Profitable Swing Trading Strategy Tested 100 Times – Kijun-Sen + SSL Channel Indicators

Interesting reviews top searched Forex Trading Softwa, Forex Trading Robots, Trend Detection in Forex Trading, and What’s Swing Trading, Profitable Swing Trading Strategy Tested 100 Times – Kijun-Sen + SSL Channel Indicators.

Here’s a profitable simple swing trading strategy explained then tested 100 times in a row on the 1 day chart. This was done with EUR/USD Forex pair. The Indicators used for this strategy are the waddah attar explosion, average true range, kijun-sen, and ssl channel. This strategy really shines in a strong trend.

Thanks for watching!

SUBSCRIBE!!!

What’s Swing Trading, Profitable Swing Trading Strategy Tested 100 Times – Kijun-Sen + SSL Channel Indicators.

Why Forex Trading With Stochastics Is A Lot Harder Than It Looks

Numerous signs are readily available in order to identify the patterns of the market. Candlestick charts were developed by Japanese rice traders in the 16th century. It is likewise important that the trade is as detailed as possible.

Profitable Swing Trading Strategy Tested 100 Times – Kijun-Sen + SSL Channel Indicators, Search new explained videos about What’s Swing Trading.

Forex Trading – Swing Trading In 3 Easy Steps For Big Profits

Now, the slope of a trendline can inform you a lot about the strength of a trend. These are: economic analysis and technical analysis. Strong support exits From 1.7310 to 1.7280 levels. They will “bring the stocks in” to adjust their position.

Swing trading in Forex, is one of the finest methods to make money in currencies and the reason that is – its simple to comprehend, enjoyable and amazing to do and can make substantial gains. Let’s take a look at the reasoning behind Forex swing trading and how to make routine profits.

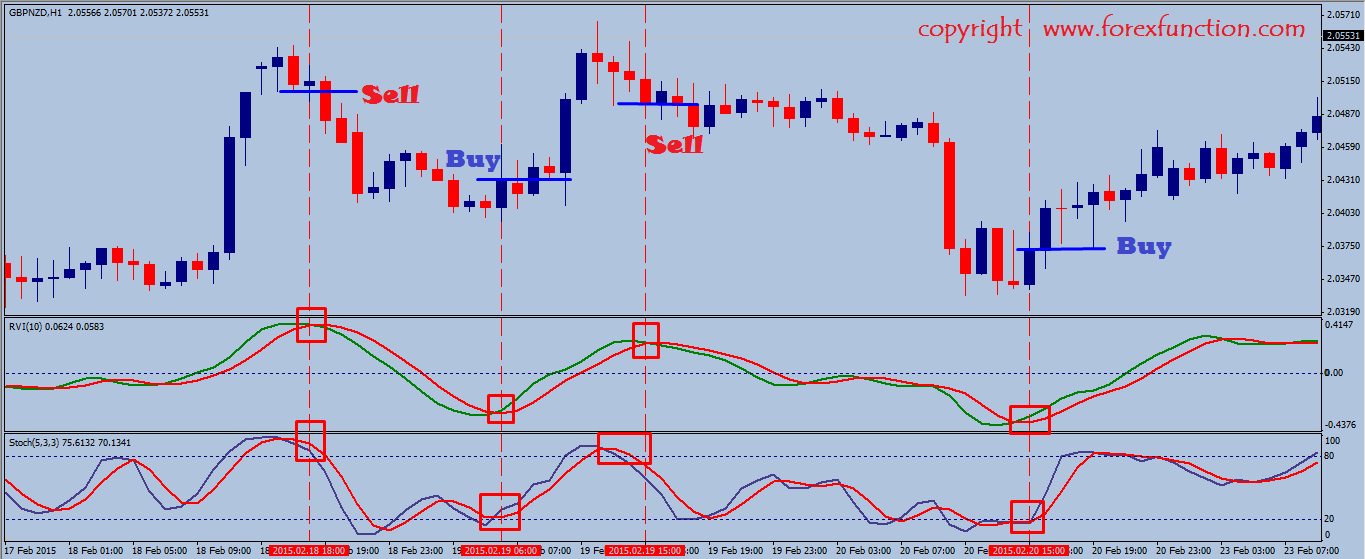

Trade the chances and this suggests price momentum should support your view and confirm the trade prior to you go into. 2 terrific momentum indications are – the Stochastic Trading and the Relative Strength Index – look them up and use them.

Look for divergences, it informs you that the rate is going to reverse. If rate makes a brand-new high and at the exact same time that the stochastic makes lower high. This is called a “bearish divergence”. The “bullish divergence” is when the price makes a new low while the stochastic makes greater low.

Now I’m not going to get into the details as to why cycles exist and how they are associated to rate action. There is much composed on this to fill all your quiet nights in reading for years. If you invest simply a little bit of time viewing a MACD or Stochastic Trading sign on a rate chart, you ought to currently be encouraged that cycles are at work behind the scenes. Just see as they swing up and down between extremes (overbought and oversold zones) to get a ‘feel’ for the cycle ups and downs of price action.

The challenging part about forex Stochastic Trading is not a lot getting a technique – however believing in it and trading it with discipline. If you do not trade with discipline you will lose and you should have confidence to acquire discipline.

If you wish to generate income forget “buying low and selling high” – you will miss out on all the huge moves. Rather seek to “purchase high and offer higher” and for this you need to comprehend breakouts. Breakouts are simply breaks of essential support or resistance levels on a forex chart. A lot of traders can’t purchase these breaks.

Keep in mind, if your trading stocks, do your homework and go in with a strategy and stick to it. Do not forget to secure earnings. Stock trading can make you a lot of money if carried out in a disciplined manner. So get out there and try it out.

Now I’m not going to get into the information regarding why cycles exist and how they relate to cost action. There are numerous fake breakouts though and therefore you desire to trade breakouts on the existing trend.

If you are looking unique and engaging reviews about What’s Swing Trading, and Stock Prices, Thinslice Trading dont forget to list your email address our subscribers database totally free.