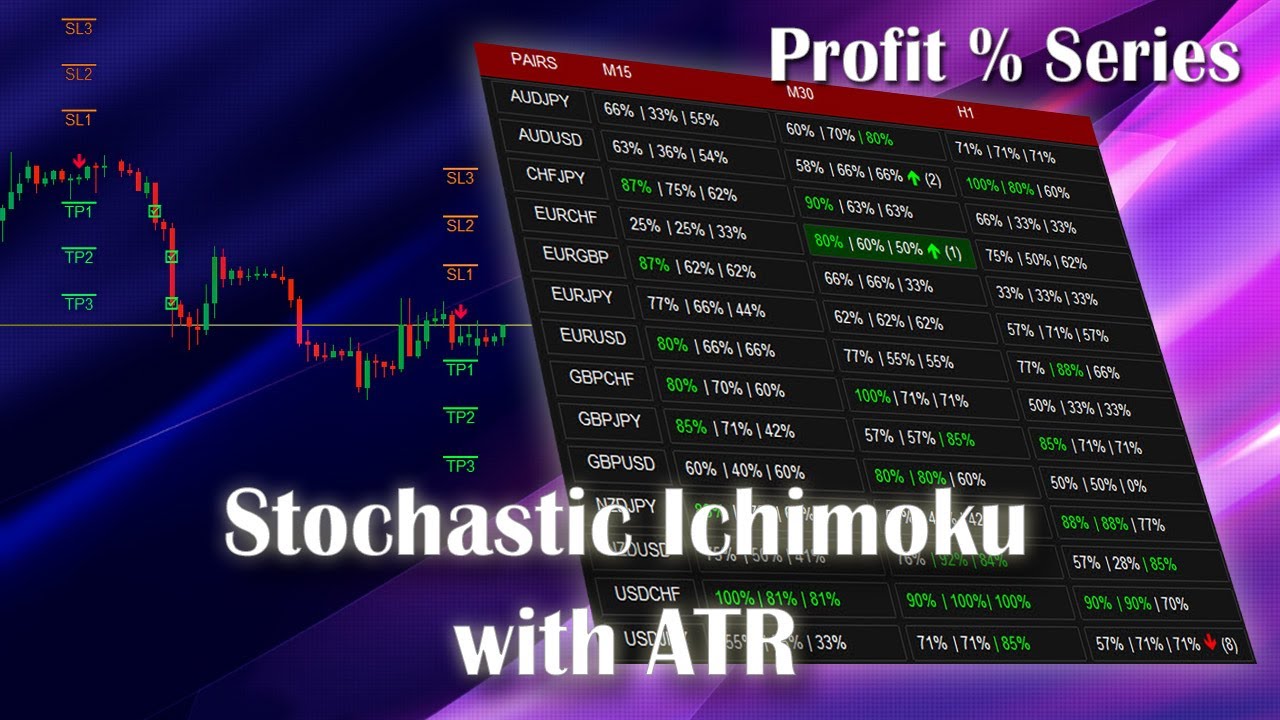

Abiroid Profit Percent Series 1: Stochastic Ichimoku with ATR Arrows and Scanner Dashboard (MT4)

Popular guide top searched Effectively Trade Forex, Simple Forex Trading Strategy, Unpredictable Market, and Most Accurate Stochastic Settings, Abiroid Profit Percent Series 1: Stochastic Ichimoku with ATR Arrows and Scanner Dashboard (MT4).

Arrows (Paid):

https://www.mql5.com/en/market/product/48565/

or

https://abiroid.com/product/profit-percent-stoch-ichimoku-with-atr

And get Extra Downloads like ATR Channels and best Templates and Settings files from the post above.

Scanner is free:

https://www.mql5.com/en/market/product/49217/

About The Strategy:

This strategy has 3 main parts.

Main Signal, Trend Check and SL/TP Prediction:

1. Stochastic/RSI/CCI OB/OS (Main Signal)

This allows you to use multiple indicators (comma separated names and settings)

Indicator1: (Main Signal)

For BUY: Oversold crossed and back

For SELL: Overbought crossed and back

Indicator 2+ (Validating Indicators – Optional)

Both BUY and SELL Signals will check if Indicator 2 and more are inside safe OverBought/Oversold range. If OB/OS Values are reversed, then you can check if price is beyond OB/OS. Sometimes this reverse case gets better percentages.

Once a successful signal is generated, it will check the trend. All Trend checks are optional.

2. Ichimoku or EMA Higher TF (Trend Check Optional)

Use Ichimoku:

Possible Checks (all optional):

For BUY:

– Price above Kumo Cloud (at least Min Distance away Points)

– Tenkan above Kijun (Min Distance)

– Chikou Span away and above Kumo Cloud (Min Distance)

– Chikou Span away and above Price (Min Distance)

For SELL, same settings only vice-versa

Use EMA for Higher Timeframes (also Optional):

You can specify number of Higher Timeframes for which you need to check EMA Trend for.

If you are trading on M30 and you keep Check EMA HTF number to “3”

Then it will check trend for current timeframe M30 and 2 higher timeframes H1,H4.

If it sees all trends aligned then it will allow the BUY/SELL Signal.

3. ATR (SL/TP Prediction)

The Take Profit and Stop Loss are predicted using ATR Channels. There are 6 channels available.

You can specify how which channel is for TP and SL.

Suppose you are using TP1,TP2,TP3 and SL1,SL2,SL3 as shown in image:

It will compare past bars and check if TP1 was hit or SL1. TP2 is compared with SL2 and so on.

Indicator will show you a percent of successful TP1, 2 or 3 Profits. Or unsuccessful hits and losses with SL Percentage.

Most Accurate Stochastic Settings, Abiroid Profit Percent Series 1: Stochastic Ichimoku with ATR Arrows and Scanner Dashboard (MT4).

Generate Income Fast – Basic Trading Pointers To Build Real Wealth

The more flat these two levels are, possibilities of a rewarding variety trading will be greater. This is something that you are not going to see on a simple backtest. This is where the incorrect marketing comes in.

Abiroid Profit Percent Series 1: Stochastic Ichimoku with ATR Arrows and Scanner Dashboard (MT4), Search latest replays about Most Accurate Stochastic Settings.

3 Sure-Fire Techniques For Long Term Forex Trading

Dow theory in nutshell says that you can use the past cost action to forecast the future cost action. Use these with a breakout technique and they provide you an effective mix for seeking big gains.

Although forex trading isn’t an intricate process procedurally, there are things you require to find out about the marketplace to prevent making economically agonizing errors. Never get in the forex trading market till you are armed with understanding of the marketplace, how it acts and why the pros trade the method they do. This preparation might imply the difference between terrific revenue and terrific loss.

Price increases always happen and they always fall back and the objective of the swing trader is – to sell the spike and make a fast revenue. Now we will look at an easy currency swing Stochastic Trading technique you can utilize today and if you utilize it correctly, it can make you triple digit gains.

Them major problem for many traders who use forex technical analysis or forex charts is they have no understanding of how to deal with volatility from a entry, or stop perspective.

Stochastic Trading The swing trader purchases into worry and sells into greed, so lets look at how the effective swing trader does this and look at a bullish pattern as an example.

Numerous traders make the mistake of thinking they can use the swing trade strategy daily, but this is not an excellent concept and you can lose equity quickly. Instead reserve forex swing trading for days when the market is just right for swing trading. So, how do you know when the marketplace is right? When the chart is high or low, enjoy for resistance or assistance that has actually been held numerous times like. Watch the momentum and look for when costs swing highly towards either the support or the resistance, while this is happening expect confirmation that the momentum will turn. This verification is vital and if the momentum of the rate is starting to wane and a turn is likely, then the chances remain in great favor of a swing Stochastic Trading environment.

While these breaks can often be tough to take, if the assistance or resistance stands, the chances favour a big relocation – however not all breakouts are produced equivalent.

So get learn Forex swing trading systems and choose one you like and you could soon be making big regular profits and enjoying currency trading success.

Trading without a stop loss does not motivate a calm and separated trading technique. There are several definitions to the terms vary trading. What were these fundamental analysts missing out on?

If you are searching updated and entertaining comparisons about Most Accurate Stochastic Settings, and Swing Trading Forex, Free Forex Eudcation, Determining Market Cycles you should list your email address for newsletter for free.