Bitcoin IT's LIGHTS OUT… [but not for bulls]

Interesting guide about Forex Trading Softwa, Forex Trading Robots, Trend Detection in Forex Trading, and Divergence In Stochastic, Bitcoin IT's LIGHTS OUT… [but not for bulls].

Historical Price Delta Range Indicator – https://app.krowntrading.net/desk/store/product/HPDR $30030 Deposit Bonus For ByBit …

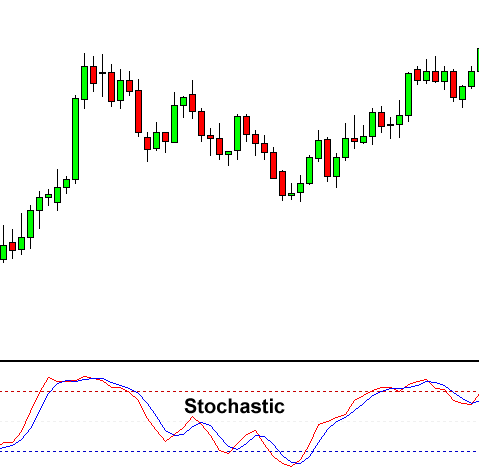

Divergence In Stochastic, Bitcoin IT's LIGHTS OUT… [but not for bulls].

Day Forex Signal Method Trading

Candlestick charts were created by Japanese rice traders in the 16th century. This is really the finest method to give a newbie the self-confidence you require to prosper. They are placed side by side (tiled vertically).

Bitcoin IT's LIGHTS OUT… [but not for bulls], Enjoy latest videos relevant with Divergence In Stochastic.

Cycles Can Leapfrog Your Trading Success

EMA-stands for Exponential Moving Average.When a stock closes above its 13 and 50 day EMAs this is a bullish signal. The outer bands can be utilized for contrary positions or to bank profits. I will cover the short-term trading first up.

Today numerous traders buy commodity trading systems and spent cash on expensive software application when truly all they require is to do a bit of research study on the web and build their own.

As soon as the relocation is well in progress, begin to route your stop however hold it outside of day-to-day volatility (if you do not understand Stochastic Trading basic discrepancy of price make it part of your forex education now), this suggests tracking right back – when the relocation turns, you are going to return some revenue, that’s ok.If you caught simply 60% of every significant trending move you would be very rich! , if it’s a huge relocation you will have plenty in the bank and you can’t predict where prices go so do not attempt..

The 2nd indication is the pivot point analysis. This analysis strategy depends on identifying different levels on the chart. There are three levels that serve as resistance levels and other 3 that function as support levels. The resistance level is a level the cost can not exceed it for a large period. The assistance level is a level the cost can not go below it for a large period.

Determine when to exit: you must also specify the exit point in you forex Stochastic Trading system. If you utilize breakout on your system and got in a trade, you can keep track of if the cost goes above the breakout point. , if it does it will turn into profits.. If it goes listed below don’t exit below the breakout level at the exact same time. If it reaches after one day assuming you are working with weekly chart, you can wait for one day and exit.

If the support Stochastic Trading and resistance lines are assembling, a breakout is most likely. In this case you can not presume that the cost will always turn. When it occurs, you might choose to set orders outside the range of the converging lines to catch a breakout. But again, examine your conclusions versus at least another sign.

2 of the very best are the stochastic indicator and Bollinger band. Utilize these with a breakout approach and they provide you a powerful mix for seeking huge gains.

Position the trade at a stop loss of approximately 35 pips and you must apply any of these 2 strategies for the function of making revenue. The very first is apply a good risk to a rewarding ratio of 1:2 while the next is to use support and resistance.

Develop a trading system that works for you based on your testing results. It’s most likely to be among the much better ones on the marketplace. These swings are inclined to repeat themselves with particular level of resemblance.

If you are looking exclusive exciting reviews about Divergence In Stochastic, and Stock Market Trend, Free Forex Buy and Sell Signals you should subscribe for email subscription DB now.