RSI Indicator Secrets: Powerful Trading Strategies to Profit in Bull & Bear Markets

Latest updated videos highly rated Short Swing Trading, Currency Trading Basics, Stock Market Trading System, and How To Use Stochastics For Day Trading, RSI Indicator Secrets: Powerful Trading Strategies to Profit in Bull & Bear Markets.

I’ve just created a new training on the RSI indicator.

Here’s what you’ll learn:

* What is the RSI indicator and how does it really work (90% of traders get this wrong)

* How to use the RSI indicator to trade with the trend and improve your winning rate

* How to use the RSI indicator and “predict” market reversals in the stock market

* How to better time your entries using this little-known technique

* And more…

Sounds good?

Then go watch it right now…

** FREE TRADING STRATEGY GUIDES **

The Ultimate Guide to Price Action Trading: https://www.tradingwithrayner.com/ultimate-guide-price-action-trading/

The Monster Guide to Candlestick Patterns: https://www.tradingwithrayner.com/candlestick-pdf-guide/

** PREMIUM TRAINING **

Pro Traders Edge: https://www.tradingwithrayner.com/pte/

Pullback Stock Trading System: https://pullbackstocktradingsystem.com/

Price Action Trading Secrets: https://priceactiontradingsecrets.com/

How To Use Stochastics For Day Trading, RSI Indicator Secrets: Powerful Trading Strategies to Profit in Bull & Bear Markets.

Swing Trading – A Revenue Opportunity Shaping Up Ideal Now

She or he has a long term time horizon like a couple of months to even a couple of years. The buzzword today in trading is “indications, signs, indications”. Remember for every purchaser there is a seller.

RSI Indicator Secrets: Powerful Trading Strategies to Profit in Bull & Bear Markets, Search popular explained videos related to How To Use Stochastics For Day Trading.

Forex Pattern Analysis – How To Identify When The Very Best Time Is To Sell

Dow theory in nutshell says that you can utilize the previous rate action to anticipate the future cost action. You are trading the reality of rate change and in Forex trading, that’s a timeless method to earn money.

Forex swing trading is simple to understand, only requires a simple system, its likewise interesting and fun to do. Here we will look at how you can become a successful swing trader from house and accumulate big profits in around 30 minutes a day.

If one ought to know anything about the stock exchange, it is this. It is ruled by feelings. Emotions resemble springs, they stretch and agreement, both for just so long. BB’s procedure this like no other sign. A stock, particularly commonly traded big caps, with all the essential research worldwide currently done, will just lie dormant for so long, and after that they will move. The move after such inactive periods will usually remain in the instructions of the total trend. And the next Stochastic Trading move will likely be up as well if a stock is above it’s 200 day moving average then it is in an uptrend.

Do not predict – you need to just act upon confirmation of cost changes and this always means trading with cost momentum in your corner – when using your forex trading method.

While the rules offer you factors to enter trades, it does not suggest that the rate will go in your desired instructions. The concept is “Do not forecast the marketplace”. Instead, you need to let the cost movement lead your method, knowing at anytime price could go and alter in a different direction. Stochastic Trading You have to offer up and stop out if the rate does not move in your favor.

You require to have the Stochastic Trading mindset that if the break occurs you go with it. Sure, you have actually missed the very first little profit but history reveals there is generally plenty more to follow.

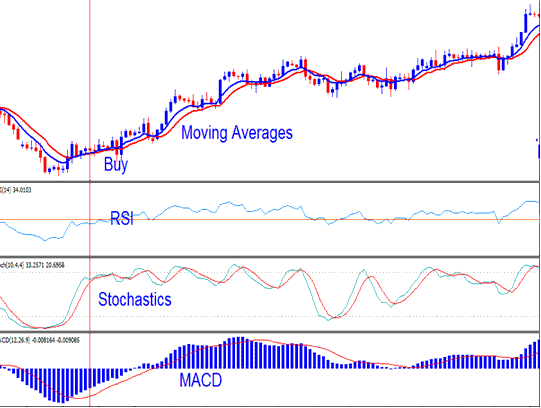

The Stochastic Sign – this has been around given that the 1950’s. It is a momentum indication which measures over bought (readings above 80) and over sold (readings below 20), it compares today’s closing rate of a stocks price variety over a current duration of time.

Position the trade at a stop loss of roughly 35 pips and you ought to apply any of these 2 techniques for the purpose of making revenue. The first is apply a good threat to a rewarding ratio of 1:2 while the next is to utilize support and resistance.

The trade offered on a slowdown in momentum after the first high at the 80.0 level. It is inadequate simply to understand the cost has actually struck the line of resistance and recuperated though.

If you are looking most entertaining comparisons related to How To Use Stochastics For Day Trading, and Make Money Online, Currency Trading, Forex Trading Divergence, Currency Swing Trading System you should signup in a valuable complementary news alert service now.