Al Brooks: Trade Management As A Swing Trader VS. Scalper

Trending videos top searched Successful Swing Trading, Forex Robots, and What’s Swing Trading, Al Brooks: Trade Management As A Swing Trader VS. Scalper.

Watch the full interview with Al Brooks here: https://youtu.be/N-kr7PTO_wU.

What’s Swing Trading, Al Brooks: Trade Management As A Swing Trader VS. Scalper.

How To Generate Income Trading The Nasdaq 100

Learn this basic Forex trading strategy and you can delight in long term currency trading success. Your ability to get the very best from this strategy depends on the method you efficaciously use the method.

Al Brooks: Trade Management As A Swing Trader VS. Scalper, Play top high definition online streaming videos about What’s Swing Trading.

Basics Of Technical Analysis In Stock Trading

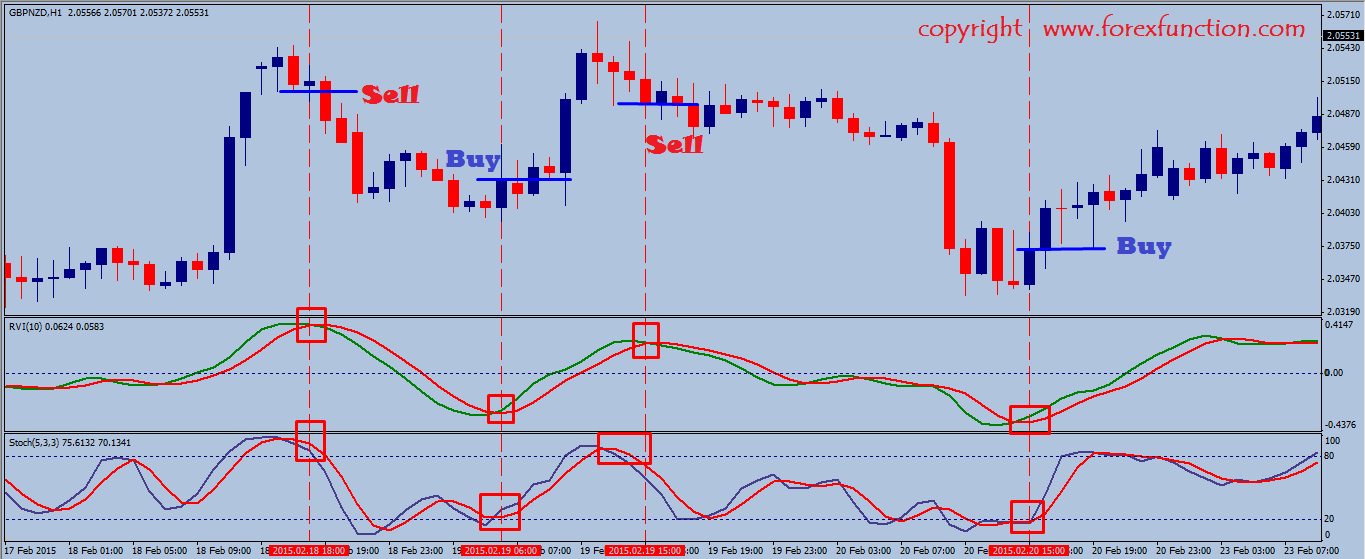

Those lines could have crossed 3 or 4 times before just to revert back. Here we are going to take a look at 2 trading opportunities recently we banked an excellent revenue in the British Pound.

Here we are going to look at two trading chances last week we banked an excellent profit in the British Pound. Today we are going to look at the United States Dollar V British Pound and Japanese Yen.

If one need to understand anything about the stock exchange, it is this. It is ruled by emotions. Feelings resemble springs, they stretch and agreement, both for just so long. BB’s measure this like no other indication. A stock, particularly widely traded big caps, with all the basic research study worldwide currently done, will just lie dormant for so long, and after that they will move. The move after such dormant periods will often remain in the instructions of the overall trend. If a stock is above it’s 200 day moving typical Stochastic Trading then it remains in an uptrend, and the next move will likely be up as well.

You require less discipline than trend following, because you do not need to hold positions for weeks on end which can be difficult. Instead, your losses and revenues come rapidly and you get lots of action.

Just as important as you will understand the reasoning that this forex Stochastic Trading strategy is based upon, you will have the discipline to trade it, even when you take a few losses as you know your trade will come.

Do you have a stop loss or target to leave a trade? One of the most significant mistakes that forex traders made is trading without a stop loss. I have actually stressed lot of times that every position must have a stop loss however till now, there are a lot of my members still Stochastic Trading without setting a stop. Are you among them?

While these breaks can sometimes be difficult to take, if the support or resistance is legitimate, the chances favour a huge relocation – however not all breakouts are produced equal.

Is it actually that easy? We believe so. We were right recently on all our trades, (and we did even much better in energies take a look at our reports) obviously we might have been incorrect, however our entries were timed well and had close stops for danger control.

You might take one appearance at it and believe it is rubbish. Emotions are like springs, they stretch and agreement, both for only so long. So how do we respect the pattern when day trading? That is why locking in revenues is so so vital.

If you are looking rare and exciting videos relevant with What’s Swing Trading, and Win at Forex, Online Currency Trading, Forex Swing Trading, Forex Software please subscribe for newsletter for free.