Understanding the Different Between Swing Trading and Day Trading

Trending complete video related to Technical Analysis, Trading Forex Online, and What’s Swing Trading, Understanding the Different Between Swing Trading and Day Trading.

There are advantages and risks to both swing and day trading. You can determine which to practice based on the current market.

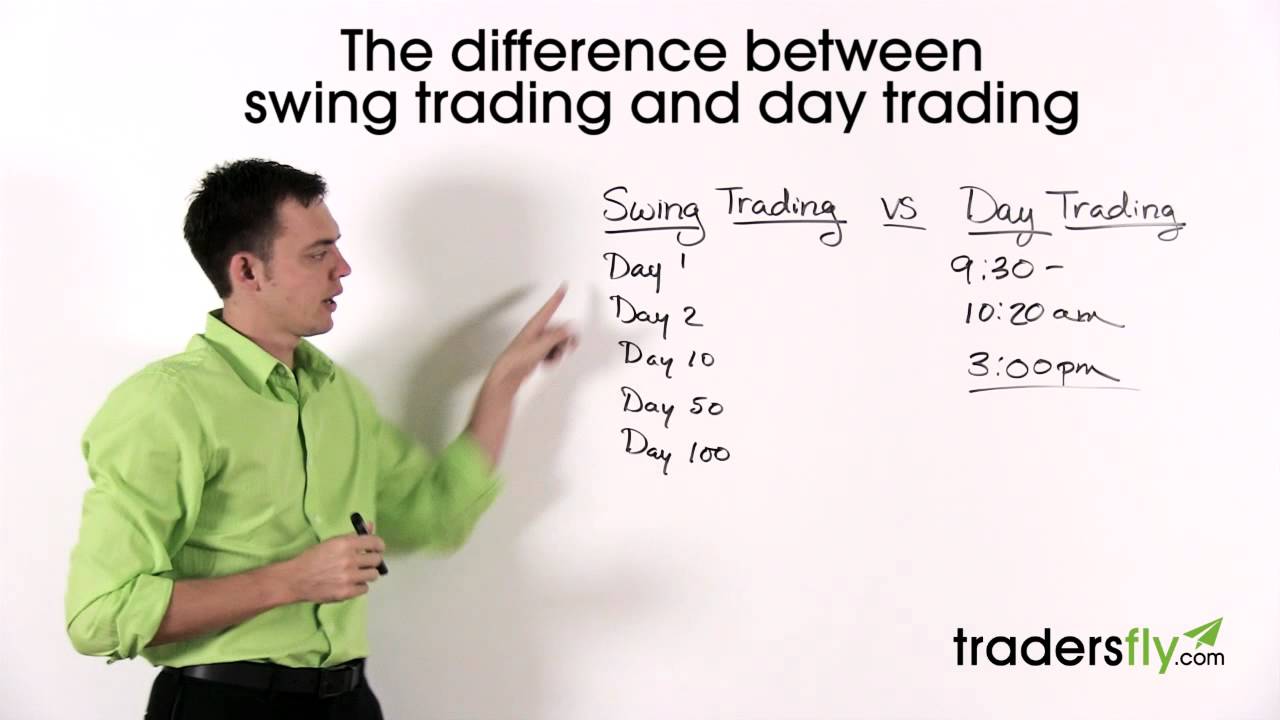

Swing Trading v. Day Trading

Swing:

-Potential to make more money than with day trading

-Going across multiple days (e.g. a 100 day period)

-You do have the risk of holding positions overnight; you also have the risk of news, politics, etc

-Gives you more room to grow than with day trading

-Requires more research about the company

Day:

-Market opens at 9:30am

-You purchase stock at 10:20am

-You have bought and sold stock and now own nothing at 3:00pm

-You are trading on the day’s gain (or losses)

-Everything is done withing one day

-Advantages: no risk behind holding positions overnight, news events (i.e. earthquake), etc

-Usually stocks will not jump very high in one day unless they are higher priced shares

#swingtrading #daytrading #tradingstocks #daytrader #swingtrader

Posted at: https://tradersfly.com/blog/understanding-the-different-between-swing-trading-and-day-trading/

🔥 GET MY FREEBIES

🎤 SUBMIT A VOICE QUESTION

👀 START HERE: FOR NEW TRADERS

🎉 START HERE: OPTION TRADERS

📈 MY CHARTING TOOLS + BROKERS

https://tradersfly.com/go/tools/

💻 MY COMPUTER EQUIPMENT

💌 GET THE NEWSLETTER

🔒 SEE OUR MEMBERSHIP PLANS

https://tradersfly.com/go/members/

📺 STOCK TRADING COURSES

📚 STOCK TRADING BOOKS:

⚽ GET PRIVATE COACHING

🌐 WEBSITES:

💌 SOCIAL MEDIA:

https://tradersfly.com/go/twitter/

https://tradersfly.com/go/facebook/

⚡ SUBSCRIBE TO OUR YOUTUBE CHANNEL

https://tradersfly.com/go/sub/

💖 MY YOUTUBE CHANNELS:

TradersFly: https://backstageincome.com/go/youtube-tradersfly/

BackstageIncome: https://backstageincome.com/go/youtube-bsi/

MyLittleNestEgg: https://mylittlenestegg.com/go/youtube/

📑 ABOUT TRADERSFLY

TradersFly is a place where I enjoy sharing my knowledge and experience about the stock market, trading, and investing.

Stock trading can be a brutal industry, especially if you are new. Watch my free educational training videos to avoid making big mistakes and just to continue to get better.

Stock trading and investing is a long journey – it doesn’t happen overnight. If you are interested to share some insight or contribute to the community we’d love to have you subscribe and join us!

What’s Swing Trading, Understanding the Different Between Swing Trading and Day Trading.

How To Make Money Trading The Nasdaq 100

Some of the stock signals traders look at are: volume, moving averages, MACD, and the stochastic. It is one of the easiest tools utilized in TA. Also trade on the period where major markets are open.

Understanding the Different Between Swing Trading and Day Trading, Find more updated videos about What’s Swing Trading.

Best Forex Trading Methods – A Simple Technique That Makes Big Gains!

Keep your stop well back until the trend is in movement. By waiting on a much better price they miss out on the move. Develop a trading system that works for you based upon your testing outcomes.

Swing trading in Forex, is one of the very best methods to generate income in currencies and the reason is – its easy to understand, enjoyable and exciting to do and can make huge gains. Let’s take a look at the reasoning behind Forex swing trading and how to make regular revenues.

You’ll discover that when a stock cost hits the lower Bollinger Band, it generally tends to increase once again. Using the SMA line in the middle of the Bollinger Bands gives Stochastic Trading us an even much better image. Remember, whatever stock symbol you select from on the NASDAQ 100, you ought to inspect for any news on it before you trade it as any negative news could impact the stock no matter what the Nasdaq efficiency is like.

When the trade remains in motion – await the trade to recover under method before moving your stop, then track it up slowly, so you do not get gotten by random volatility.

A vital beginning point suffices cash to survive the preliminary stages. , if you have enough cash you have the time to discover and enhance your Stochastic Trading up until you are making money.. Just how much money is required depends on the number of contracts you wish to trade. For example to trade 1 $100,000 dollar agreement you need in between $1000 and $1500 as margin.

If you caught just 50% of every major pattern, you would be very rich; accept brief term dips versus Stochastic Trading you and keep your eyes on the larger long term reward.

If you desire to earn money forget “purchasing low and selling high” – you will miss out on all the big relocations. Instead look to “buy high and offer higher” and for this you need to comprehend breakouts. Breakouts are just breaks of important support or resistance levels on a forex chart. The majority of traders can’t purchase these breaks.

You have to utilize short-term exit and stop rules if you are using short-term entry rule. If you are using turtle trading system, you have to utilize exit and stop rules of the turtle system.

They are the closest you can get to trading in real time with all the pressure of potential losses. It is this if one should know anything about the stock market. It is ruled by emotions.

If you are looking updated and exciting reviews about What’s Swing Trading, and Range Trading Winning, Forex Traading System dont forget to signup for a valuable complementary news alert service now.