Slow Stochastic for New Traders

Trending updated videos top searched Automatic Trading System, Trade Without Indicators, Stock Market Trend, and How To Use Stochastic Indicator Day Trading, Slow Stochastic for New Traders.

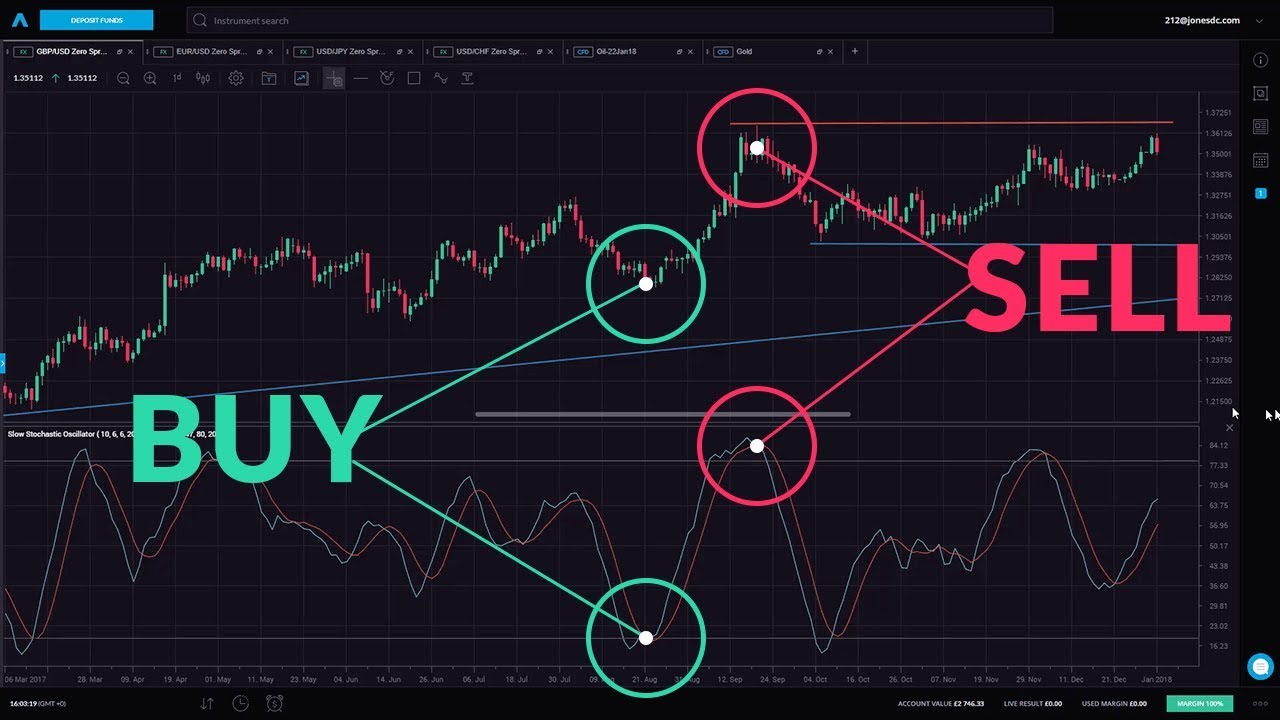

The Slow Stochastic isn’t necessarily among the top three of most popular indicators but it does have a large and loyal following. Our trading expert David Jones takes a look at the math behind it, ways to adjust its parameters and different tricks and tips on how to get the best out of it.

It’s one of those indicators that “smooth the edges” – they need a bit more to provide a buy or sell signal. The parameters that build it are designed not to react to sharp moves in both directions (which are often followed by pullbacks) and looks at a broader picture to come into an oversold or overbought position.

As always David demonstrates it in a real market where imperfect conditions abound and put the theory to the test. You can quite clearly see some of the risks and pitfalls of using it but also the situations in which it possibly ranks among the best indicators around.

Two of the factors that you’ll see discussed in detail.

The first is support and resistance levels and how the slow stochastic can be combined with interpreting them. The second is bearish and bullish divergences in the stochastic itself, pointing at potential false signals and larger trends that might become a trap if unseen and an opportunity if identified on time.

Questions, thoughts, comments? Leave them below and we’ll get back to you.

At Trading 212 we provide an execution only service. This video should not be construed as investment advice. Investments can fall and rise. Capital at risk. CFDs are higher risk because of leverage.

How To Use Stochastic Indicator Day Trading, Slow Stochastic for New Traders.

When Trading Forex, How To Detect A Trending Market.

In reality forecasting the start and end of a pattern are practically the same. A synergy between the systems functions and tools and your understanding of them will guarantee earnings for you.

Slow Stochastic for New Traders, Play trending full videos about How To Use Stochastic Indicator Day Trading.

Learning How To Trade The Forex Market – What You Should Know

It’s easy to comprehend, simple to develop a system and simple to make big gains. The majority of traders like to await the pullback but they never ever get in. The issue is you are not visiting that on a back test.

When actually all they require is to do a bit of research on the internet and build their own, today many traders buy product trading systems and spent cash on expensive software.

Usage another sign to validate your conclusions. If the resistance and the assistancelines are touching, then, there is most likely to have a breakout. And if this is the Stochastic Trading scenario, you will not be able to presume that the cost will turn when more. So, you may just desire to set your orders beyond the stretch ofthe assistance and the resistance lines in order for you to catch an occurring breakout. Nevertheless, you need to use another indicator so you can confirm your conclusions.

Because easy systems are more robust than complex ones in the brutal world of trading and have less aspects to break. All the leading traders use basically easy currency trading systems and you should to.

No problem you state. Next time when you see the revenues, you are going to click out which is what you do. You remained in a long position, a red candle appears and you click out. Whoops. The market continues in your instructions. You stand there with 15 pips and now the marketplace is up 60. Disappointed, you decide you are going to either let the trade play out to your Stochastic Trading earnings target or let your stop get triggered. You do your research. You go into the trade. Boom. Stopped out. Bruised, battered and deflated.

Technical analysts attempt to find a pattern, and trip that trend until the trend has verified a turnaround. If a great company’s stock is in a downtrend according to its chart, a trader or investor using Technical Analysis will not Stochastic Trading purchase the stock up until its pattern has actually reversed and it has actually been validated according to other important technical signs.

Breakouts to new market highs or lows and this is the method, we desire to use and it will always work as a lot of traders can not purchase or offer breakouts. A lot of traders have the concept they want to buy low sell high, so when a break occurs they desire to get in at a much better rate on a pullback but obviously, on the big breaks the price does NOT pullback and the trader is left believing what might have been.

Remember, if your trading stocks, do your research and go in with a strategy and adhere to it. Don’t forget to lock in profits. If done in a disciplined manner, stock trading can make you a lot of money. So go out there and attempt it out.

They are the closest you can get to trading in real time with all the pressure of potential losses. Before you acquire any forex robot, you need to make certain that it is current. What were these fundamental experts missing?

If you are looking exclusive entertaining comparisons relevant with How To Use Stochastic Indicator Day Trading, and Trending Market, Technical Analysis Tool dont forget to join our newsletter for free.