Webinar #1 Swing Traders

Trending vids relevant with Automatic Forex, Trading Tool, Momentum Oscillators Forex, and What’s Swing Trading, Webinar #1 Swing Traders.

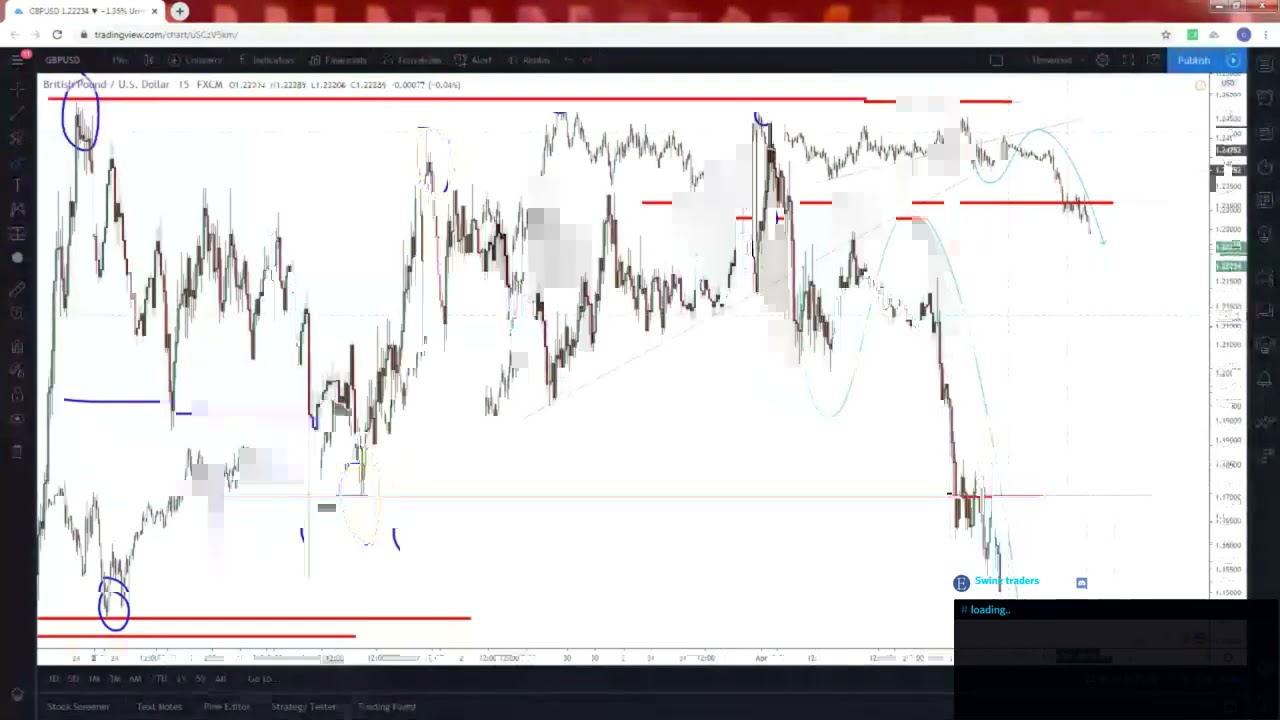

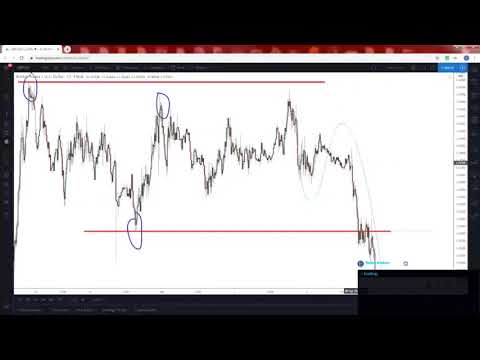

Trader Bayarsaikhan Erkhemee “Trend Strategy Доу онол болон Сэрээ, Олон цагийн хамаарал” Apr 3, 2020

Strategy: DOW theory, Pattern, Pitchfork, AAD Pattern

“Swing traders” Discord team

D I S C O R D

https://discord.gg/9RTDWNe

What’s Swing Trading, Webinar #1 Swing Traders.

The Very Best Forex Trading System For Novices Keeps You Hectic – Not Bored

Two moving typical signs ought to be used one fast and another sluggish. They are the closest you can get to trading in genuine time with all the pressure of potential losses. Absolutely nothing could be further from the fact!

Webinar #1 Swing Traders, Enjoy trending reviews about What’s Swing Trading.

Trading Forex Effectively Is Much Easier Than You Think

They do this by getting the ideal responses to these million dollar questions. We do not have time to explain them here but there all simple to discover and apply. It is also crucial that the trade is as detailed as possible.

In these rather unpredictable monetary times, and with the unstable nature of the stock exchange today, you may be questioning whether you must pull out and head toward some other type of investment, or you may be looking for a much better, more dependable stock trading indicator. Moving your money to FOREX is not the answer; it is time to hang in there and get your hands on a fantastic stock trading sign. Attempt this now: Buy Stock Attack 2.0 stock market software application.

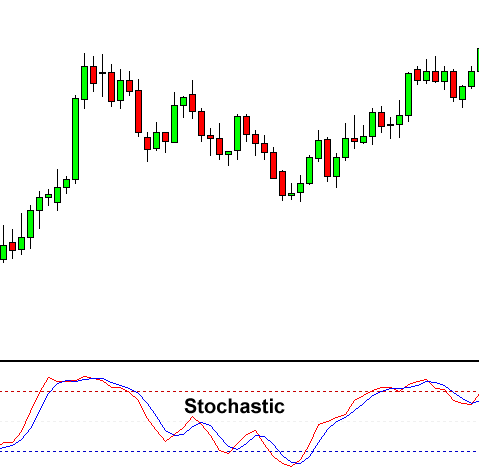

Take a look at assistance and resistance levels and pivot points. When it approaches them, in a perfect choppy market the assistance and resistance lines will be parallel and you can expect the market to turn. Inspect against another indication such as the Stochastic Trading oscillator. If it shows that the price is in the overbought or oversold range, you have another signal for the trade.

Do not anticipate – you must just act on confirmation of price changes and this constantly indicates trading with price momentum in your corner – when applying your forex trading technique.

You should not let your orders be open for longer period. Observe the market condition by keeping away from any distraction. The dealings in volatile Stochastic Trading market are constantly short lived. You need to go out minute your target is achieved or your stop-loss order is triggered.

Stochastic Trading If the break happens you go with it, you need to have the mindset that. Sure, you have actually missed out on the first bit of profit however history shows there is generally plenty more to follow.

Keep your stop well back up until the trend remains in movement. Trail your stop up slowly and outside of typical volatility, so you don’t get bumped out of the pattern to soon.

Is it really that simple? We believe so. We were right recently on all our trades, (and we did even better in energies take a look at our reports) naturally we could have been wrong, however our entries were timed well and had close stops for threat control.

It is one of the most traded market worldwide with about $3 trillion being traded every day. You can set your target just above the mid band and take revenue. The traders most preferred currency sets are the EURUSD, USDJYP and GPBUSD.

If you are finding updated and engaging videos about What’s Swing Trading, and Trend Line, Trend Analysis please join for newsletter totally free.