Applying Risk Reward Ratio to Swing Trading

Latest YouTube videos relevant with Turtle Trading, Commodity Markets, Trading Rules, Trading 4x Online, and What’s Swing Trading, Applying Risk Reward Ratio to Swing Trading.

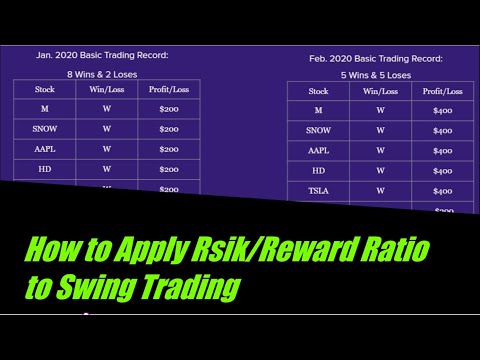

Understanding and using Risk/Reward properly is the key to being a profitable trader. This video explains the concept of Risk/Reward or Risk to Reward Ratio and how it should be applied in order to profit from trading over time.

From watching the video, you will be able to define risk, reward, and risk to reward ratio. You will also be able to decide your own risk tolerance and apply it to your trading plans.

This video explains this concept better: https://youtu.be/az-36OyV7So

Please forgive the audio error around the 5:00 mark. :I

Need ideas for swing trades?

I send out free weekly emails with my ideas for trades to provide you information and inspiration so that you can make your own decisions.

Join the Weekly Watch List email group here: https://mailchi.mp/03333e0773a2/swingtradefromscratchwwl.

Trying to learn how to become an independent, professional swing trader?

My courses will give you everything you need in order to accomplish that goal.

Swing Trading 1: Foundations and Basics

-This is an accessible program for those interested in step-by-step guidance in the foundations and basics of swing trading, including: financial vocabulary, stock market sectors, technical analysis, fundamental analysis, and general trade ideas.

https://perfectyourtrading.com/s/courses/101/preview/guest

Swing Trading 2: Strategy and Practice

-Building off the baseline knowledge, this course provides instruction in the strategies and practical operations of profitable swing trading with a focus on Event Driven trading, Global Macro trading, risk management, ordering, and creating a trading plan.

https://perfectyourtrading.com/s/courses/102/preview/guest

Outlook & Recap Playlist Home:

Please contact me in the comments, via email, or on social media with any questions, concerns, feedback, or ideas.

This video is intended for educational purposes only.

#SwingTrading #SwingTradingStrategy #RiskReward #Risk #Reward #RiskRewardRatio #RisktoRewardRatio #Trading #TradingPlan #WallStreet #LearntoTrade #SwingTradefromScratch #FinancialLiteracy #HowtoSwingTrade #swingTradingCourse #SwingTrading101

What’s Swing Trading, Applying Risk Reward Ratio to Swing Trading.

Best Forex Trading Strategy

This will not only guarantee higher profits but likewise lessen the risk of higher losses in trade. Do you have a stop loss or target to exit a trade? This is simply a minimum list of tools that you will need to be effective.

Applying Risk Reward Ratio to Swing Trading, Find top reviews relevant with What’s Swing Trading.

The Less Is More Approach To Discovering To Trade Forex Successfully

The application is, as constantly, cost and time. Without a stop loss, do you know that you can erase your trading account very quickly? Catching the big long term trends and these just come a few times a year.

One of the aspects that you need to learn in Forex trading is understand the value of currency trading charts. The main purpose of Forex charts is to help making presumptions that will cause much better decision. But prior to you can make good one, you initially must find out to know how to use them.

The trader can keep track of at which pivot level the cost has reached. if it goes at higher level, this can be presumed as extreme point for the rate, the trader then needs to check the Stochastic Trading worth. This will be sign that the currency is overbought and the trader can go short if it is higher than 80 percent for long time. the currency will go short to much at this case.

You need less discipline than trend following, since you do not have to hold positions for weeks on end which can be hard. Instead, your losses and profits come rapidly and you get plenty of action.

Now I’m not going to get into the information regarding why cycles exist and how they belong to cost action. There is much written on this to fill all your quiet nights in checking out for decades. If you spend just a bit of time viewing a MACD or Stochastic Trading indication on a cost chart, you should already be convinced that cycles are at work behind the scenes. Simply enjoy as they swing up and down between extremes (overbought and oversold zones) to get a ‘feel’ for the cycle ebb and circulation of price action.

Technical experts attempt to identify a trend, and ride that trend up until the trend has actually validated a reversal. If a good company’s stock remains in a downtrend according to its chart, a trader or investor utilizing Technical Analysis will not Stochastic Trading purchase the stock until its trend has reversed and it has been validated according to other important technical indicators.

To see how overbought the currency is you can utilize some momentum indications which will provide you this info. We don’t have time to describe them here however there all simple to use and learn. We like the MACD, the stochastic and the RSI but there are a lot more, simply choose a couple you like and use them.

Yes and it will constantly generate income as long as markets trend breakouts will happen and if you are selective on the ones you select and validate the moves, you could enjoy amazing currency trading success.

Momentum is up at present – will the resistance hold its time to take a look at the daily chart. Then, like magic, the perfect divergence pattern would appear, but I would not be in the trade.

If you are looking updated and exciting comparisons relevant with What’s Swing Trading, and Forex Day, Currency Trading Method, Forex Success, Learn to Day Trade Forex please join our a valuable complementary news alert service for free.