like. Watch the momentum and look for when costs swing strongly toward either the resistance or the support, while this is occurring look for verification that the momentum will turn. This confirmation is critical and if the momentum of the price is beginning to wane and a turn is likely, then the chances remain in terrific favor of a swing Stochastic Trading environment.

The Stochastic Sign – this has been around since the 1950’s. It is a momentum sign which determines over bought (readings above 80) and over sold (readings below 20), it compares today’s closing price of a stocks cost variety over a recent amount of time.

I call swing trading “hit and run trading” and that’s what your doing – getting high odds set ups, hitting them and after that banking revenues, before the position can turn back on you. If you discover and practice the above technique for a week approximately, you will soon be positive adequate to applly it for long term currency trading success.

But before you can make great one, you first need to learn to understand how to utilize them. What is does is link a series of points together forming a line. They will “bring the stocks in” to adjust their position.

If you are looking most engaging videos relevant with What’s Swing Trading, and Line D Stock, Trend Detection in Forex Trading, Forex Swing Traders, Forex Trading Strategy please join in a valuable complementary news alert service now.