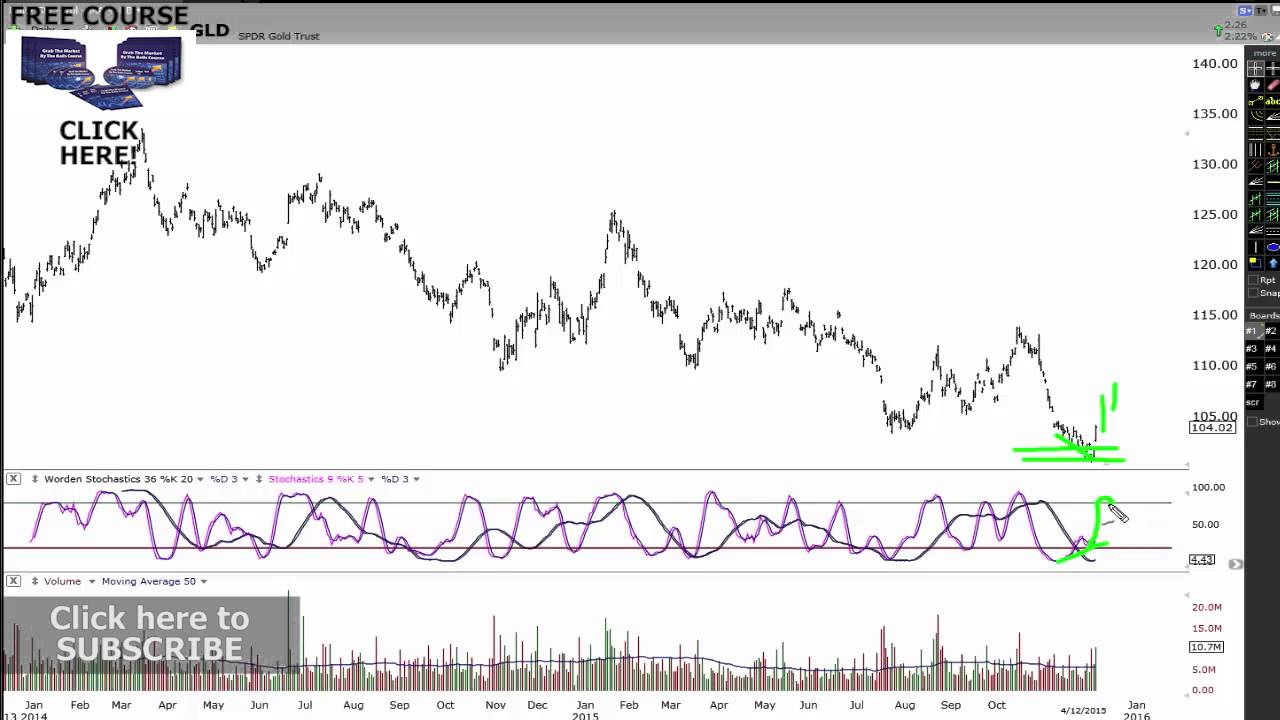

A Recent Trade on GLD Using The Double Stochastics

Latest videos highly rated Technical Indicators, Forex Effectively, Trade Forex, and Trading Stochastic Divergence, A Recent Trade on GLD Using The Double Stochastics.

A Recent Trade on GLD Using The Double Stochastics

Free Trading course — http://officialjohnhowell.com/ytfc/

http://officialjohnhowell.com/

In this video , I’m going to cover and go into detail on ” A Recent Trade on GLD Using The Double Stochastics “. I hope you like it and if you could like it , give it a thumbs up and subscribe for more videos.

Johns story ( Almost bankrupt – cancer – and so much more)

Watch the video here:

http://officialjohnhowell.com/about-john/

FACE Book Page

See the full video blog post here:

http://officialjohnhowell.com/a-recent-trade-on-gld-using-the-double-stochastics/

Face Book

John Daily investing FB page:

https://www.facebook.com/Sharetradingmastery

Johns Fitness and Health page:

https://www.facebook.com/JohnHowellpage

Twitter :

https://twitter.com/JohnHowell_page

Video Blog Education:

Daily Investing Tips:

http://officialjohnhowell.com/category/fe-smart-investing/

Cutting Edge Fitness and Health

http://officialjohnhowell.com/category/health-weightloss/

Johns Coaching Podcast – http://officialjohnhowell.com/category/johns-pod-cast/

You Tube Channels:

Trading and investing : https://www.youtube.com/tradingandinvesting

Health and Fitness : https://www.youtube.com/pumpjunkies

Watch this video again on ( A Recent Trade on GLD Using The Double Stochastics ) here: https://youtu.be/PIwXlXCwCtQ

Tags: John Howell, Trading systems, Trading strategies, Stock Market, Stock Market Update,

Forex , Options, Dow Jones, Options, Trading, Trading options, Investing, Trading coach, share trading,

share trading courses, stock market, stock market trading, the stock market game, stock market crash,

Dow Jones stock market, S&P 500 dow jones, S&P 500, Nasdaq stock market,

Trading Stochastic Divergence, A Recent Trade on GLD Using The Double Stochastics.

3 Simplest Ways To End Up Being An Effective Forex Swing Trader Fast

I’ll expose what these factors are with the hope that you can discover the ideal robot to help you trade successfully.

The trade sold on a downturn in momentum after the very first high at the 80.0 level.

A Recent Trade on GLD Using The Double Stochastics, Enjoy popular videos related to Trading Stochastic Divergence.

Thinking Of Getting A Forex Trading Robot? Three Concepts To Get It Right

Without a stop loss, do you understand that you can eliminate your trading account really quickly? Path your stop up gradually and beyond typical volatility, so you do not get bumped out of the pattern to quickly.

Numerous traders seek to buy a currency trading system and do not realize how simple it is to build their own. Here we wish to look at constructing a sample trading system for substantial revenues.

You’ll notice that when a stock cost hits the lower Bollinger Band, it typically tends to rise once again. Using the SMA line in the middle of the Bollinger Bands gives Stochastic Trading us an even much better image. Keep in mind, whatever stock sign you select from on the NASDAQ 100, you should inspect for any news on it prior to you trade it as any negative news could affect the stock no matter what the Nasdaq performance is like.

His primary approaches include the Commitment of Traders Index, which reads like a stochastic and the 2nd is Major & Minor Signals, which are based on a static dive or decrease in the aforementioned index. His work and research are first class and parallel his character as a person. Nevertheless, for any method to work, it needs to be something the trader is comfortable with.

A necessary starting point suffices cash to survive the initial stages. , if you have adequate cash you have the time to discover and improve your Stochastic Trading till you are making cash.. How much cash is needed depends upon how many contracts you wish to trade. For instance to trade 1 $100,000 dollar contract you need in between $1000 and $1500 as margin.

You require to have the Stochastic Trading mindset that if the break happens you opt for it. Sure, you have actually missed the first little profit but history shows there is generally plenty more to follow.

Breakouts to new market highs or lows and this is the methodology, we wish to use and it will constantly work as the majority of traders can not purchase or sell breakouts. Most traders have the concept they wish to purchase low sell high, so when a break occurs they wish to get in at a much better rate on a pullback however of course, on the huge breaks the cost does NOT pullback and the trader is left thinking what may have been.

Remember, if your trading stocks, do your research and go in with a plan and stay with it. Do not forget to secure revenues. Stock trading can make you a lot of cash if performed in a disciplined way. So get out there and try it out.

Yet again, check your assessments versus at least 1 extra indicator. In common with essentially all aspects of life practice is the crucial to getting all 4 components collaborating.

If you are finding exclusive engaging videos relevant with Trading Stochastic Divergence, and Trading Opportunities, Trade Stochastics dont forget to signup for newsletter now.