Big ones – RSI + Stochastic oscillator

https://www.youtube.com/watch?v=-glgmFEINV8

New clips top searched Trading Success, Forex Tip, and Stochastic Oscillator, Big ones – RSI + Stochastic oscillator.

Forex trading takes time. Learn, fail and learn again … repeat everything #forex #money #youtube.

Stochastic Oscillator, Big ones – RSI + Stochastic oscillator.

Forex Trading Method – 3 Fundamental Actions For Forex Success

In fact predicting the start and end of a trend are basically the very same. A synergy in between the systems operations and tools and your understanding of them will insure revenues for you.

Big ones – RSI + Stochastic oscillator, Get new high definition online streaming videos related to Stochastic Oscillator.

Daily Charts Method That Pulls 100-500+ Pips Per Trade

That is, obviously, until I got so burned out trying to capture the turnaround and I would give up. They await a particular price target that they believe to be an excellent buy. The application is, as always, rate and time.

Trading on the day-to-day charts is a much easier method as compared to trading intraday. This daily charts technique can make you 100-500 pips per trade. When trading with this everyday charts method, you do not need to sit in front of your computer for hours.

It is this if one ought to understand anything about the stock market. It is ruled by emotions. Feelings resemble springs, they stretch and agreement, both for only so long. BB’s measure this like no other indicator. A stock, specifically commonly traded large caps, with all the fundamental research study worldwide currently done, will just lie inactive for so long, and after that they will move. The move after such dormant durations will often be in the direction of the general trend. If a stock is above it’s 200 day moving typical Stochastic Trading then it is in an uptrend, and the next relocation will likely be up also.

Them significant problem for the majority of traders who use forex technical analysis or forex charts is they have no understanding of how to deal with volatility from a entry, or stop perspective.

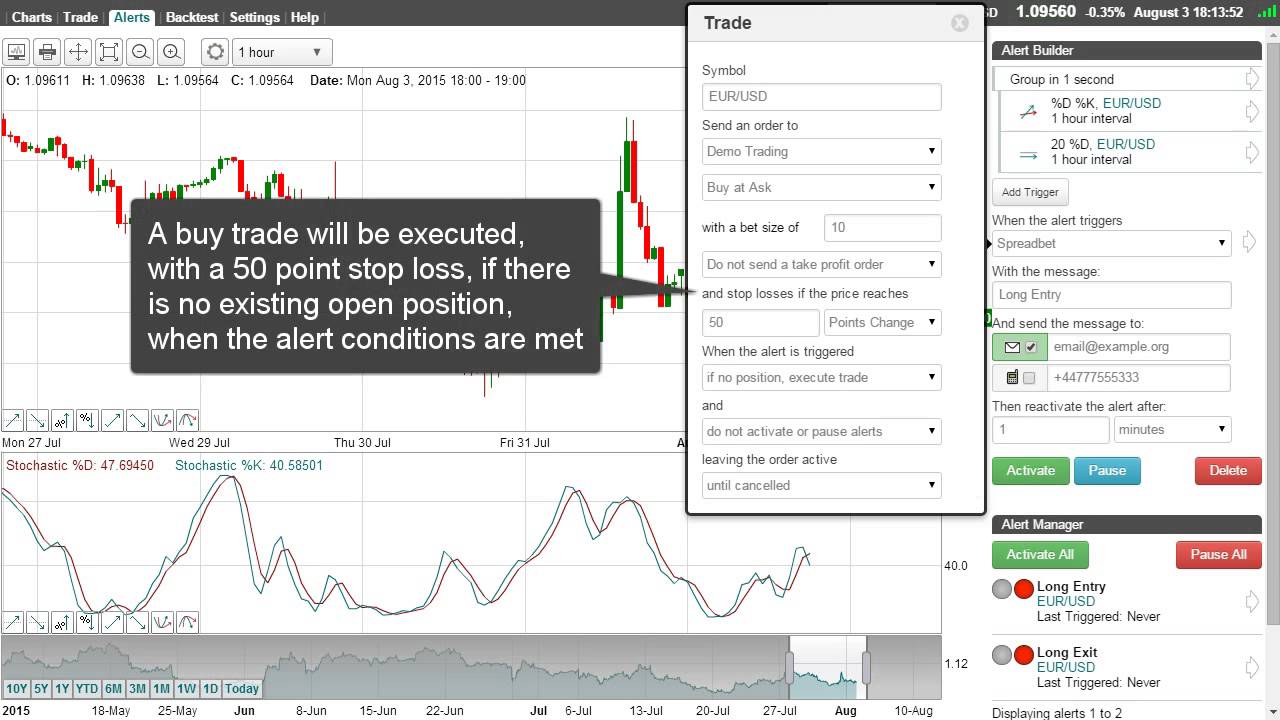

Not all breakouts continue naturally so you require to filter them and for this you need some momentum indications to verify that rate momentum is speeding up. 2 excellent ones to use are the Stochastic Trading and RSI. These indications offer confirmation of whether momentum supports the break or not.

You can spend around thirty minutes a day, trading this method with your forex Stochastic Trading technique and after that go and do something else. You just need to check the costs one or two times a day and that’s it.

The Stochastic Indicator – this has been around considering that the 1950’s. It is a momentum indication which measures over purchased (readings above 80) and over offered (readings below 20), it compares today’s closing price of a stocks rate range over a current time period.

Is it truly that simple? We believe so. We were right last week on all our trades, (and we did even much better in energies inspect out our reports) of course we could have been wrong, however our entries were timed well and had close stops for danger control.

As we talked about in Part 1 of this series, by now you should have an identified trends for the stocks you are watching. Flatter the assistance and resistance, stronger will be your conviction that the variety is real.

If you are looking rare and exciting reviews about Stochastic Oscillator, and Forex Trading Ways, Simple Forex Trading you should join for subscribers database totally free.