3 Top Indicators to use on Thinkorswim

Best overview top searched Currency Trading Education, Momentum Trading, How to Trade Support and Resistance, and What Is The Best Stochastic Setting For Day Trading, 3 Top Indicators to use on Thinkorswim.

PersonsPlanet.com is an Educational and Advisory service company for investors and active traders founded by John Person. We have a variety of products and services to meet the needs of all individuals interested in learning to trade for the beginner or the advanced students.

We help traders with products such as Newsletters on Stocks, Futures and ETF’s including videos, updates, emails alerts and trading systems with our proprietary indicators.

The University program formatted to fit all type of traders, beginners and advance is the BEST program available to teach you step by step all the information you will need to create and develop your OWN trading plan.

John Person is a 33 year veteran of the Futures and Options Trading industry. He started on the Floor of the Chicago Mercantile Exchange back in 1979. He then had the privilege of working with George Lane , the innovator of the stochastic indicator. John has worked his way throughout the industry as an independent Trader, Broker, Analyst and Branch Manager for one of Chicago’s largest discount / full service firms under the direct supervision of a former Chairman of the Chicago Board of Trade.

John is the author of several top rated trading courses and books including The Complete Guide to Technical Analysis for the Futures Markets, Candlestick and Pivot Point Trading Triggers, Forex Conquered: High Probability Systems and Strategies for Active Traders and he is co-author of the Commodity Traders Almanac series all published by John Wiley and Sons. He was the first ever to introduce traders to a powerful combination of candlesticks and pivot point analysis.

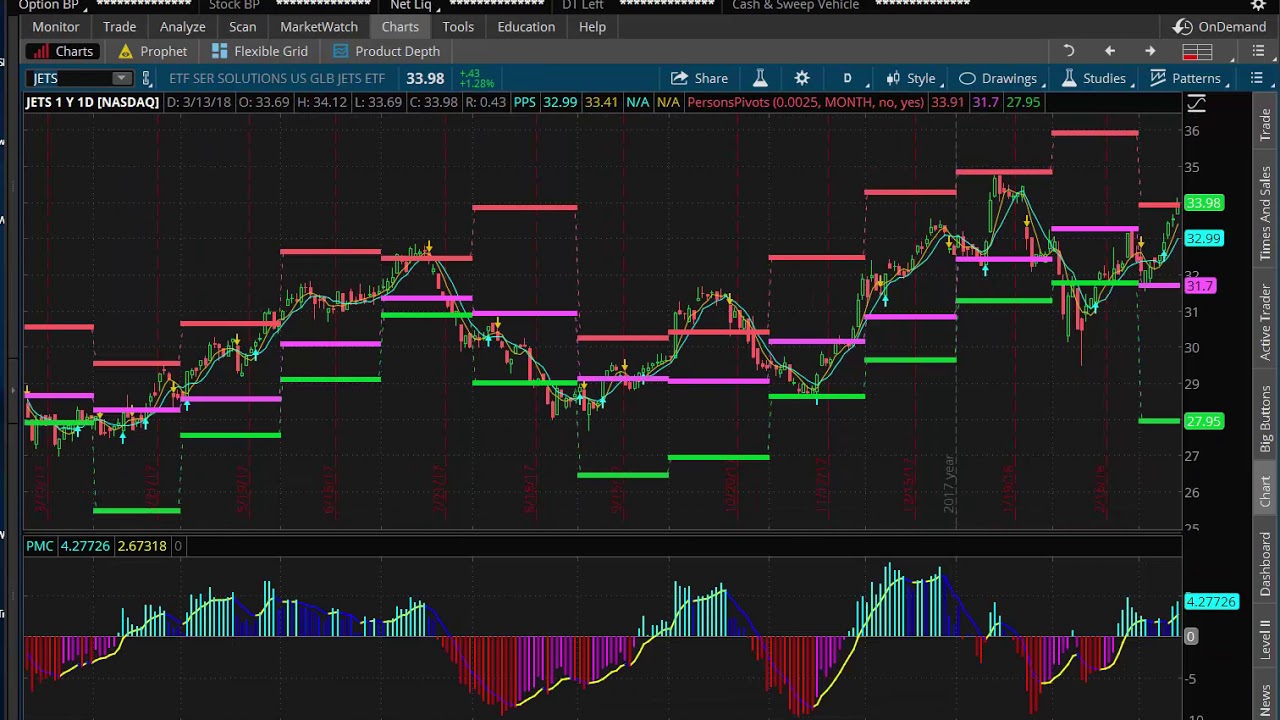

In 1998, he developed his own proprietary trading system and began publishing “The Bottom-Line Financial and Futures Newsletter”, a monthly publication that incorporates fundamental developments as well as technical analysis that includes the data from his trading system, with his powerful indicator “Persons Pivots” as well as his moving average methodology that created the PPS indicator on TD Ameritrades Thinkorswim platform. In addition, John Publishes PA Stock Alerts, with daily and weekly stock trades and video analysis on select stocks and ETF’s. The nations most respected business journalists call on John for his market opinions. He is widely quoted by CBS Market Watch, Reuters, Dow Jones, and has appeared regularly on CNBC, Bloomberg and Fox News. He is sought after speaker for many of the worlds top professional organizations such as the IFTA, ATAA and the MTA, as well as some of the countries top national investment conferences.

What Is The Best Stochastic Setting For Day Trading, 3 Top Indicators to use on Thinkorswim.

British Pound Forex Trading Timing

This graph has 2 lines, the crossing of the two lines is a signal of a new trend. You then require to see if the odds are on your side with the breakout so you check price momentum. So how do we respect the trend when day trading?

3 Top Indicators to use on Thinkorswim, Get trending full length videos relevant with What Is The Best Stochastic Setting For Day Trading.

Utilizing Bollinger Bands For Trading Big Cap Stocks

One reason this happens is that the market makers and specialist frequently take the opposite side of your trade. The support level is a level the cost can not go below it for a large duration.

There is a difference in between trading and investing. Trading is always short-term while investing is long term. The time horizon in trading can be as short as a couple of minutes to a couple of days to a couple of weeks. Whereas in investing, the time horizon can be months to years. Lots of people day trade or swing trade stocks, currencies, futures, options, ETFs, products or other markets. In day trading, a trader opens a position and closes it in the very same day making a quick revenue. In swing trading, a trader tries to ride a pattern in the market as long as it lasts. On the other hand, a financier is least pushed about the short-term swings in the market. He or she has a long term time horizon like a couple of months to even a few years. This very long time horizon matches their financial investment and financial goals!

Price increases constantly take place and they constantly fall back and the aim of the swing trader is – to sell the spike and make a fast profit. Now we will take a look at a basic currency swing Stochastic Trading strategy you can utilize today and if you use it properly, it can make you triple digit gains.

The very first indicate make is if you like action and desire to trade all the time don’t keep reading – this is everything about trading extremely high odds trades for huge profits not trading for fun or messing about for a couple of pips.

Just as essential as you will understand the logic that this forex Stochastic Trading technique is based upon, you will have the discipline to trade it, even when you take a couple of losses as you understand your trade will come.

Some of the stock signals traders look at are: volume, moving averages, MACD, and the Stochastic Trading. They likewise must try to find floorings and ceilings in a stock chart. This can reveal a trader about where to get in and about where to go out. I say “about” due to the fact that it is pretty hard to guess an “exact” bottom or an “exact” top. That is why locking in profits is so so crucial. , if you do not lock in revenues you are truly running the danger of making an useless trade.. Some traders become truly greedy and it only harms them.

How do you draw trendlines? In an up pattern, connect two lower highs with a line. That’s it! And in a downtrend, connect two higher lows with a straight line. Now, the slope of a trendline can inform you a lot about the strength of a pattern. For instance, a high trendline reveals extreme bullish mindset of the buyers.

Currency trading is a way of making cash but it likewise depends on the luck element. However all is not lost if the traders make rules for themselves and follow them. This will not only guarantee higher revenues but likewise reduce the threat of greater losses in trade.

They are the nearest you can get to trading in real time with all the pressure of prospective losses. If one must understand anything about the stock market, it is this. It is ruled by feelings.

If you are looking rare and exciting videos relevant with What Is The Best Stochastic Setting For Day Trading, and Forex Trading Tips, Currency Trading, Online Trading, Thinslice Trading please subscribe our newsletter for free.