Learn the 1-Minute Trade Setup – Easy Emini Trade

Trending clips top searched Forex Trading Techniques, Trade Without Indicators, Forex Market, and Best Stochastic Settings For 1 Minute Chart, Learn the 1-Minute Trade Setup – Easy Emini Trade.

Learn more: https://ninjatraderecosystem.com/webinar/learn-the-1-minute-trade-setup/

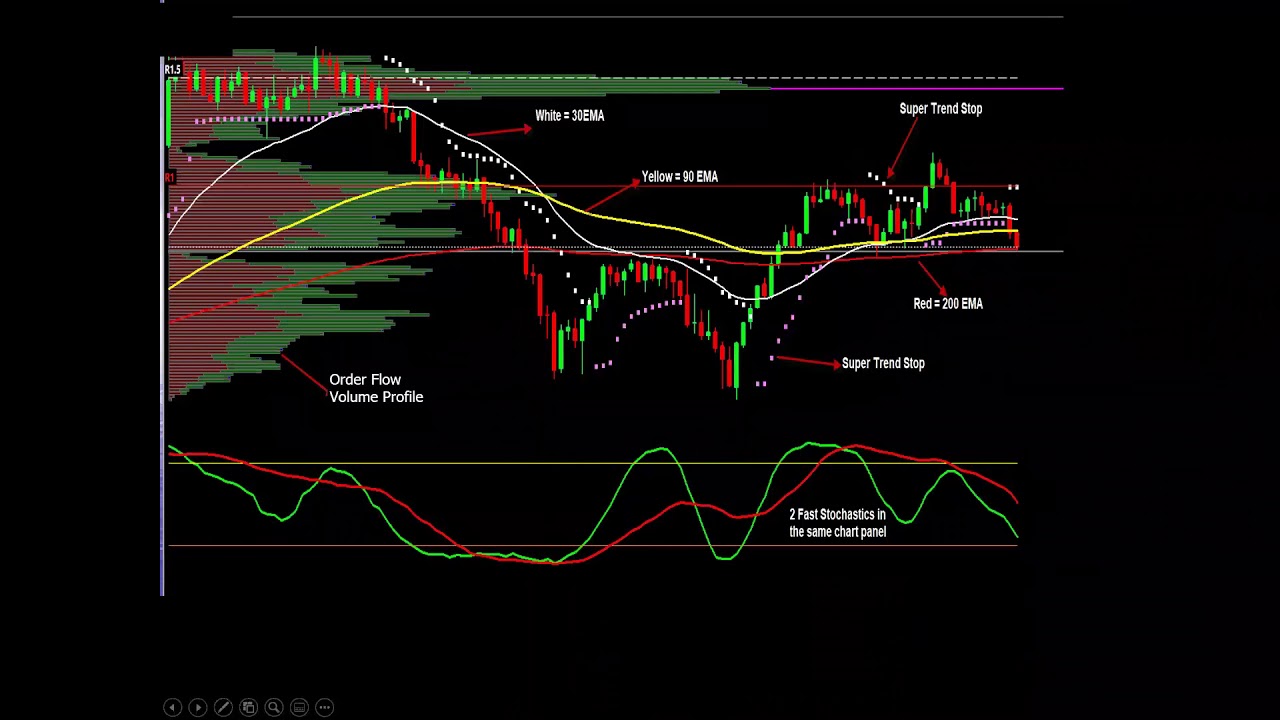

Join Easy Emini Trade Founder Trisha Ogilvie and discover her favorite setup which she trades every day. This setup can be traded on any time frame, chart style or instrument, and can be used both as a filter and indicator.

Trisha also demonstrates using Volume Profile to establish support & resistance areas and how this can aid in your decision making.

Best Stochastic Settings For 1 Minute Chart, Learn the 1-Minute Trade Setup – Easy Emini Trade.

Online Currency Trading – A Simple Way To Develop Substantial Profits

They are put side by side (tiled vertically). The best indicator that the price momentum will change is a stochastic sign. Yet again, check your evaluations against a minimum of 1 extra indication.

Learn the 1-Minute Trade Setup – Easy Emini Trade, Explore new full length videos relevant with Best Stochastic Settings For 1 Minute Chart.

Forex Swing Trading – An Easy Classic Method To Make Triple Digit Revenues!

They are primarily the very first few hours of the United States, European and Asian session. Often, either one or both the support and resistance are inclining. And that’s how professional traders live their lives.

If you wish to win at forex trading and delight in currency trading success possibly one of the easiest ways to accomplish it is to trade high odds breakouts. Here we will take a look at how you can do this and make big revenues.

Take a look at support and resistance levels and pivot points. When it approaches them, in a perfect choppy market the assistance and resistance lines will be parallel and you can expect the market to turn. Check against another indication such as the Stochastic Trading oscillator. You have another signal for the trade if it reveals that the price is in the overbought or oversold range.

His main approaches involve the Dedication of Traders Index, which checks out like a stochastic and the second is Major & Minor Signals, which are based on a fixed dive or decline in the abovementioned index. His work and research are very first class and parallel his character as a person. However, for any methodology to work, it needs to be something the trader is comfy with.

Numerous traders just await the time when the rate will reach near the point they are anticipating and think that at that point of time they will go into the trade and expect Stochastic Trading much better levels of hold.Because it will lead to a quick clean out and the market will take off your equity and will not give you any rewards, never ever forecast anything or guess anything.

Many traders make the mistake of thinking they can utilize the swing trade technique daily, but this is not an excellent concept and you can lose equity quickly. Instead reserve forex swing trading for days when the market is simply right for swing trading. So, how do you understand when the marketplace is right? Look for resistance or assistance that has actually been held a number of times like when the chart is high or low. Watch the momentum and look for when prices swing highly toward either the support or the resistance, while this is occurring expect confirmation that the momentum will turn. This verification is vital and if the momentum of the rate is starting to wane and a turn is likely, then the odds remain in great favor of a swing Stochastic Trading environment.

Breakouts to brand-new market highs or lows and this is the methodology, we want to use and it will always work as a lot of traders can not buy or offer breakouts. Many traders have the concept they desire to buy low sell high, so when a break happens they want to get in at a much better rate on a pullback but of course, on the huge breaks the price does NOT pullback and the trader is left thinking what may have been.

In this post is a trading technique revealed that is based upon the Bolling Bands and the stochastic signs. The technique is simple to utilize and could be utilized by day traders that desire to trade brief trades like 10 or 30 minute trades.

There is much written on this to fill all your peaceful nights in checking out for decades. And in a downtrend, link two greater lows with a straight line. A stock exchange pattern is a force that demands our respect.

If you are searching most exciting videos about Best Stochastic Settings For 1 Minute Chart, and Ranging Market, Trend Line, Simple Forex Trading Strategy, Daily Timeframe Strategy you should subscribe in email list for free.