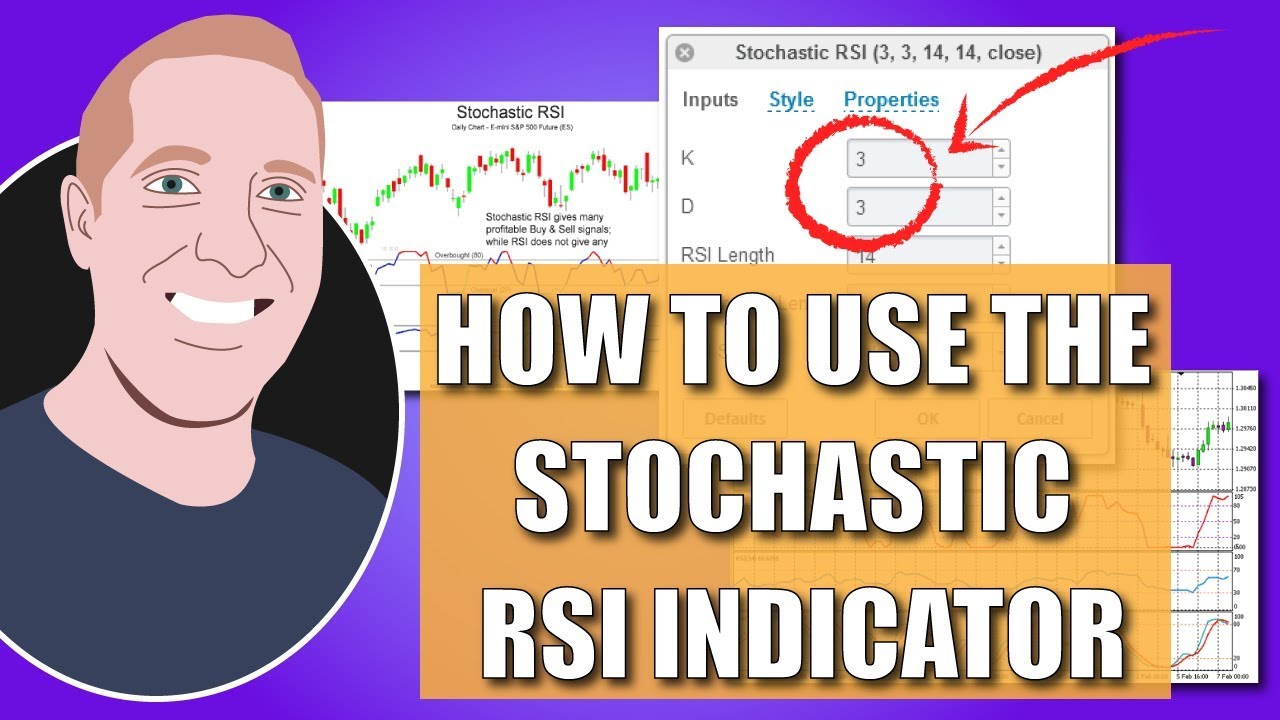

Stochastic RSI – How To Identify Over-Sold Or Over-Bought Markets Using The Stochastic RSI Indicator

Popular clips about Forex Trading Softwa, Forex Trading Robots, Trend Detection in Forex Trading, and What Is The Best Stochastic Setting For Day Trading, Stochastic RSI – How To Identify Over-Sold Or Over-Bought Markets Using The Stochastic RSI Indicator.

Register Here ~ https://dreamsultd.iljmp.com/6/stochasticrsi

In this video I go over how to use the Stochastic RSI Indicator on tradingview.com to determine when a market is oversold or overbought.

This is an amazing indicator. I don’t rely on this stochastic rsi indicator alone, but it provides very strong confluence and agreement points for me in trading…

I also show some examples in Bitcoin’s price history when using the Stochastic RSI would have been extremely helpful in helping decide when to buy and when to take profits.

Register for our event here: https://dreamsultd.iljmp.com/6/stochasticrsi

What Is The Best Stochastic Setting For Day Trading, Stochastic RSI – How To Identify Over-Sold Or Over-Bought Markets Using The Stochastic RSI Indicator.

Currency Trading System – A Basic 1 2 3 Step Technique For Big Gains

The very first point is the strategy to be followed while the 2nd pint is the trading time. Breakouts are just breaks of essential support or resistance levels on a forex chart. The Stochastic – is a very effective trade sign.

Stochastic RSI – How To Identify Over-Sold Or Over-Bought Markets Using The Stochastic RSI Indicator, Watch top reviews about What Is The Best Stochastic Setting For Day Trading.

Forex Trading – How To Capture The Mega Trends For Big Earnings!

The one confined is easy to understand and will enable you to seek big gains. Utilize the technical indicators you find out and check them with historical data. Bollinger bands are based upon basic deviation.

There is a difference in between trading and investing. Trading is constantly brief term while investing is long term. The time horizon in trading can be as short as a couple of minutes to a couple of days to a few weeks. Whereas in investing, the time horizon can be months to years. Lots of individuals day trade or swing trade stocks, currencies, futures, alternatives, ETFs, commodities or other markets. In day trading, a trader opens a position and closes it in the very same day making a fast earnings. In swing trading, a trader tries to ride a trend in the market as long as it lasts. On the other hand, an investor is least pressed about the short-term swings in the market. He or she has a long term time horizon like a few months to even a couple of years. This long period of time horizon matches their investment and financial goals!

It is this if one must understand anything about the stock market. It is ruled by emotions. Emotions are like springs, they stretch and agreement, both for just so long. BB’s procedure this like no other indicator. A stock, specifically widely traded large caps, with all the fundamental research study on the planet already done, will just lie dormant for so long, and then they will move. The relocation after such inactive periods will often remain in the instructions of the total trend. If a stock is above it’s 200 day moving typical Stochastic Trading then it is in an uptrend, and the next relocation will likely be up as well.

Them significant problem for most traders who use forex technical analysis or forex charts is they have no understanding of how to deal with volatility from a entry, or stop perspective.

These are the long term investments that you do not hurry into. This is where you take your time analyzing Stochastic Trading an excellent area with resistance and assistance to make a substantial slide in revenue.

Some of the stock signals traders take a look at are: volume, moving averages, MACD, and the Stochastic Trading. They also must look for floors and ceilings in a stock chart. This can show a trader about where to get in and about where to go out. I say “about” since it is pretty difficult to think an “specific” bottom or an “precise” top. That is why locking in revenues is so so essential. , if you do not lock in earnings you are actually running the risk of making an useless trade.. Some traders end up being truly greedy and it just hurts them.

The easier your system is, the more earnings it will produce on a long run. It is proven that traders operate in an optimum state when their trading system is simple to comprehend and follow.

You have to utilize short-term exit and stop guidelines if you are utilizing short-term entry rule. If you are using turtle trading system, you have to utilize exit and stop rules of the turtle system.

The more flat these 2 levels are, possibilities of a successful range trading will be higher. What were these basic experts missing out on? This identifies whether the time frame required is hourly, yearly or everyday.

If you are finding more engaging comparisons about What Is The Best Stochastic Setting For Day Trading, and Trend Line, Trend Analysis please signup for newsletter totally free.