Stochastic Oscillator Tutorial – Learn to Trade Forex with cTrader – Episode 17

Interesting high defination online streaming relevant with Currency Swing Trading System, Trading Winning Strategies, Simple Forex Trading, and Trading Stochastic Divergence, Stochastic Oscillator Tutorial – Learn to Trade Forex with cTrader – Episode 17.

Contents 00:00 – Stochastic Oscillator (introduction and calculation) 02:26 – Trading the Stochastic Oscillator (Overbought and Oversold areas) 05:11 – Using two …

Trading Stochastic Divergence, Stochastic Oscillator Tutorial – Learn to Trade Forex with cTrader – Episode 17.

Forex Trading – How To Capture The Mega Patterns For Substantial Revenues!

This identifies whether the time frame required is hourly, daily or yearly. What it suggests is that when an existing trend ends, a brand-new trend starts. The technical analysis must also be determined by the Forex trader.

Stochastic Oscillator Tutorial – Learn to Trade Forex with cTrader – Episode 17, Get top reviews related to Trading Stochastic Divergence.

Cycles Can Leapfrog Your Trading Success

The one enclosed is basic to understand and will allow you to look for huge gains. Use the technical indicators you discover and test them with historical data. Bollinger bands are based on basic variance.

Here we are going to look at currency trading essentials from the standpoint of getting a currency trading system for earnings. The one confined is easy to comprehend and will allow you to seek substantial gains.

You’ll observe that when a stock cost hits the lower Bollinger Band, it normally tends to rise once again. Utilizing the SMA line in the middle of the Bollinger Bands offers Stochastic Trading us an even much better image. Keep in mind, whatever stock symbol you pick from on the NASDAQ 100, you must examine for any news on it prior to you trade it as any negative news could affect the stock no matter what the Nasdaq efficiency resembles.

Testing is a process and it is suggested to test various tools during the years. The goal in testing the tools is to discover the ideal trading tool the trader feels comfy with in different market circumstance but likewise to improve trading abilities and earnings margin.

Resistance is the location of the chart where the price stops increasing. No new highs have actually been satisfied in the last few Stochastic Trading sessions and the price remains in a sideways instructions.

To get the odds much more Stochastic Trading in your corner, when the breakout starts, price momentum must be on the rise and here you need to discover momentum oscillators.

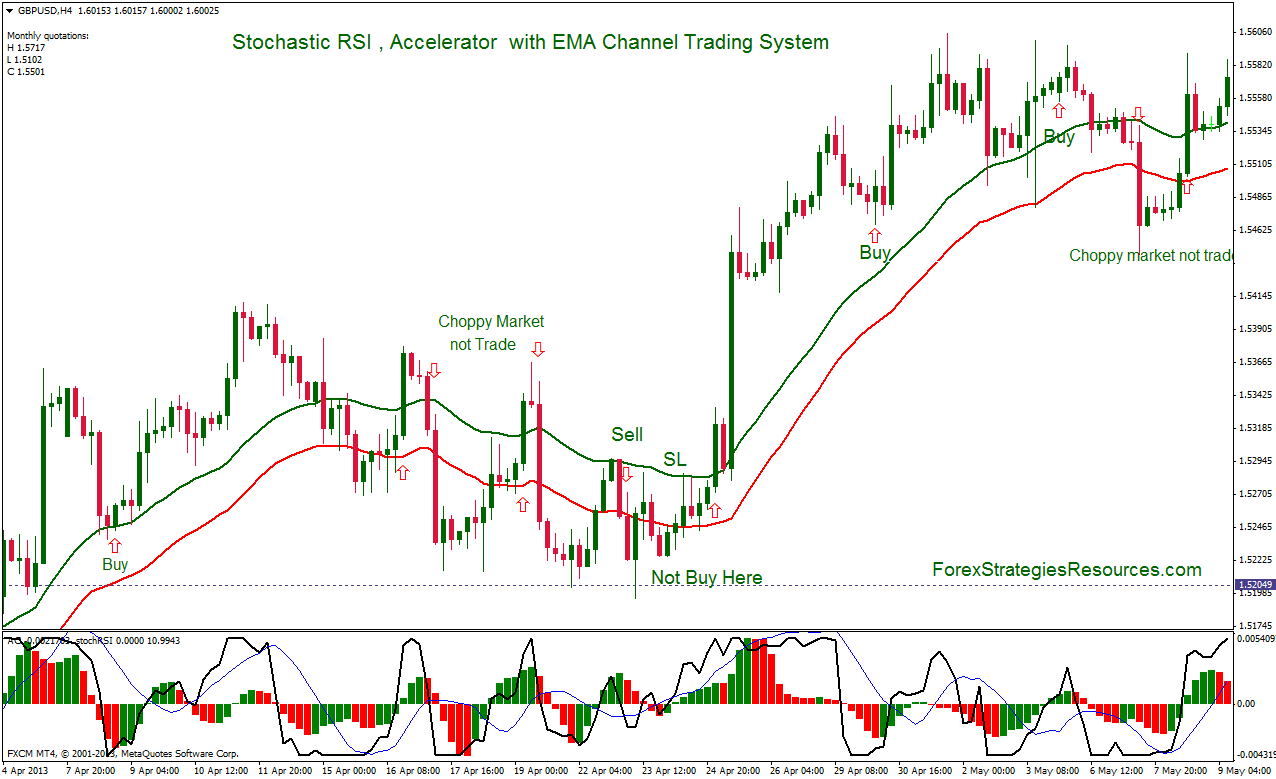

The technical analysis should also be determined by the Forex trader. This is to forecast the future trend of the rate. Typical indications utilized are the moving averages, MACD, stochastic, RSI, and pivot points. Keep in mind that the previous signs can be utilized in combination and not just one. This is to verify that the price pattern holds true.

Remember, if your trading stocks, do your homework and share a strategy and stay with it. Do not forget to secure earnings. Stock trading can make you a great deal of cash if done in a disciplined manner. So get out there and attempt it out.

A synergy in between the systems functions and tools and your understanding of them will insure profits for you. That takes a long period of time to establish, and it’s something I’ll cover in my website in a lot more detail.

If you are looking most exciting comparisons about Trading Stochastic Divergence, and Trading 4x Online, E Mini Trading please signup our email list now.