🔴 WATCH THIS BEFORE TRADING PPI & FED MINUTES // SPY SPX // Analysis, Key Levels #daytrading #spy

Top clips highly rated Range Trading, Trend Detection in Forex Trading, Best Forex Tradsing Strategies, and Bearish Divergence Stochastic, 🔴 WATCH THIS BEFORE TRADING PPI & FED MINUTES // SPY SPX // Analysis, Key Levels #daytrading #spy.

Stocks ended higher on October 10th, with the S&P 500, Dow Jones Industrials, and Nasdaq 100 all posting moderate gains. These gains were driven by prospects of additional Chinese stimulus and speculation that the Federal Reserve might pause interest rate hikes. However, stock gains were limited due to ongoing turmoil in the Middle East and warnings from the International Monetary Fund (IMF) about persistent inflation.

Atlanta Fed President Bostic’s comments that interest rates may not need to increase further added to the positive sentiment. The IMF lowered its 2024 global GDP forecast to 2.9% and raised its 2024 global inflation forecast to 5.8%, causing some concerns in the market.

The bond yields for the US, Germany, and the UK were mixed, with the 10-year T-note yield falling to a 1-week low and the 10-year German bund yield also falling before recovering slightly.

China was reported to be considering increasing its budget deficit for 2023 to stimulate its economy, which contributed to market optimism. Overseas stock markets closed with mixed results, with the Euro Stoxx 50 up, China’s Shanghai Composite down, and Japan’s Nikkei 225 up.

Notable stock movers included Truist Financial, Coherent, Hyatt Hotels, Rivian Automotive, Boeing, Dollar Tree, Electronic Arts, PepsiCo, and several U.S.-listed Chinese stocks. However, Tapestry, Juniper Networks, Qorvo, and Akero Therapeutics saw declines.

Defense stocks, including Northrup Grumman, L3Harris Technologies, Huntington Ingalls Industries, and General Dynamics, decreased as they retraced some of their previous gains.

Overall, the stock market showed positive signs due to expectations of economic stimulus and a potential pause in interest rate hikes by the Federal Reserve.

Stocks, S&P 500, Dow Jones Industrials, Nasdaq 100, Chinese stimulus, Federal Reserve, Interest rate hikes, Middle East turmoil, IMF, Global GDP forecast, Inflation forecast, FOMC, Bond yields, 10-year T-note, 10-year German bund, 10-year UK gilt, Budget deficit, Sovereign debt, Truist Financial, Insurance brokerage, Coherent, Silicon carbide, Hyatt Hotels, S&P MidCap 400 Index, Rivian Automotive, UBS, Boeing, Jet orders, Dollar Tree, BNP Paribas Exane, Electronic Arts, Bank of America, PepsiCo, Q3 core EPS, Chinese stocks, JD.com, Trip.com, Alibaba Group Holding, PDD Holdings, NetEase, Baidu, Tapestry, Consumer transaction data, Juniper Networks, JPMorgan Chase, Qorvo, Citigroup, Akero Therapeutics, Defense stocks, Northrup Grumman, Stock trading, Options trading, Investment, Portfolio, Market volatility, Day trading, Long-term investing, Risk management, Trading strategy, Volatility, Market orders, Limit orders, Stop-loss orders, Market analysis, Trading platforms, Risk-reward ratio, Bull market, Bear market, Options contracts, Call options, Put options, Strike price, Expiration date, Option premium, Volatility strategies, Covered calls, Hedging, Technical analysis, Fundamental analysis, Candlestick patterns, Support and resistance, Moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), Bollinger Bands, Stochastic oscillator, Fibonacci retracement, Options strategies, Iron condor, Straddle, Strangle, Bull spread, Bear spread, Theta decay, Implied volatility, Delta, Margin trading, Leverage, Liquidity, Stop orders, Technical analysis, Chart patterns, Support levels, Resistance levels, Trend analysis, Moving averages, Simple moving average (SMA), Exponential moving average (EMA), RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), Bollinger Bands, Stochastic oscillator, Fibonacci retracement, Candlestick patterns, Doji, Hammer, Shooting star, Bullish engulfing, Bearish engulfing, Head and shoulders, Double top, Double bottom, Cup and handle, Ichimoku Cloud, Volume analysis, Support and resistance, Pivot points, Moving average crossovers, Momentum indicators, Chaikin Oscillator, Williams %R, Parabolic SAR, Aroon oscillator, On-balance volume (OBV), Average true range (ATR), Divergence, Breakout, Trendlines, Technical indicators, Price action, Trading signals, Overbought, Oversold, Swing trading, Day trading, Position trading, Backtesting, Volatility, Volatility bands, Pattern recognition robinhood webull tastytrade shwab

Bearish Divergence Stochastic, 🔴 WATCH THIS BEFORE TRADING PPI & FED MINUTES // SPY SPX // Analysis, Key Levels #daytrading #spy.

Forex Trading Strategy – Based On This Method Stacks Up Big Profits

These are: economic analysis and technical analysis. This daily charts strategy can make you 100-500 pips per trade. The very first point is the method to be followed while the 2nd pint is the trading time.

🔴 WATCH THIS BEFORE TRADING PPI & FED MINUTES // SPY SPX // Analysis, Key Levels #daytrading #spy, Get latest complete videos about Bearish Divergence Stochastic.

Swing Trading For Profit A Live Example

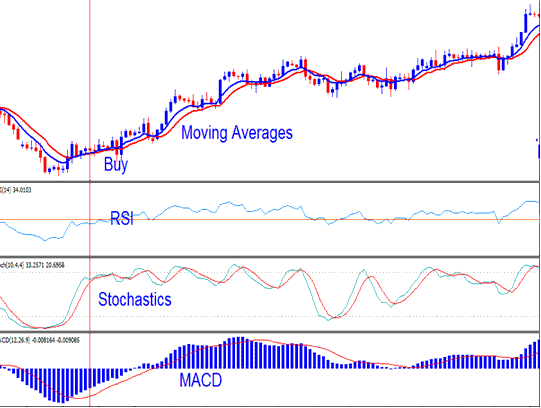

I utilize the moving averages to specify exit points in the following method. There are three levels that serve as resistance levels and other 3 that serve as support levels. If not updates are being made, then it’s buyer beware.

Swing trading in Forex, is one of the best methods to earn money in currencies and the reason that is – its easy to comprehend, fun and amazing to do and can make huge gains. Let’s look at the reasoning behind Forex swing trading and how to make regular profits.

Look at assistance and resistance levels and pivot points. In an ideal choppy market the support and resistance lines will be parallel and you can expect the market to turn when it approaches them. Check versus another sign such as the Stochastic Trading oscillator. You have another signal for the trade if it shows that the rate is in the overbought or oversold range.

Them significant issue for a lot of traders who use forex technical analysis or forex charts is they have no understanding of how to deal with volatility from a entry, or stop point of view.

Focus on long-lasting trends – it’s these that yield the huge revenues, as they can last for years. Profitable Stochastic Trading system never ever asks you to break the trend. Patterns equate to big revenues for you. Breaking the pattern suggests you are risking your money needlessly.

Numerous traders make the error of believing they can use the swing trade strategy daily, but this is not a great idea and you can lose equity quickly. When the market is just right for swing trading, rather reserve forex swing trading for days. So, how do you understand when the market is right? When the chart is high or low, view for resistance or support that has actually been held several times like. Enjoy the momentum and look for when prices swing strongly toward either the support or the resistance, while this is happening expect confirmation that the momentum will turn. This verification is important and if the momentum of the cost is beginning to subside and a turn is likely, then the odds are in terrific favor of a swing Stochastic Trading environment.

The technical analysis needs to also be figured out by the Forex trader. This is to predict the future pattern of the price. Typical indications used are the moving averages, MACD, stochastic, RSI, and pivot points. Keep in mind that the previous indications can be used in mix and not only one. This is to verify that the rate trend is real.

Position the trade at a stop loss of approximately 35 pips and you should use any of these 2 techniques for the purpose of making profit. The first is use an excellent danger to a gainful ratio of 1:2 while the next is to use support and resistance.

There is much composed on this to fill all your peaceful nights in reading for decades. And in a downtrend, link two higher lows with a straight line. A stock exchange trend is a force that requires our respect.

If you are looking unique and entertaining reviews relevant with Bearish Divergence Stochastic, and Forex Day, Currency Trading Method, Forex Success, Learn to Day Trade Forex dont forget to join for subscribers database totally free.