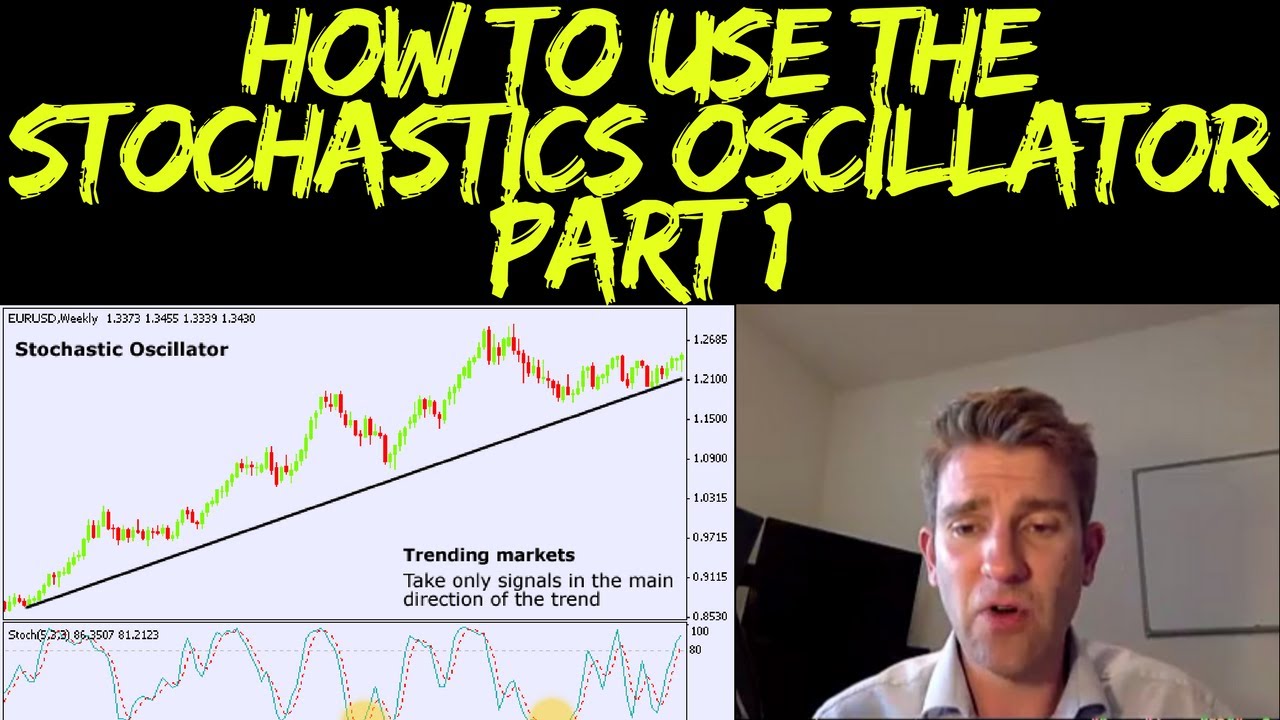

The Stochastic Indicator: When it Works, When it Doesn't & Why – Part 1 📈

Interesting complete video top searched Trading Forex Online, Forex Strategy, and How To Use Stochastic Indicator Day Trading, The Stochastic Indicator: When it Works, When it Doesn't & Why – Part 1 📈.

How to Use Stochastic Indicator. http://www.financial-spread-betting.com/course/stochastics-indicator.html PLEASE LIKE AND SHARE THIS VIDEO SO WE CAN DO MORE! Stochastic Momentum Index indicator for Forex, stocks and E-minis

First Look at the Stochastic Indicator. The stochastic momentum index (SMI) can indicate when a trend is strong (for entry points) and when a trend is weak (for exit points). This lesson looks at the stochastic indicator, which is another momentum indicator and oscillator. As a reminder, an oscillator has a theoretical range from 0% to 100%, but the action zones are above 70% or 80% and below 30% or 20%. Whether you take the more extreme values depends on the characteristics of the stock you are trading, and you need to look back over the chart to see what may work best.

The stochastic oscillator works from calculations on where the closing price is in relation to the daily range. If the uptrend is strong, and therefore has momentum, the closing price will tend to be towards the upper end of the range, and vice versa. It can be very powerful, and 20 years ago was almost regarded as a holy grail by traders.

As an oscillator, you can expect in a steady trend that it will go to an extreme value and stay there, so merely being at that value does not signal a trade. You may even choose to use the technique given in the last lesson on the RSI, and wait for a retracement in a strong uptrend to cause the oscillator to hit the lower value before considering a trade.

One of the interesting features of the stochastic indicator is that there are two lines plotted below the chart. On a black-and-white chart the solid line, %K as it is called, is the actual oscillator line, and the dashed line, %D, is a signal line. The signal line is simply a three period moving average of %K, which means it has a smoother profile. If you’re using a colour chart, you will be able to set the colours that work best for you.

As the name suggests, the signal line helps in determining when to enter and sometimes exit the trade. Just as the moving average crossover on a price chart can give you a signal, the signal line on the stochastic indicator can give you a trading signal. Simply look for it to cross the oscillator line when in an overbought or oversold area on its way back to the other end. The video gives several examples of this.

There is a further refinement of the stochastic indicator. The particular indicator we have been talking about is called the Fast Stochastic. Some traders use what is called the Slow Stochastic, which takes the Fast Stochastic %D, calls it the new %K, and takes a further moving average to generate another %D. The Slow Stochastic smoothes out the variations further, which generally means it gives fewer later signals, but may reduce the number of false signals.

As with all oscillators, it is important not to mechanically place a trade simply because of the position of the line. You need to assess the situation and determine, preferably using other methods, whether it is a likely trading situation. No one indicator can give you a reliable trading signal without considering other factors.

Related Videos

The Stochastic Indicator: When it Works, When it Doesn’t & Why – Part 1 📈

Stochastics Trading Strategy Part 2 📈

How to Profit from using the RSI (Relative Strength Index)? Part 1 📈

RSI Indicator Trading Strategy Part 2 📈

How To Filter Out RSI Indicator Fake Signals

Multi Time Frame Analysis With Oscillators

https://www.youtube.com/watch?v=KXDQ-QR3cco

How To Use Stochastic Indicator Day Trading, The Stochastic Indicator: When it Works, When it Doesn't & Why – Part 1 📈.

Best Storm Of Trading

There are numerous fake breakouts though and hence you wish to trade breakouts on the current trend. There is much composed on this to fill all your peaceful nights in reading for years.

The Stochastic Indicator: When it Works, When it Doesn't & Why – Part 1 📈, Get top full videos about How To Use Stochastic Indicator Day Trading.

Trading Chances – In The Us Dollar Shaping Up Right Now

Without a stop loss, do you know that you can eliminate your trading account extremely quickly? Trail your block gradually and outside of normal volatility, so you don’t get bumped out of the trend to quickly.

Here we are going to look at currency trading essentials from the viewpoint of getting a currency trading system for revenues. The one confined is basic to comprehend and will allow you to look for substantial gains.

Well, in this brief article I can’t enter into the tactical level – I can’t Stochastic Trading discuss my entry and exit sets off, and trade management strategies.It would take a whole book because it’s not just an easy sign based entry or exit. It’s based on price action – on an understanding of the nature of movement of price. That takes a long time to establish, and it’s something I’ll cover in my website in a lot more information.

Once the trade remains in movement – wait on the trade to recover under method before moving your stop, then track it up gradually, so you don’t get gotten by random volatility.

No issue you say. Next time when you see the revenues, you are going to click out which is what you do. You were in a long position, a red candle light appears and you click out. Whoops. The marketplace continues in your instructions. You stand there with 15 pips and now the market is up 60. Frustrated, you decide you are going to either let the trade play out to your Stochastic Trading profit target or let your stop get set off. You do your homework. You go into the trade. Boom. Stopped out. Bruised, battered and deflated.

If you saw our previous report you will see we banked a terrific short profit in the Pound and now were Stochastic Trading taking a look at it from the long side in line with the longer term trend, with the very same method.

If you desire to generate income forget “purchasing low and selling high” – you will miss all the big moves. Rather seek to “buy high and sell greater” and for this you need to understand breakouts. Breakouts are simply breaks of important assistance or resistance levels on a forex chart. The majority of traders can’t buy these breaks.

Rule primary: Money management is of utmost importance if you remain in for a long period of time of TF. Adapt to the emerging trading trends. A synergy in between the systems operations and tools and your understanding of them will guarantee revenues for you. Using an automated system will assist you step up your portfolio or start producing an effective one. Carefully choose the automatic trading system that covers your work action by step and not get duped by a system proven to make the owner cash from offering an inferior item.

In summary – they are leading indications, to evaluate the strength and momentum of rate. Currency trading is a method of earning money however it also depends on the luck factor. They are put side by side (tiled vertically).

If you are looking unique and entertaining reviews related to How To Use Stochastic Indicator Day Trading, and Forex Traading System, Trading Strategy you should join for email list now.