Swing Trading with Volume Profile – Trader Dale

Popular full length videos about Online Currency Trading, Range Trading, Short Swing Trading, and What’s Swing Trading, Swing Trading with Volume Profile – Trader Dale.

Learn more: https://ninjatraderecosystem.com/webinar/swing-trading-with-volume-profile/

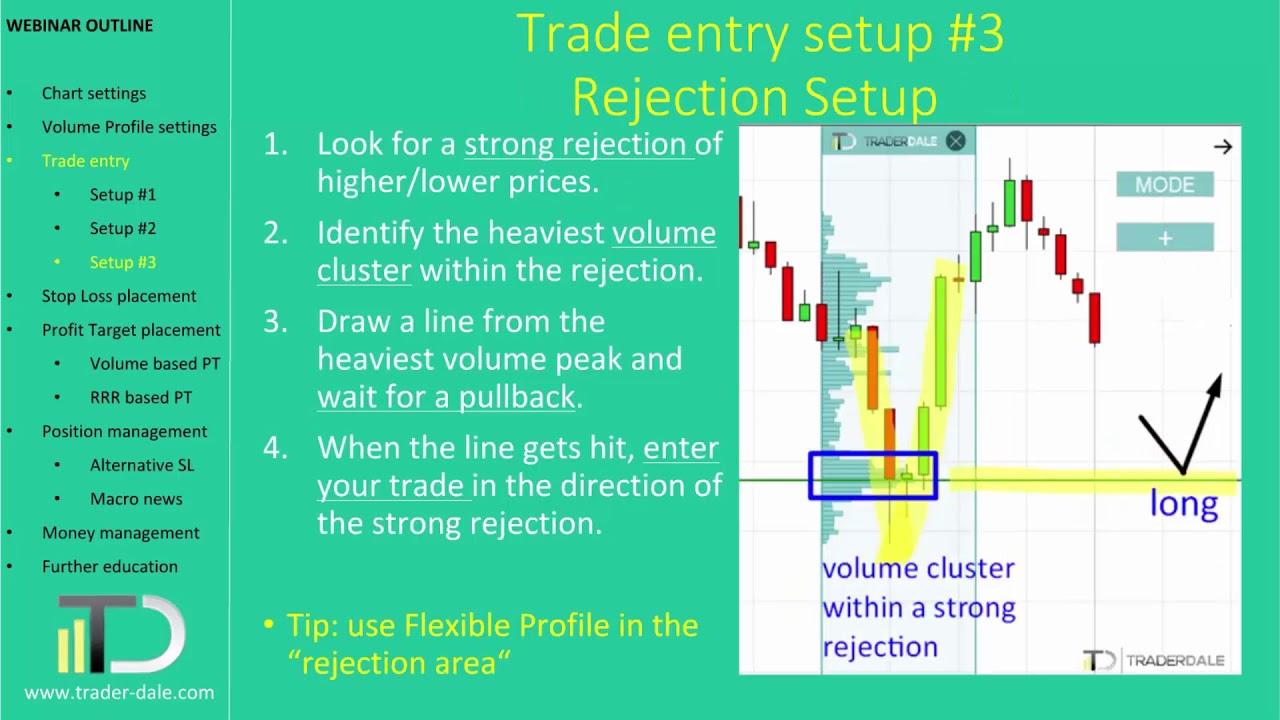

Join Trader Dale for a step-by-step guide to swing trading with Volume Profile. He discusses chart settings, trade entry strategies, SL&TP placement, position management and money management. Dale also provides concrete trading rules and some of his favorite swing trading tricks.

This presentation is a continuation of topics covered in Trader Dale’s previous webinar: https://ninjatraderecosystem.com/webinar/how-to-trade-with-volume-profile/

What’s Swing Trading, Swing Trading with Volume Profile – Trader Dale.

Daily Charts Method That Pulls 100-500+ Pips Per Trade

This strategy is basic and it is not complicated in any way. The above method is incredibly simple however all the very best systems and strategies are. They also need to look for floors and ceilings in a stock chart.

Swing Trading with Volume Profile – Trader Dale, Watch most shared full length videos relevant with What’s Swing Trading.

Forex Swing Trading – An Easy Ageless Method To Make Triple Digit Revenues!

The idea here is to draw a quick moving typical and a slow one. These two signs can be learned in a number of hours and give you a visual view of momentum. Trend trading is certainly my favorite kind of trading.

There is a distinction in between trading and investing. Trading is always brief term while investing is long term. The time horizon in trading can be as brief as a few minutes to a few days to a few weeks. Whereas in investing, the time horizon can be months to years. Many individuals day trade or swing trade stocks, currencies, futures, alternatives, ETFs, commodities or other markets. In day trading, a trader opens a position and closes it in the exact same day making a fast profit. In swing trading, a trader tries to ride a trend in the market as long as it lasts. On the other hand, a financier is least pressed about the short-term swings in the market. She or he has a long term time horizon like a couple of months to even a couple of years. This long time horizon matches their investment and monetary objectives!

Some these “high flyers” come out the high tech sector, that includes the Internet stocks and semiconductors. Other “high leaflets” come from the biotech stocks, which have increased volatility from such news as FDA approvals. After a while you will recognize the symbols Stochastic Trading due to the fact that there are less of them than on the NASDAQ that trade like a home on fire on the best news.

Most traders like to wait for the pullback but they never get in. By waiting for a better rate they miss out on the relocation. Losers do not go with breakouts winners do.

Concentrate on long-term patterns – it’s these that yield the huge revenues, as they can last for many years. Lucrative Stochastic Trading system never asks you to break the pattern. Trends translate to huge revenues for you. Breaking the trend suggests you are risking your money unnecessarily.

In summary – they are leading signs, to assess the strength and momentum of cost. You desire momentum to support any break prior to performing your Stochastic Trading signal as the chances of continuation of the pattern are greater.

But don’t think it’s going to be a breeze either. Don’t anticipate t be a millionaire overnight, since that’s just not practical. You do need to put in the time to learn about technical analysis. By technical analysis, I don’t indicate tossing a number of stochastic indicators on your charts, and have them inform you what to do. Sadly, that’s what a great deal of traders believe technical analysis is.

Guideline number one: Finance is of utmost value if you are in for a long period of time of TF. Adapt to the emerging trading patterns. A synergy between the systems operations and tools and your understanding of them will insure revenues for you. Utilizing an automated system will help you step up your portfolio or start developing an effective one. Thoroughly select the automatic trading system that covers your work action by action and not get swindled by a system proven to make the owner money from offering an inferior item.

In truth that’s why on a monthly basis you can see new plans being offered online to brand-new traders. Try this now: Buy Stock Assault 2.0 stock exchange software application.

If you are looking updated and entertaining reviews about What’s Swing Trading, and Stock Market Trend, Trading Strategies, Forex Trading Tips, Forex Trading Ideas please signup our email list for free.

![5 Best Altcoins To Swing Trade!!! RIGHT NOW!!! [Bitcoin/Cryptocurrency Investment] 5 Best Altcoins To Swing Trade!!! RIGHT NOW!!! [Bitcoin/Cryptocurrency Investment]](https://Stochastictrader.com/wp-content/uploads/5-Best-Altcoins-To-Swing-Trade-RIGHT-NOW-BitcoinCryptocurrency-Investment-200x137.jpg)