How to Trade the Stochastic Indicator Effectively (Forex & Stock Trading) Effective Trading Strategy

Trending un-edited videos about Forex Trading Strategy, Simple System, and Moving Average And Stochastic Strategy, How to Trade the Stochastic Indicator Effectively (Forex & Stock Trading) Effective Trading Strategy.

Trading the Stochastic Indicator Effectively (Forex & Stock Trading) Effective Trading Strategy

With the stochastic indicator, you can use four effective trading strategies. It can be used for both forex and stock trading. You should pay close attention to how the stochastic indicator works as part of your trading strategy.

IThe stochastic oscillator is used to identify potential trend reversals in forex trading.Momentum indicators compare the closing price to the trading range over a given period.

Stochastic Indicator Strategy

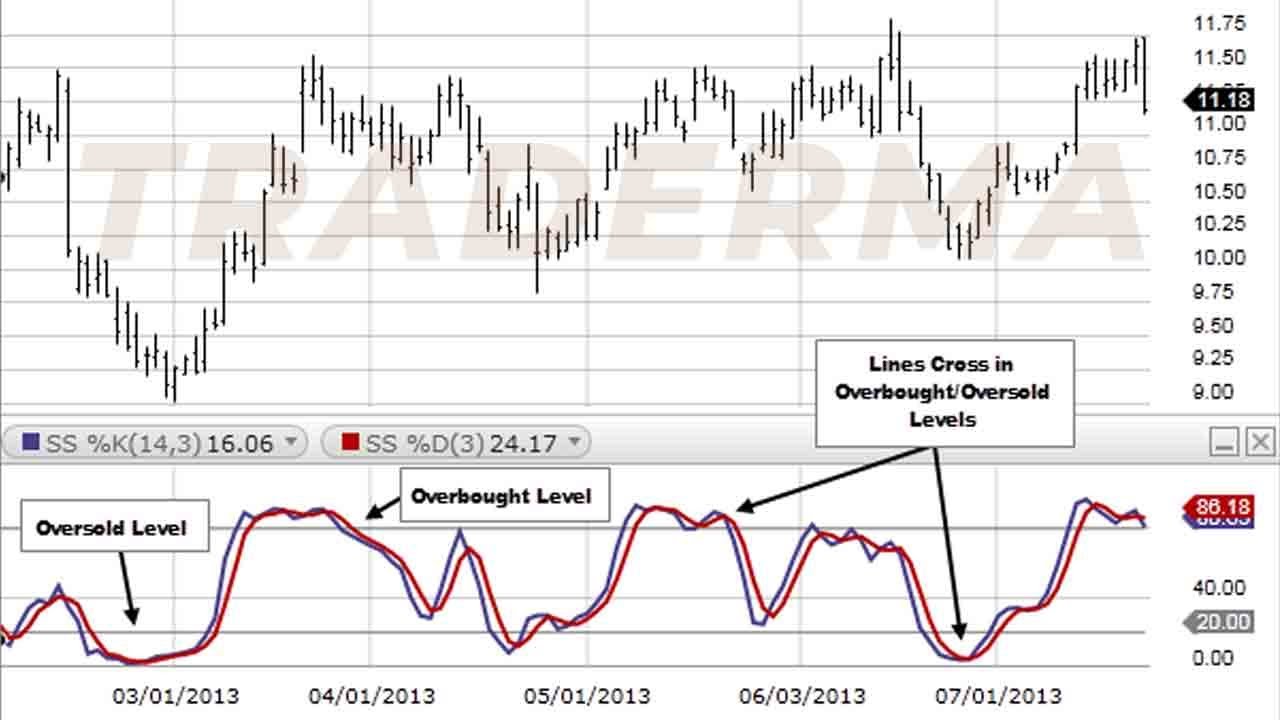

In fact, the charted stochastic oscillator consists of two lines: the indicator, represented by %K, and a signal line that represents the three-day simple moving average (SMA) of %K. An intersection of these two lines indicates that a trend shift may be imminent. A downward cross through the signal line, for example, indicates that the most recent closing price is closer to the lowest low of the look-back period than in the previous three sessions. The sudden drop to the lower end of a trading range after sustained upward movement may indicate that bulls are losing steam.

Relative Strength Index

In a similar way to the relative strength index (RSI) and Williams %R, the stochastic oscillator is useful for determining overbought and oversold conditions. The stochastic oscillator indicates overbought conditions with a reading over 80 and oversold conditions with a reading under 20 on the scale of 0 to 100. These are considered particularly powerful crossovers. Signals that do not occur at these extremes are often ignored.

Whenever you are developing a strategy based on the stochastic oscillator in the forex market, look for currency pairs that exhibit a pronounced and prolonged bullish trend. Despite price approaching a previous area of resistance, the ideal currency pair has already been in overbought territory for some time. Waning volume is another indicator of bullish exhaustion. Once the stochastic oscillator crosses through the signal line, watch for the price to follow. Even though these combined signals indicate a reversal, wait for price confirmation before entering – momentum oscillators sometimes give false signals.

Using this setup with candlestick charting techniques can help to enhance your strategy and provide clear entry and exit signals.

Moving Average And Stochastic Strategy, How to Trade the Stochastic Indicator Effectively (Forex & Stock Trading) Effective Trading Strategy.

Forex Trading – Swing Trading In 3 Simple Actions For Big Profits

This strategy is simple and it is not complicated in any way. The above strategy is extremely simple however all the very best systems and techniques are. They likewise ought to look for floors and ceilings in a stock chart.

How to Trade the Stochastic Indicator Effectively (Forex & Stock Trading) Effective Trading Strategy, Play most searched videos relevant with Moving Average And Stochastic Strategy.

Using The Very Best Forex Chart Indication To Your Advantage

This is genuinely the best way to provide a beginner the self-confidence you require to prosper. Remember for every single purchaser there is a seller. Forex trading is all about purchasing and selling of foreign currencies.

You can so this by utilizing the stochastic momentum sign (we have actually written often on this and it’s the best indication to time any trade and if you are not farmiliar with it learn more about it now) watch for the stochastic lines to decline and cross with bearish divergence and go short.

Cost surges constantly occur and they constantly fall back and the objective of the swing trader is – to offer the spike and make a quick revenue. Now we will look at an easy currency swing Stochastic Trading technique you can use today and if you utilize it properly, it can make you triple digit gains.

Two of the very best are the stochastic indication and Bollinger band. Use these with a breakout approach and they offer you an effective mix for looking for big gains.

While the rules provide you reasons to get in trades, it does not indicate that the cost will enter your wanted direction. The concept is “Do not anticipate the market”. Rather, you have to let the rate motion lead your method, knowing at anytime cost could alter and go in a different instructions. If the cost does stagnate in your favor, you have to Stochastic Trading offer up and stop out.

The hard part about forex Stochastic Trading is not so much getting an approach – but having confidence in it and trading it with discipline. , if you do not trade with discipline you will lose and you should have self-confidence to get discipline..

To see how overbought the currency is you can utilize some momentum indications which will provide you this info. We don’t have time to explain them here however there all simple to find out and apply. We like the MACD, the stochastic and the RSI but there are a lot more, just select a couple you like and use them.

Keep in mind, if your trading stocks, do your homework and share a strategy and stick to it. Don’t forget to lock in profits. If done in a disciplined way, stock trading can make you a lot of money. So get out there and try it out.

It operates even in unstable market conditions. The traders most preferred currency pairs are the EURUSD, USDJYP and GPBUSD. Determine when to leave: you must likewise specify the exit point in you forex trading system.

If you are looking most exciting videos related to Moving Average And Stochastic Strategy, and Forex Softwares, Technical Indicators, Forex Trading Education dont forget to join for email list now.