Best Swing Trading Stocks For This Week | Swing Trade Stocks Today | Swing Trade Stocks 2023

Top overview top searched Win at Forex, Best Forex Trading, and What’s Swing Trading, Best Swing Trading Stocks For This Week | Swing Trade Stocks Today | Swing Trade Stocks 2023.

Best Swing Trading Stocks For This Week | Swing Trade Stocks Today | Swing Trade Stocks 2023

Stocks covered in this video

Daawat

GAEL

Rushil Decor

#trading #stockmarket

About us

Rajneesh Dua popularly known and RD sir is one the top mentors in Stock trading and Investing. Having total teaching experience of above 20 years, he is a passionate trader and a NISM Certified Research Analyst. His ability to make people understand complex stock market concepts has attracted many people to learn from his courses and mentorship program.

Social Links 😍

Website- www.rajneeshdua.com

Join my Telegram Channel- https://t.me/PowerOfTA

Instagram- https://www.instagram.com/powerofta/

My Trading & Investing Apps 🚀

Upstox- https://upstox.com/open-demat-account/?f=2BAW2H

Zerodha- https://tinyurl.com/zerodha21

StockEdge- https://tinyurl.com/stockedgepremium

TradingView- https://tinyurl.com/tradingview21

Topics Covered :-

swing trading stocks for this week

swing trading strategies

today swing trading stocks

swing stocks for tomorrow

swing trading stocks for tomorrow

swing trading for beginners

swing trading stock selection

best swing trading stocks

how to select stocks for swing trading

stock of the week

stocks for swing trading today

swing trading stocks for next week

best swing trading strategy

swing trading stocks for February

stocks for swing trading

stocks to watch tomorrow

swing trade for tomorrow

swing trading for next week

swing trading for tomorrow

best stocks for swing trading

stocks for swing trading

swing trade stocks

swing trading stock selection

DISCLAIMER- THIS VIDEO IS FOR EDUCATIONAL PURPOSE ONLY. I AM NOT SEBI REG. ANALYST. TAKE ADVISE FROM YOUR FINANCIAL ADVISOR BEFORE INVESTING.

Tags-

best swing trading stocks for this week,swing trade stocks today,swing trade stocks 2023,swing trading strategies,swing trading stocks,swing trading for beginners,swing trading stock selection,best swing trading stocks,best swing trading stocks for next week,best swing trading stocks for tomorrow,best swing trading stocks now,swing trading stocks latest,swing trading stocks right now,swing trade stocks,top 3 swing trading stocks

What’s Swing Trading, Best Swing Trading Stocks For This Week | Swing Trade Stocks Today | Swing Trade Stocks 2023.

Forex Swing Trading – The Ideal Method For Beginners To Look For Huge Gains

Two moving average signs should be made use of one quick and another slow. They are the nearby you can get to trading in genuine time with all the pressure of prospective losses. Nothing could be further from the fact!

Best Swing Trading Stocks For This Week | Swing Trade Stocks Today | Swing Trade Stocks 2023, Explore popular replays relevant with What’s Swing Trading.

Forex Charts – Standard Earnings Ideas For Beginners

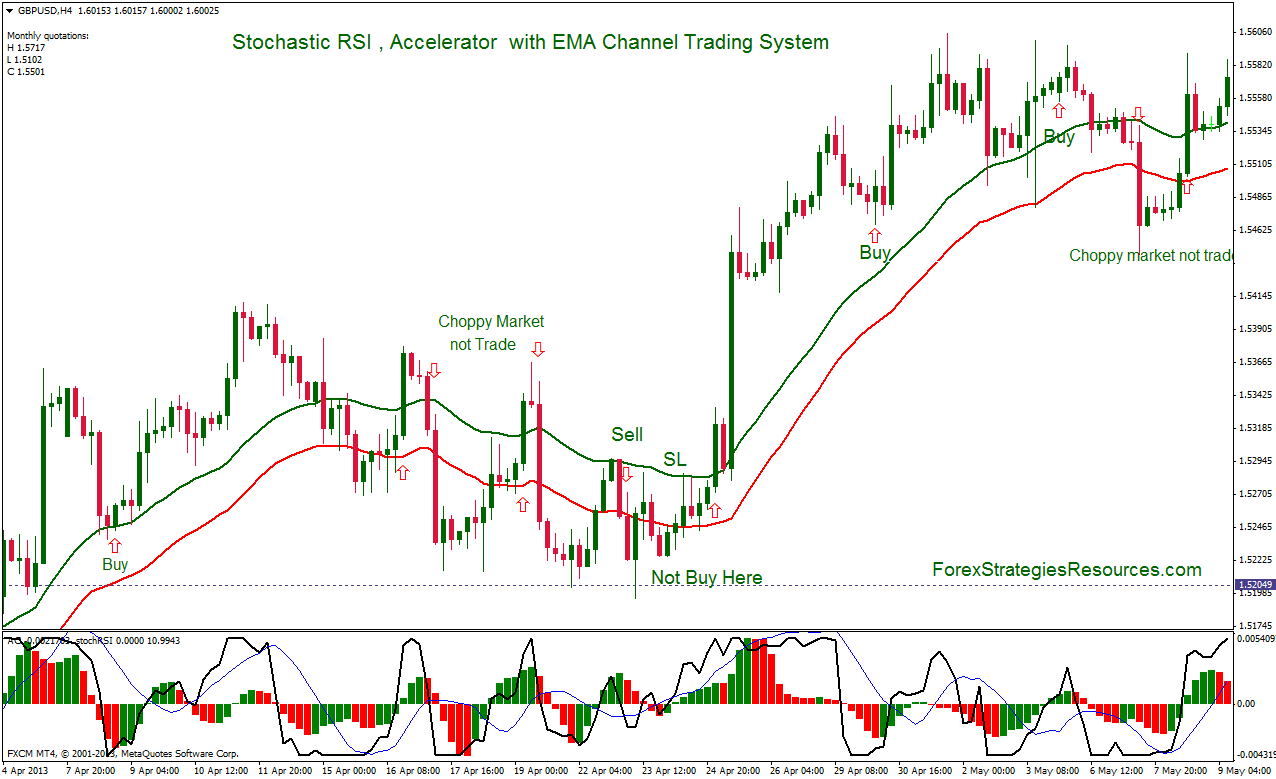

As a market moves up toward a resistance, stochastic lines should normally point up. He or she has a long term time horizon like a couple of months to even a couple of years. Nobody can anticipate where the market will go.

There is a distinction in between trading and investing. Trading is constantly short term while investing is long term. The time horizon in trading can be as brief as a couple of minutes to a few days to a couple of weeks. Whereas in investing, the time horizon can be months to years. Lots of people day trade or swing trade stocks, currencies, futures, choices, ETFs, products or other markets. In day trading, a trader opens a position and closes it in the same day making a quick earnings. In swing trading, a trader tries to ride a trend in the market as long as it lasts. On the other hand, an investor is least pressed about the short-term swings in the market. She or he has a long term time horizon like a couple of months to even a couple of years. This long time horizon matches their investment and financial objectives!

It is this if one must understand anything about the stock market. It is ruled by emotions. Emotions resemble springs, they stretch and agreement, both for only so long. BB’s procedure this like no other indication. A stock, particularly extensively traded big caps, with all the basic research study on the planet currently done, will only lie inactive for so long, and then they will move. The move after such dormant durations will usually be in the instructions of the general trend. And the next Stochastic Trading relocation will likely be up as well if a stock is above it’s 200 day moving average then it is in an uptrend.

His primary methods include the Dedication of Traders Index, which reads like a stochastic and the second is Major & Minor Signals, which are based upon a static jump or decrease in the abovementioned index. His work and research study are very first class and parallel his character as a person. However, for any approach to work, it has to be something the trader is comfortable with.

A vital starting point is sufficient cash to make it through the initial phases. If you have sufficient cash you have the time to learn and enhance your Stochastic Trading until you are making cash. Just how much cash is needed depends on the number of contracts you desire to trade. For example to trade 1 $100,000 dollar contract you require in between $1000 and $1500 as margin.

MACD Crossover. After you have actually researched a stocks chart to see if the stock is trending, you should now inspect out its MACD chart. MACD-stands for Moving Typical Convergence-Divergence. This chart has 2 lines, the crossing of the two lines is a signal of a new pattern. The 2 lines consist of a slow line and a quick line. Where the crossover happens tells you if there is Stochastic Trading a trend. The quick line needs to cross above the sluggish line, or above the 0 line. The higher it rises above the 0 line the stronger the uptrend. The lower it descends below the 0 line the more powerful the downtrend. A trader or financier desires to capture stocks that are trending huge time, that is how it is possible to make great cash!

Check some momentum indications, to see how overbought momentum is and a terrific one is the stochastic. We do not have time to discuss it in full detail here so look it up, its a visual sign and will only take thirty minutes or two to learn. Search for it to become overbought and after that. just watch for the stochastic lines to turn and cross down and get short.

In common with virtually all elements of life practice is the essential to getting all 4 components collaborating. This is now simpler to accomplish as lots of Forex websites have presentation accounts so you can practice without running the risk of any real cash. They are the nearest you can get to trading in real time with all the pressure of possible losses. However remember – practice makes ideal.

With this plan, you can trade by yourself schedule and exploit price changes in the market. In common with essentially all elements of life practice is the crucial to getting all 4 components collaborating.

If you are searching unique and exciting reviews related to What’s Swing Trading, and Swing Trading Ranges, Trading Success, Trend Detection in Forex Trading you are requested to subscribe for email list totally free.