Top 3 Swing Trading Indicators – 2021

Top guide related to Trading Forex Online, Learn Currency Trading Online, and What’s Swing Trading, Top 3 Swing Trading Indicators – 2021.

✅ Join the exclusive Swing Trading Facebook Group by clicking below!

https://www.facebook.com/groups/swingtradinguniversity

📸 Follow and DM me on Instagram!

https://www.instagram.com/chris.w.clay

@chris.w.clay

👀 Watch the FULL Swing Trading Playlist:

Swing trading indicators are some of the most important tools for a swing trader. This video will go over the 3 swing trading indicators, which will help you develop consistent swing trading strategies.

The 3 swing trading indicators are the MACD indicator, VWAP indicator and RSI indicator. As a bonus, this video will also go over how to spot an RSI divergence using the RSI indicator.

The best swing trading strategies combine multiple indicators, and this video will help you understand how to best apply all 3 indicators for swing trading.

Timestamps:

0:00 Introduction to the Best Swing Trading Indicators

00:20 MACD Indicator

03:47 VWAP indicator

06:00 RSI Indicator

07:33 RSI Divergence

08:25 Apple Stock Analysis (RSI Divergence)

10:22 Tesla Stock Analysis (Huge RSI Divergence)

DISCLAIMER: All of Swing Trading University, my trades, strategies, and news coverage are based on my opinions alone and are only for entertainment purposes. You should not take any of this information as guidance for buying or selling any type of investment or security. I am not a financial advisor and anything that I say on this YouTube channel should not be seen as financial advice. I am only sharing my biased opinion based off of speculation and personal experience. An individual trader’s results may not be typical and may vary from person to person. It is important to keep in mind that there are risks associated with investing in the stock market and that one can lose all of their investment. Thus, trades should not be based on the opinions of others but by your own research and due diligence.

––––––––––––––––––––––––––––––

Music used:

––––––––––––––––––––––––––––––

Still Back by ZAYFALL https://soundcloud.com/zayfallmusic

Creative Commons — Attribution 3.0 Unported — CC BY 3.0

Free Download / Stream: http://bit.ly/2QJ2XY0

Music promoted by Audio Library https://youtu.be/bkRr409ghOQ

––––––––––––––––––––––––––––––

🎵 Track Info:

Title: Still Back by ZAYFALL

Genre and Mood: Dance & Electronic · Bright

———

🎧 Available on:

YouTube: https://youtube.com/watch?v=SeQBNy5ygMU

SoundCloud: https://soundcloud.com/zayfallmusic/s…

———

😊 Contact the Artist:

zayfall.music@gmail.com

https://youtube.com/channel/UCj9ob6Js…

https://open.spotify.com/artist/2T1zr…

https://twitter.com/ZAYFALL_Music

https://instagram.com/zayfallmusic

https://facebook.com/zayfall

———

What’s Swing Trading, Top 3 Swing Trading Indicators – 2021.

Forex Swing Trading Strategy – A Simple One For Big Gains Anybody Can Use

They are the nearest you can get to trading in genuine time with all the pressure of prospective losses. The outer bands can be utilized for contrary positions or to bank revenues. It functions even in volatile market conditions.

Top 3 Swing Trading Indicators – 2021, Play more videos about What’s Swing Trading.

Trend Trading Or Counter Trend Trading – Which Is Best?

Without a stop loss, do you know that you can erase your trading account really easily? Trail your block gradually and beyond normal volatility, so you don’t get bumped out of the pattern to quickly.

There is a difference in between trading and investing. Trading is constantly brief term while investing is long term. The time horizon in trading can be as short as a couple of minutes to a few days to a couple of weeks. Whereas in investing, the time horizon can be months to years. Lots of people day trade or swing trade stocks, currencies, futures, choices, ETFs, commodities or other markets. In day trading, a trader opens a position and closes it in the same day making a fast revenue. In swing trading, a trader attempts to ride a pattern in the market as long as it lasts. On the other hand, a financier is least pressed about the short-term swings in the market. He or she has a long term time horizon like a couple of months to even a couple of years. This very long time horizon matches their investment and financial objectives!

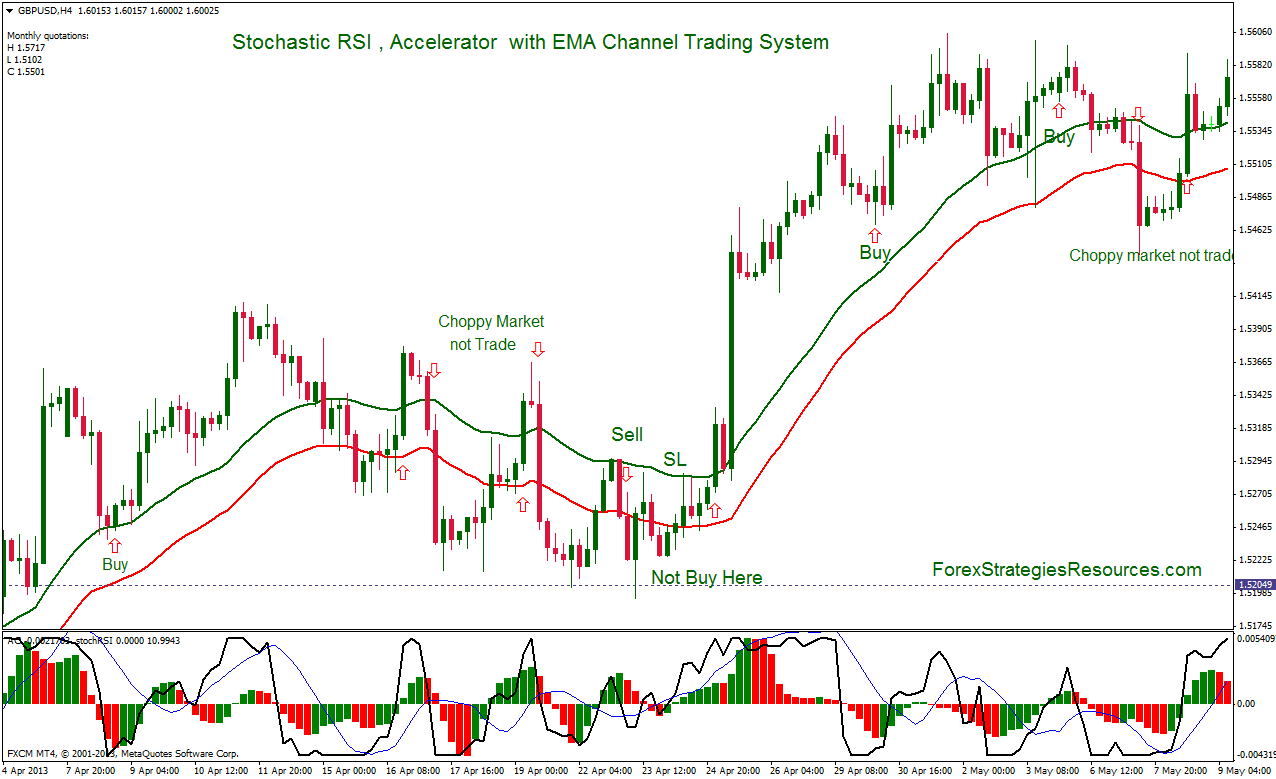

Use another indicator to confirm your conclusions. If the resistance and the supportlines are touching, then, there is likely to have a breakout. And if this is the Stochastic Trading situation, you will not be able to presume that the price will turn once more. So, you may just want to set your orders beyond the stretch ofthe resistance and the assistance lines in order for you to catch a taking place breakout. However, you need to use another sign so you can verify your conclusions.

You need less discipline than trend following, due to the fact that you do not need to hold positions for weeks on end which can be difficult. Instead, your losses and profits come rapidly and you get plenty of action.

So, here are some helpful ideas to effectively trade foreign currency exchange in an unpredictable market. Sure enough, you can apply these ideas while utilizing a demonstration account. After all, utilizing a demo account will enable you to practice forex Stochastic Trading and make you gotten ready for the genuine thing.

Swing Stochastic Trading systems come with different indications but the objective is constantly the very same, to benefit from short-term price spikes, offer or buy them and look for a go back to a moving average.

The simpler your system is, the more profits it will generate on a long run. When their trading system is easy to understand and follow, it is proven that traders run in an optimum state.

If the cost goes to a higher pivot level (which can be support or resistance) and the stochastic is low or high for a large time, then a turnaround will take place. Then a brand-new trade can be gone into accordingly. Thus, in this forex trading strategy, w wait till the market saturate to high or low and then sell or purchase depending on the scenario.

The trade sold on a downturn in momentum after the very first high at the 80.0 level. It is inadequate just to know the price has actually hit the line of resistance and recuperated though.

If you are finding instant exciting comparisons related to What’s Swing Trading, and Currency Trading, Market Cycles, Mechanical Forex Trading System dont forget to list your email address in subscribers database totally free.