Powerful Triple Stochastics Screening System 💡

Top reviews related to Forex Day Trading, Simple System, and Best Stochastic Settings For 5 Minute Chart, Powerful Triple Stochastics Screening System 💡.

✅ Check Mark’s Premium Course: https://price-action-trading.teachable.com/

📞 Join Mark’s TradersMastermind: https://www.tradersmastermind.com/mastermind

✅ Please like, subscribe & comment if you enjoyed – it helps a lot!

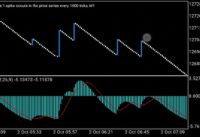

Triple stochastics screening. How do you use a stochastic indicator? This video is about looking at an indicator like the Stochastics on three separate timeframes to help us 1) stay out of potentially bad trades 2) help guide us into the correct trend and approach as opposed to chasing stuff. I have a daily chart, 60 minute chart and 5 minute chart- you can play around this a little bit. The daily chart is in an uptrend, the 60 minute – a downtrend with a push up, downtrend again and another pushup. On the 5 minute chart we get consolidation and then a good rally back. We want to align ourselves with the trend in the best possible way without chasing the trend… Because if you buy at highs it might still work but you might end up sitting on a hefty pullback. It is best to buy on a pullback at the right time. At the bottom of each of the charts we have a stochastic indicator. So what is the triple stochastics screening strategy?

Related Videos

The Stochastic Indicator: When it Works, When it Doesn’t & Why – Part 1 📈

Powerful Triple Stochastics Screening System 💡

Stochastics Trading Strategy Part 2 📈

Should I use RSI, CCI or Stochastics? 💡

https://www.youtube.com/watch?v=aLii-ZHIhIc

Best Stochastic Settings For 5 Minute Chart, Powerful Triple Stochastics Screening System 💡.

4 Guidelines For Success In Swing Trading

So if you want to swing trade ranges, you can use the ADX (Typical Directional Index) oscillator. These are the long term investments that you do not hurry into. You stand there with 15 pips and now the marketplace is up 60.

Powerful Triple Stochastics Screening System 💡, Play interesting videos relevant with Best Stochastic Settings For 5 Minute Chart.

Trading Stochastics – It’s Not All That It’s Split Up To Be

The support and resistance levels in the variety need to form a horizontal line. Forex trading can be found out by anybody and basic forex trading systems are best. This implies you don’t need to be smart and have a college education.

Trading on the daily charts is a a lot easier technique as compared to trading intraday. This daily charts strategy can make you 100-500 pips per trade. You do not need to sit in front of your computer for hours when trading with this daily charts technique.

If the break happens you go with it, you need to have the Stochastic Trading frame of mind that. Sure, you have missed out on the first little bit of revenue however history reveals there is generally plenty more to follow.

Do not predict – you ought to just act upon confirmation of cost modifications and this constantly means trading with cost momentum on your side – when using your forex trading technique.

If you Stochastic Trading take a look at the weekly chart you can plainly see resistance to the dollar at 114. We also have a yen trade that is up with lower highs from the July in a strong pattern the mid Bollinger band will act as resistance or support, in this case it acts as resistance and is simply above the 114.00 level. Momentum is up at present – will the resistance hold its time to take a look at the daily chart.

Numerous traders make the mistake of believing they can utilize the swing trade method daily, however this is not a great idea and you can lose equity rapidly. When the market is just right for swing trading, rather reserve forex swing trading for days. So, how do you understand when the marketplace is right? Look for resistance or assistance that has been held numerous times like when the chart is high or low. View the momentum and look for when rates swing strongly toward either the resistance or the assistance, while this is occurring watch for verification that the momentum will turn. This confirmation is crucial and if the momentum of the cost is beginning to subside and a turn is likely, then the chances are in fantastic favor of a swing Stochastic Trading environment.

Breakouts to new market highs or lows and this is the methodology, we want to use and it will always work as most traders can not buy or offer breakouts. Many traders have the idea they want to buy low sell high, so when a break happens they want to get in at a better cost on a pullback however of course, on the big breaks the cost does NOT pullback and the trader is left thinking what might have been.

If you are utilizing short-term entry guideline, you need to utilize short-term exit and stop rules. If you are utilizing turtle trading system, you have to use exit and stop guidelines of the turtle system.

Use these with a breakout technique and they provide you an effective combination for looking for huge gains. This implies reducing your possible loses on each trade utilizing a stop loss.

If you are searching instant entertaining reviews about Best Stochastic Settings For 5 Minute Chart, and Line D Stock, Trend Detection in Forex Trading, Forex Swing Traders, Forex Trading Strategy you should join for newsletter for free.