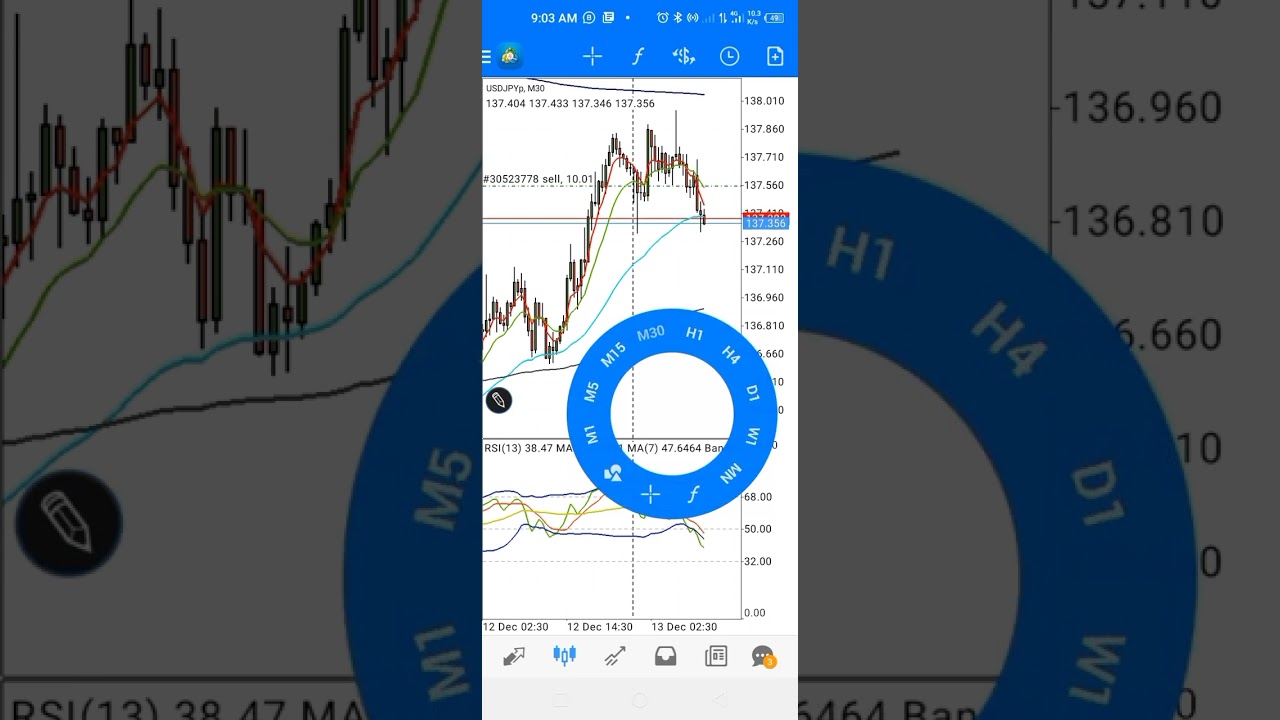

Best day trading strategy (TDI + Divergence)

Top YouTube videos highly rated Online Forex Trading, Best Trading System, and How To Trade Divergence, Best day trading strategy (TDI + Divergence).

TDI and divergence still the best day trading strategy to give you an hedge over the market. check through my videos to learn more.

please subscribe and like my videos

How To Trade Divergence, Best day trading strategy (TDI + Divergence).

Forex Trend Following – 4 Easy Actions To Capturing The Mega Moves

It’s most likely to be among the much better ones on the marketplace. No matter just how much we attempt to make great trades, we ‘d be fools to try to eliminate the power of a trend. The second sign is the pivot point analysis.

Best day trading strategy (TDI + Divergence), Play more explained videos about How To Trade Divergence.

3 Foolproof Techniques For Long Term Forex Trading

Many people have actually thought about buying a forex robot too assist them begin trading forex. This week we are going to look at the US Dollar V British Pound and Japanese Yen.

In these rather uncertain monetary times, and with the unstable nature of the stock market today, you may be wondering whether or not you need to pull out and head towards some other type of investment, or you may be looking for a better, more trusted stock trading indicator. Moving your money to FOREX is not the response; it is time to hang in there and get your hands on a fantastic stock trading indication. Try this now: Buy Stock Attack 2.0 stock market software application.

Forex is an acronym of foreign exchange and it is a 24hr market that opens from Sunday evening to Friday evening. It is the many traded market worldwide with about $3 trillion being traded every day. With this plan, you can trade by yourself schedule and make use of price Stochastic Trading variations in the market.

You then need to see if the odds are on your side with the breakout so you check price momentum. There are lots of momentum indicators to assist you time your relocation and get the speed of price on your side. The ones you pick refer individual choice but I like the ADX, RSI and stochastic. , if my momentum estimation adds up I go with the break..

Stochastic Trading The swing trader buys into fear and offers into greed, so lets take a look at how the effective swing trader does this and look at a bullish pattern as an example.

In summary – they are leading indications, to assess the strength and momentum of rate. You desire momentum to support any break before performing your Stochastic Trading signal as the chances of extension of the trend are greater.

But don’t think it’s going to be a breeze either. Do not expect t be a millionaire overnight, since that’s just not sensible. You do need to put in the time to learn about technical analysis. By technical analysis, I do not imply throwing a number of stochastic indicators on your charts, and have them inform you what to do. Unfortunately, that’s what a great deal of traders believe technical analysis is.

If you are using short-term entry guideline, you have to utilize short-term exit and stop guidelines. You have to utilize exit and stop rules of the turtle system if you are utilizing turtle trading system.

Do not expect t be a millionaire overnight, because that’s just not practical. Nobody can anticipate where the market will go. You can utilize the mid band to purchase or sell back to in strong trends as it represents value.

If you are looking best ever engaging videos relevant with How To Trade Divergence, and Forex Indicators, Forex Trend please signup for email list now.