ASX Stochastic Reversal Strategy

Top YouTube videos related to Trend Analysis, Forex Options, and Stochastic Crossover Signal, ASX Stochastic Reversal Strategy.

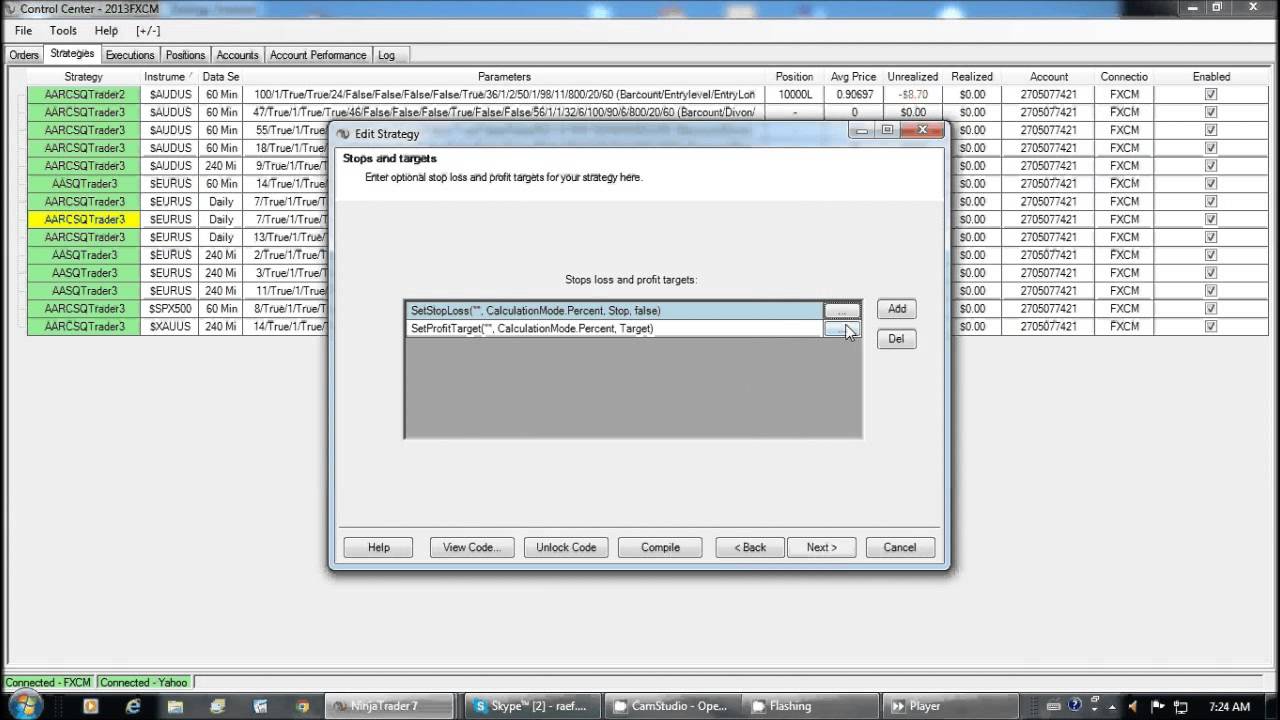

Making a NinjaTrader 7 Stochastic Reversal Strategy with the strategy wizard. It will enable to back test different trading ideas before you apply them in real time. A basic introduction to using the strategy wizard in NinjaTrader7. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. Risk Disclaimer.

Stochastic Crossover Signal, ASX Stochastic Reversal Strategy.

How To Utilize Fibonacci In Forex

Without mincing words, forex trading offers you among the bast and fastest methods of making money at home. Focus on long-lasting trends – it’s these that yield the huge revenues, as they can last for several years.

ASX Stochastic Reversal Strategy, Enjoy top full videos related to Stochastic Crossover Signal.

Producing Profits Utilizing Technical Analysis Trading Strategies

Cash management: this subject is among the most crucial things to consider when building the system. You can make cash in a varying market, and here is how. By awaiting a better rate they miss out on the move.

There is a distinction in between trading and investing. Trading is always brief term while investing is long term. The time horizon in trading can be as brief as a couple of minutes to a few days to a few weeks. Whereas in investing, the time horizon can be months to years. Many individuals day trade or swing trade stocks, currencies, futures, options, ETFs, products or other markets. In day trading, a trader opens a position and closes it in the exact same day making a fast earnings. In swing trading, a trader attempts to ride a pattern in the market as long as it lasts. On the other hand, a financier is least pushed about the short term swings in the market. She or he has a long term time horizon like a couple of months to even a couple of years. This long period of time horizon matches their investment and financial goals!

Well, in this brief article I can’t go into the tactical level – I can’t Stochastic Trading discuss my entry and exit activates, and trade management strategies.Since it’s not just a simple indicator based entry or exit, it would take a whole book. It’s based on cost action – on an understanding of the nature of motion of cost. That takes a long time to develop, and it’s something I’ll cover in my site in a lot more information.

The 2nd significant point is the trading time. Typically, there are specific time durations that are perfect to get in a trade and period that are hard to be rewarding or very dangerous. The dangerous time periods are the times at which the rate is fluctuating and tough to anticipate. The most risky period are the periods at which economy new are arisen. Since the cost can not be predicted, the trader can enter a trade at this time. Also at the end day, the trader must not enter a trade. In the Forex market, completion day is on Friday.

So, here are some useful suggestions to effectively trade foreign currency exchange in an unpredictable market. Sure enough, you can use these suggestions while utilizing a demonstration account. After all, utilizing a demo account will allow you to practice forex Stochastic Trading and make you gotten ready for the genuine thing.

It is essential to find a forex robot that comes with a 100% cash back assurance. , if there is a money back ensure this means that it is one of the best forex Stochastic Trading robots out there..

Technical Analysis is based on the Dow Theory. Dow theory in nutshell says that you can utilize the previous cost action to predict the future rate action. These rates are supposed to integrate all the openly readily available details about that market.

Currency trading is a way of making money but it likewise depends on the luck aspect. However all is not lost if the traders make guidelines for themselves and follow them. This will not only ensure higher revenues but also reduce the risk of higher losses in trade.

I use the moving averages to specify exit points in the following method. In summary – they are leading signs, to assess the strength and momentum of rate. It is one of the simplest tools used in TA.

If you are looking most entertaining reviews related to Stochastic Crossover Signal, and Techncial Analysis, E Mini Trading you should list your email address in newsletter for free.