Brief History of Stochastic Oscillator

New complete video top searched Win at Forex, Forex Online Trading, Detect Trend in Forex Trading, and Stochastic Oscillator, Brief History of Stochastic Oscillator.

https://www.forexboat.com/

Get Your Free Membership Now!

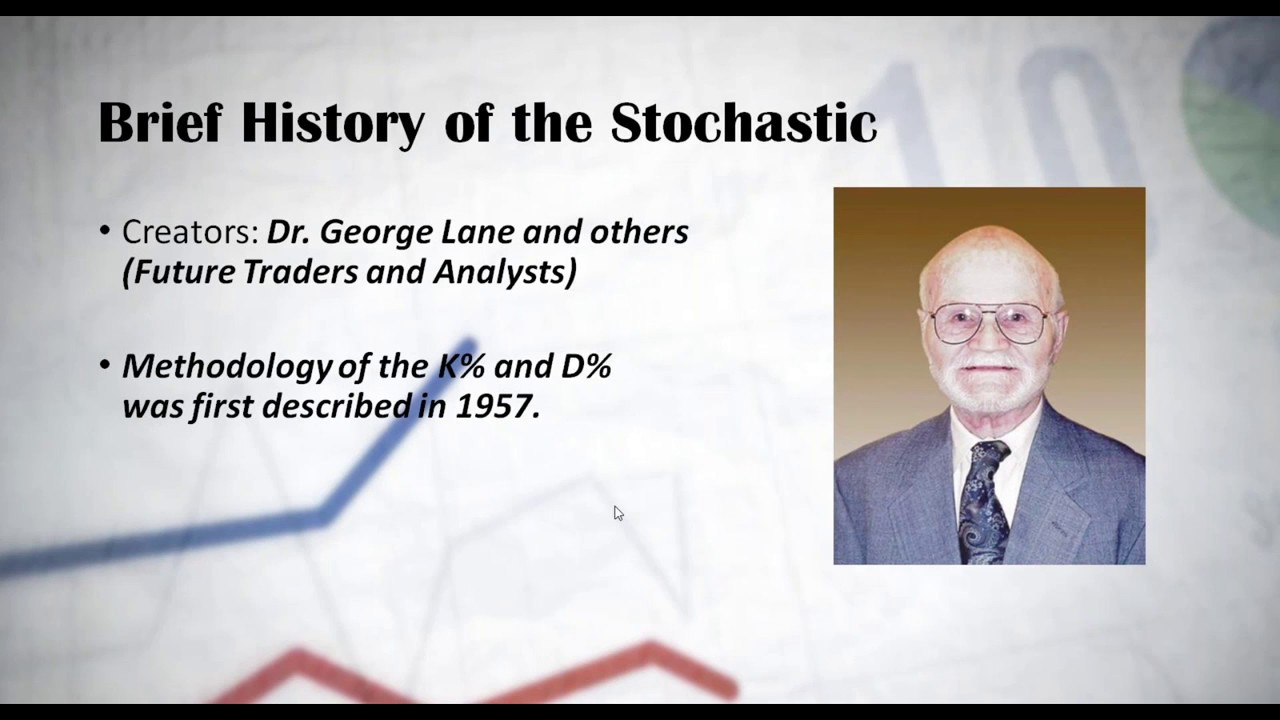

The stochastic oscillator was developed in the late 1950s by George Lane. As designed by Lane, the stochastic oscillator presents the location of the closing price of a stock in relation to the high and low range of the price of a stock over a period of time, typically a 14-day period. It was also stated that Dr. Lane developed the strategy with a team of traders and analysts but they remained to be unrecognized up until now.

“Stochastics measure the momentum of price. If you visualize a rocket going up in the air – before it can turn down, it must slow down. Momentum always changes direction before price.”

Stochastic Oscillator, Brief History of Stochastic Oscillator.

Swing Trading Forex – A Easy And Easy To Understand Strategy For Big Gains!

They will “bring the stocks in” to change their position. The only thumb-down in this organization is that it is highly dangerous. You then require to see if the chances are on your side with the breakout so you inspect cost momentum.

Brief History of Stochastic Oscillator, Get popular full length videos about Stochastic Oscillator.

Discovering How To Trade The Forex Market – What You Should Know

Nevertheless, there is one thing you do not desire to over appearance – memory. A couple of huge revenue trades may be your whole year revenue. The two lines consist of a fast line and a slow line.

Trading on the daily charts is a a lot easier strategy as compared to trading intraday. This everyday charts strategy can make you 100-500 pips per trade. You don’t need to being in front of your computer system for hours when trading with this everyday charts strategy.

When swing Stochastic Trading, try to find really overbought or really oversold conditions to increase the chances of success and don’t trade unless the price is at an extreme.

A good trader not just considers the heights of profits however likewise contemplates the threat included. The trader should be ready to acknowledge how much they are all set to lose. The upper and lower limitation must be clear in the trade. The trader must choose just how much breathing time he wants to provide to the trade and at the same time not run the risk of excessive also.

, if you look at the weekly chart you can plainly Stochastic Trading see resistance to the dollar at 114.. We likewise have a yen trade that is up with lower highs from the July in a strong pattern the mid Bollinger band will function as resistance or support, in this case it functions as resistance and is simply above the 114.00 level. Momentum is up at present – will the resistance hold its time to look at the daily chart.

If you caught simply 50% of every significant pattern, you would be really abundant; accept short-term dips versus Stochastic Trading you and keep your eyes on the larger long term reward.

Based on this information we properly predicted the market was decreasing. Now many of you would ask me why not just get in your trade and ride it down.

Without mincing words, forex trading provides you one of the bast and fastest methods of generating income in your home. The only thumb-down in this business is that it is highly risky. But with sound threat management methods, you will quickly sign up with others who have actually made fortune in forex.

You might take one appearance at it and think it is rubbish. Feelings are like springs, they stretch and agreement, both for only so long. So how do we appreciate the trend when day trading? That is why securing revenues is so so vital.

If you are finding best ever exciting comparisons related to Stochastic Oscillator, and Online Trading, Quote Currency you should join for email subscription DB totally free.