What is the Difference Between Swing And Position Trading

Top un-edited videos related to Forex Software, Forex Trading Course, Learn How to Trade Options, and What’s Swing Trading, What is the Difference Between Swing And Position Trading.

Subscribe to our Channel

Get a Free 15-Day Pro Membership today. Sign up here now:

https://tackletrading.com/pro-member-…

Follow Our Socials!

Twitter – https://twitter.com/TackleTrading

Facebook – https://www.facebook.com/teamtackletr…

Instagram – https://www.instagram.com/tackletrading/

What’s Swing Trading, What is the Difference Between Swing And Position Trading.

Forex Trading – My Day Trading Thoughts

Having 3 out of the 4 elements is never ever great enough to allow you to consistently make money.

Next time when you see the earnings, you are going to click out and that is what you do.

What is the Difference Between Swing And Position Trading, Find interesting full videos related to What’s Swing Trading.

Using Bollinger Bands For Trading Large Cap Stocks

This analysis technique depends upon identifying different levels on the chart. This indicates, to name a few things, just investing what you can afford to lose. Never have a huge stop loss unless you are doing swing trading.

There is a difference between trading and investing. Trading is constantly short-term while investing is long term. The time horizon in trading can be as brief as a couple of minutes to a couple of days to a few weeks. Whereas in investing, the time horizon can be months to years. Many individuals day trade or swing trade stocks, currencies, futures, alternatives, ETFs, products or other markets. In day trading, a trader opens a position and closes it in the same day making a quick revenue. In swing trading, a trader tries to ride a trend in the market as long as it lasts. On the other hand, an investor is least pressed about the short-term swings in the market. He or she has a long term time horizon like a couple of months to even a few years. This long period of time horizon matches their investment and financial goals!

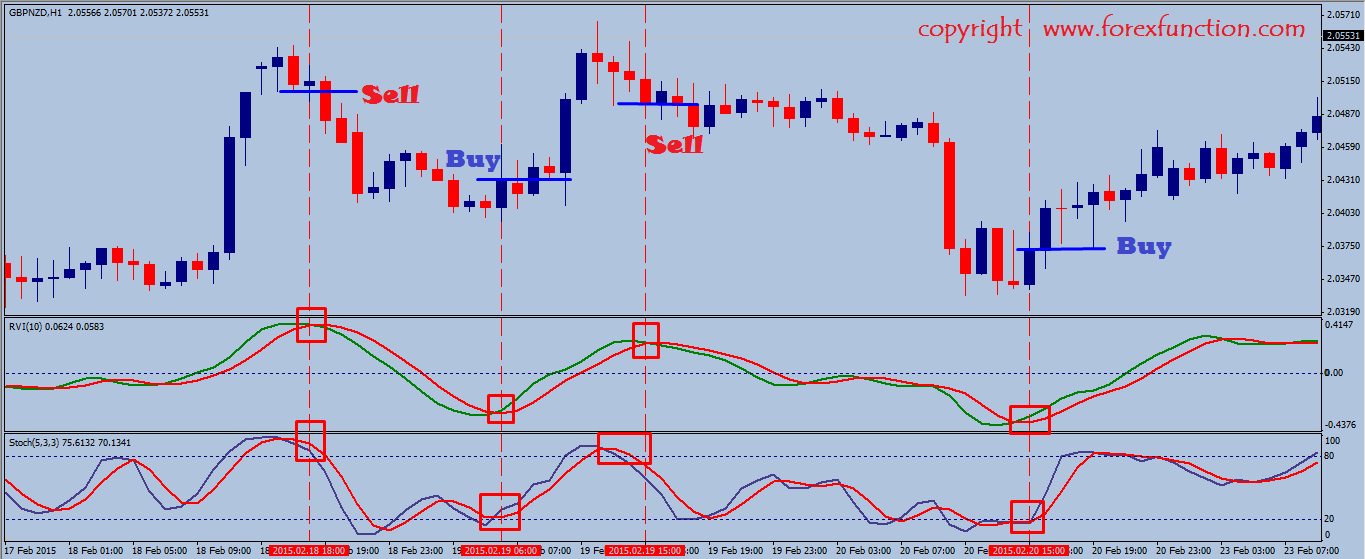

You require to have the frame of mind that if the break occurs you Stochastic Trading go with it. Sure, you have actually missed out on the very first little earnings however history shows there is generally plenty more to follow.

Try to find divergences, it informs you that the cost is going to reverse. , if price makes a new high and at the very same time that the stochastic makes lower high.. This is called a “bearish divergence”. The “bullish divergence” is when the price makes a brand-new low while the stochastic makes greater low.

It needs to go up the earnings and cut the losses: when you see a trend and use the system you constructed Stochastic Trading , it must continue opening the deal if the earnings going high and seal the deal if the losses going on.

It is necessary to discover a forex robot that includes a 100% cash back guarantee. , if there is a cash back ensure this suggests that it is one of the best forex Stochastic Trading robots out there..

When the break occurs, put your stop behind the breakout point and wait up until the move is well in progress, before trailing your stop. Do not put your stop to close, or within typical volatility – you will get bumped out the trade.

Wait for the indicators to indicate the bears are taking control, through the stochastic and RSI and keep in mind the bulls only take charge above January’s highs.

Also, check the copyright at the bottom of the page to see how frequently the page is updated. I strongly suggest you get at least a megabyte or more of memory. This depends upon how often one refers the trade charts.

If you are looking unique and entertaining videos relevant with What’s Swing Trading, and Slow Stochastic, Swing Trading, Stock Market System you should list your email address our email list totally free.