3 July | Live Market Analysis For Nifty/Banknifty | Trap Trading Live

Popular vids highly rated Trading Plan, Currency Swing Trading, and What Is The Best Stochastic Setting For Day Trading, 3 July | Live Market Analysis For Nifty/Banknifty | Trap Trading Live.

Open Your Free Trading Account – https://linktr.ee/tradersparadiselivee

Telegram – https://telegram.dog/tradersparadiseofficial

Master Bundle Course – https://zefvcm.courses.store/313758

Download our App for free Master Technical Analysis video and Course

Android – https://play.google.com/store/apps/details?id=co.edvin.ublwf

IOS- https://apps.apple.com/in/app/myinstitute/id1472483563

(Org Code – ZEFVCM)

Website/Course – https://www.tradersparadise.co.in/courses

Crypto Premium Channel – https://rpy.club/g/YZYcJCQCb3

Dhan – https://invite.dhan.co/?invite=PMFVM39774

Delta Exchange – https://www.delta.exchange/?code=FTFHOO

For Support – support@tradersparadise.co.in

Disclaimer – All Videos/Information on this channel are for Education purpose only .They are not buy/Sell Recommendations . Please consult your financial Advisor before taking any trade or investment.

#livetrading #niftybanknifty #intradaytrading #tradersparadiselive #abhaypatil

What Is The Best Stochastic Setting For Day Trading, 3 July | Live Market Analysis For Nifty/Banknifty | Trap Trading Live.

Using Bollinger Bands For Trading Big Cap Stocks

This Daily Timeframe technique uses only 2 indications. I highly suggest you get at least a megabyte or more of memory. It shows you the crossovers of bullish and bearish divergence of oversold and overbought levels.

3 July | Live Market Analysis For Nifty/Banknifty | Trap Trading Live, Get top updated videos about What Is The Best Stochastic Setting For Day Trading.

Forex Trading Technique – Based On This Method Piles Up Big Profits

This will not only guarantee higher profits but also minimize the danger of greater losses in trade. No one can anticipate where the marketplace will go. Those lines could have crossed 3 or 4 times prior to just to revert back.

Among the things a new trader finds out within a couple of weeks or so of starting his new adventure into the world of day trading is the distinction in between three symbol stocks and 4 symbol stocks.

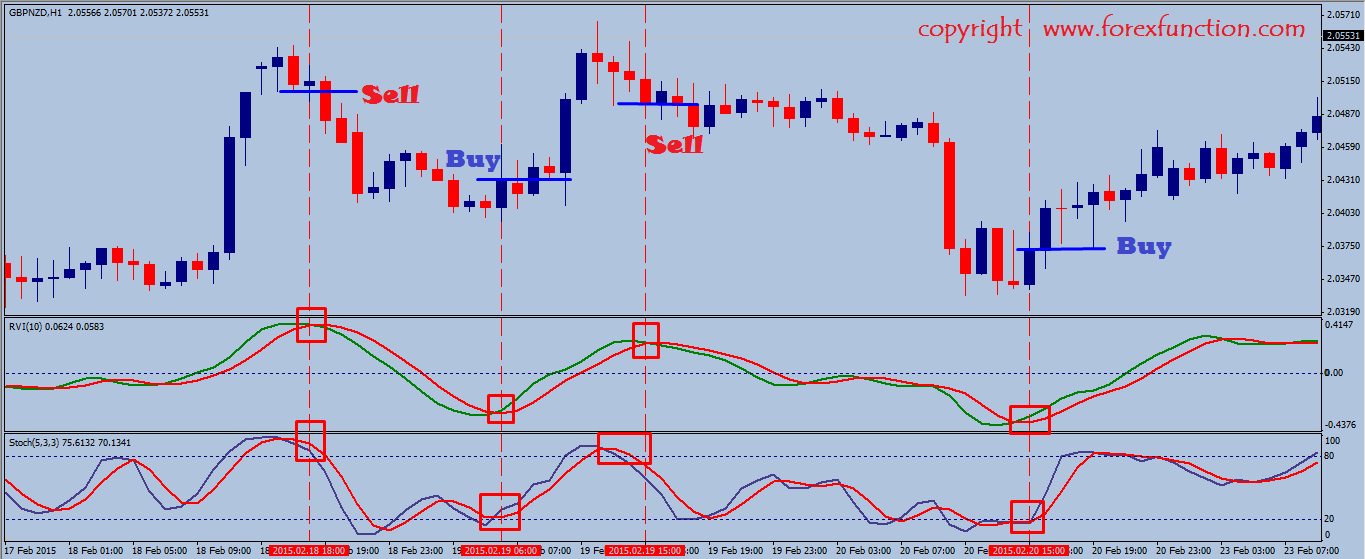

Price increases constantly occur and they always fall back and the aim of the swing trader is – to sell the spike and make a fast revenue. Now we will take a look at a simple currency swing Stochastic Trading strategy you can use today and if you utilize it properly, it can make you triple digit gains.

You then require to see if the odds are on your side with the breakout so you inspect price momentum. There are lots of momentum indicators to assist you time your relocation and get the velocity of price on your side. The ones you choose are a matter of individual preference however I like the ADX, RSI and stochastic. , if my momentum estimation adds up I go with the break..

Now I’m not going to get into the information as to why cycles exist and how they are related to cost action. There is much written on this to fill all your peaceful nights in checking out for years. If you invest simply a little bit of time viewing a MACD or Stochastic Trading indication on a price chart, you need to already be persuaded that cycles are at work behind the scenes. Just watch as they swing up and down in between extremes (overbought and oversold zones) to get a ‘feel’ for the cycle ebb and circulation of cost action.

Lots of traders make the mistake of believing they can use the swing trade method daily, however this is not an excellent idea and you can lose equity rapidly. Rather reserve forex swing trading for days when the market is just right for swing trading. So, how do you know when the marketplace is right? Expect resistance or support that has been held a number of times like when the chart is low or high. Look and watch the momentum for when rates swing highly towards either the resistance or the assistance, while this is happening expect verification that the momentum will turn. This verification is important and if the momentum of the rate is beginning to wane and a turn is likely, then the chances remain in terrific favor of a swing Stochastic Trading environment.

When a price is increasing highly. momentum will be rising. What you need to look for is a divergence of momentum from cost i.e. prices continue to increase while momentum is turning down. This is known as divergence and trading it, is among the very best currency trading techniques of all, as it’s cautioning you the pattern will reverse and prices will fall.

Wait for the indicators to signal the bears are taking control, through the stochastic and RSI and keep in mind the bulls just take charge above January’s highs.

You’ll discover that when a stock rate strikes the lower Bollinger Band, it generally tends to rise again. The Stochastic Oscillator is an overbought/oversold indicator developed by Dr. Let’s discuss this Day-to-day Timeframe Strategy.

If you are looking most exciting videos about What Is The Best Stochastic Setting For Day Trading, and Currency Trading Training, Forex Profits, Swing Trading Securities, Forex Trading Tips you are requested to subscribe our a valuable complementary news alert service for free.