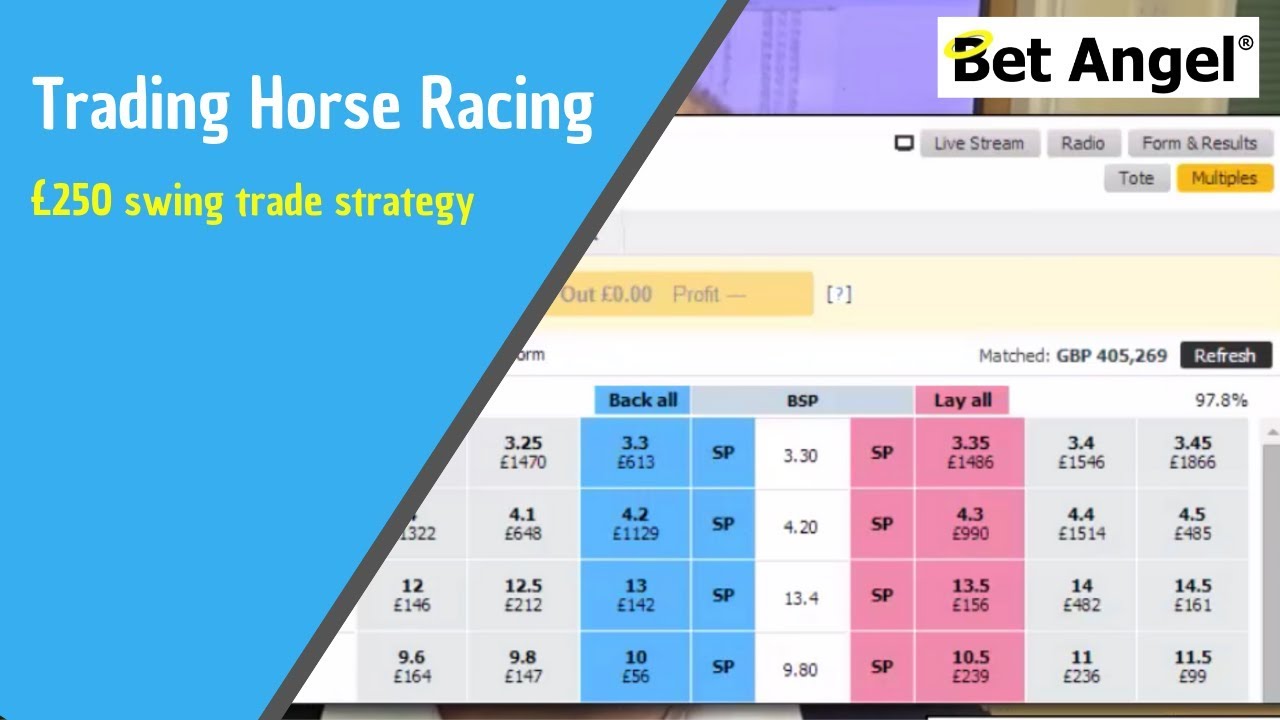

Betfair trading – Strategy behind a £250 swing trade

Interesting YouTube videos related to Trading Forex Online, Learn Currency Trading Online, and What’s Swing Trading, Betfair trading – Strategy behind a £250 swing trade.

I posted up a number of good results last week. Here is of them and the underlying strategy that created it. This is a ‘real’ swing trade, a retracement to mean …

What’s Swing Trading, Betfair trading – Strategy behind a £250 swing trade.

5 Actions To Trading Success Using Technical Analysis

The Stochastic Oscillator is an overbought/oversold sign developed by Dr.

The above method is very easy and can be discovered by anybody and is a classic way to make huge Forex gains.

Betfair trading – Strategy behind a £250 swing trade, Play interesting videos related to What’s Swing Trading.

3 Most Convenient Ways To Become A Successful Forex Swing Trader Fast

This is really the finest method to give a beginner the confidence you require to succeed. Remember for every single purchaser there is a seller. Forex trading is all about trading of foreign currencies.

In these rather uncertain monetary times, and with the volatile nature of the stock exchange today, you may be questioning whether or not you should pull out and head toward some other kind of investment, or you might be looking for a much better, more trusted stock trading indicator. Moving your cash to FOREX is not the answer; it is time to hang in there and get your hands on an excellent stock trading indicator. Attempt this now: Buy Stock Assault 2.0 stock market software.

You’ll observe that when a stock price hits the lower Bollinger Band, it usually tends to rise once again. Utilizing the SMA line in the middle of the Bollinger Bands gives Stochastic Trading us an even better image. Remember, whatever stock sign you choose from on the NASDAQ 100, you ought to examine for any news on it prior to you trade it as any negative news could affect the stock no matter what the Nasdaq efficiency is like.

Most traders like to wait for the pullback however they never ever get in. By awaiting a much better price they miss out on the relocation. Losers don’t choose breakouts winners do.

Not all breakouts continue of course so you need to filter them and for this you need some momentum indicators to validate that cost momentum is speeding up. 2 good ones to utilize are the Stochastic Trading and RSI. These indicators offer verification of whether momentum supports the break or not.

A breakout is likely Stochastic Trading if the assistance and resistance lines are assembling. In this case you can not presume that the rate will constantly turn. You might prefer to set orders outside the variety of the assembling lines to catch a breakout when it happens. However again, inspect your conclusions versus at least another indicator.

If the cost action of the marketplace has actually moved sideways the trend line (18 bars) remains in holding pattern, no action needs to be taken. you must be on the sidelines waiting on a breakout to one side or another.

This forex trading method highlights how concentrating on a bearish market can benefit a currency that is overbought. Whether this technique is best or wrong, it presents a great risk-reward trade off and is well established on its short position in forex trading.

In an uptrend each brand-new peak that is formed is greater than the prior ones. The Stochastic – is an extremely effective trade indicator. His work and research are first class and parallel his character as an individual.

If you are finding exclusive entertaining videos about What’s Swing Trading, and Online Currency Trading, Commodity Trading Systems, Unpredictable Market you are requested to join our email alerts service for free.