I traded 100 TIMES with the Stochastic Trading Strategy but the win rate was… – Forex Day Trading

Latest clips top searched Online Forex Trading, Best Trading System, and Stochastic Day Trading Strategy, I traded 100 TIMES with the Stochastic Trading Strategy but the win rate was… – Forex Day Trading.

How to trade and use the Stochastic Trading Strategy? Is the Stochastic indicator good for trading forex and stock market? Is it better than those Stochastic RSI strategies?

Official Trading Rush Website: https://tradingrush.net

Download Official Trading Rush APP (Thanks): https://bit.ly/tradingrushapp

Support the Channel on Patreon (Thanks): https://www.patreon.com/tradingrush

Trading Merch for Best Traders: https://teespring.com/stores/trading-rush

Watch More Videos:

MACD Trading Strategy tested 100 times : https://youtu.be/nmffSjdZbWQ

Trading Strategies Tested 100 Times : https://www.youtube.com/playlist?list=PLuBdu9GKAoP4shAZd6QnM5BJUy1-IcnyD

Trading Strategies : https://www.youtube.com/playlist?list=PLuBdu9GKAoP6MEtX7stfzTGx62M5r3F4Z

Trading Tips and Mistakes : https://www.youtube.com/playlist?list=PLuBdu9GKAoP6lPl2txSXE8AlkhiwgWU2O

Download Excel Sheet for Day Trading : https://youtu.be/fLKd7uKZOvA

Subscribe For More Videos.

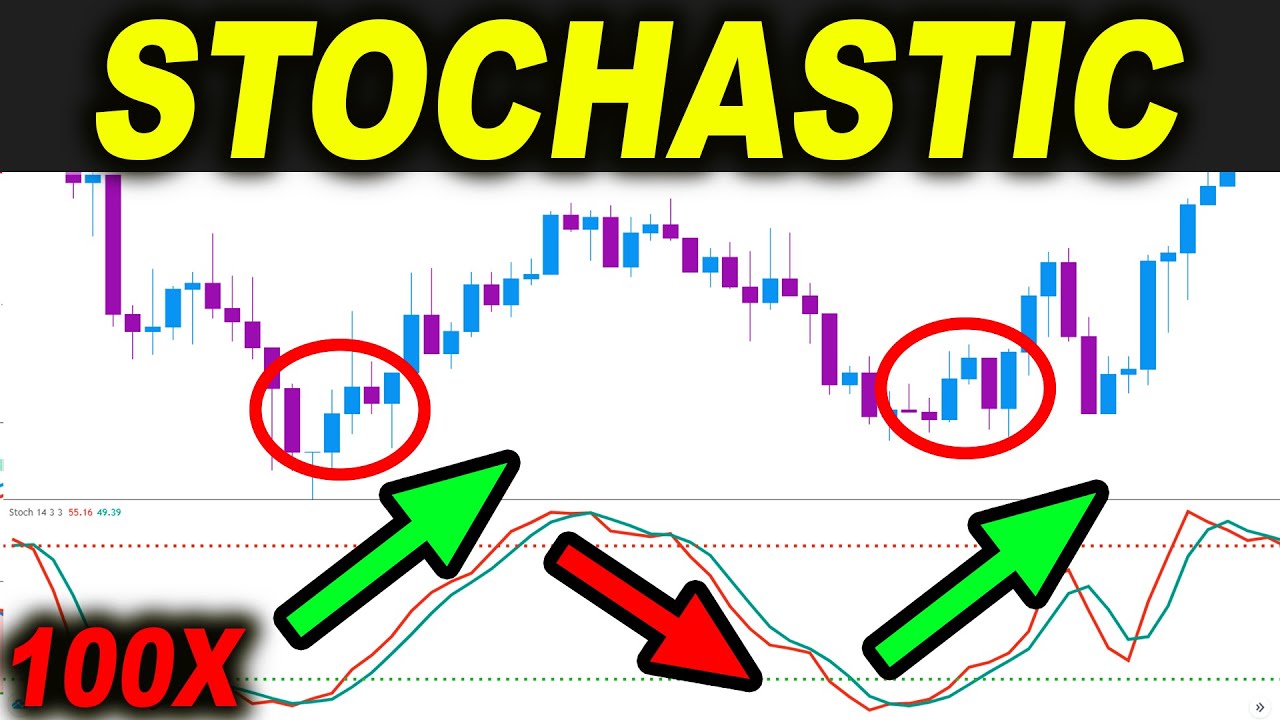

How good of an indicator stochastic really is on its own? Is stochastic Trading Strategy a profitable trading strategy? In the last video, we tested a trading strategy 100 times, where entry signals were generated by using the MACD and Stochastic indicator. The win rate was good enough to make a decent profit in the long run, but it was not as good as the win rate the MACD strategy achieved on its own. We have already tested both MACD and Stochastic RSI trading strategy 100 times to find their approximate win rates. MACD had an excellent win rate of more than 60 percent even with a reward to risk ratio of 1.5 to 1. Stochastic RSI on the other hand, only had an approximate win rate of 46 percent. Even though stochastic and stochastic RSI are not exactly the same thing, there is a good chance that the profitable win rate we got with MACD Stochastic strategy in the last video, is highly based on the MACD indicator alone. In other words, there is a chance that the stochastic indicator doesn’t have a very good win rate, just like the Stochastic RSI indicator. So to find out if the Stochastic Trading Strategy is a profitable trading strategy or not, and to find its approximate win rate, I tested it 100 times, just like other trading strategies we have tested on this channel. If you haven’t watched them, go watch now, and subscribe to the Trading Rush channel and ring that notification bell, after all you don’t want to put your money on an indicator that doesn’t even work.

Stochastic is a popular indicator that is used to find the over bought and over sold zones. It was developed in 1950s, and since 1950s markets have changed. Today, almost anyone can create a trading account, but back in those days, trading was less liquid because trading stocks was less accessible. Back then if the price of a stock was in a range, indicators like the stochastic would have worked excellently, as they are designed to find the overbought and oversold zones. Now, most people find reversal trading difficult, and trade with the trend instead to catch the big move. There are modified stochastic strategies but the entry signal almost always remains the same. Buy when the stochastic says oversold, and sell when the stochastic says over bought, nothing less nothing more.

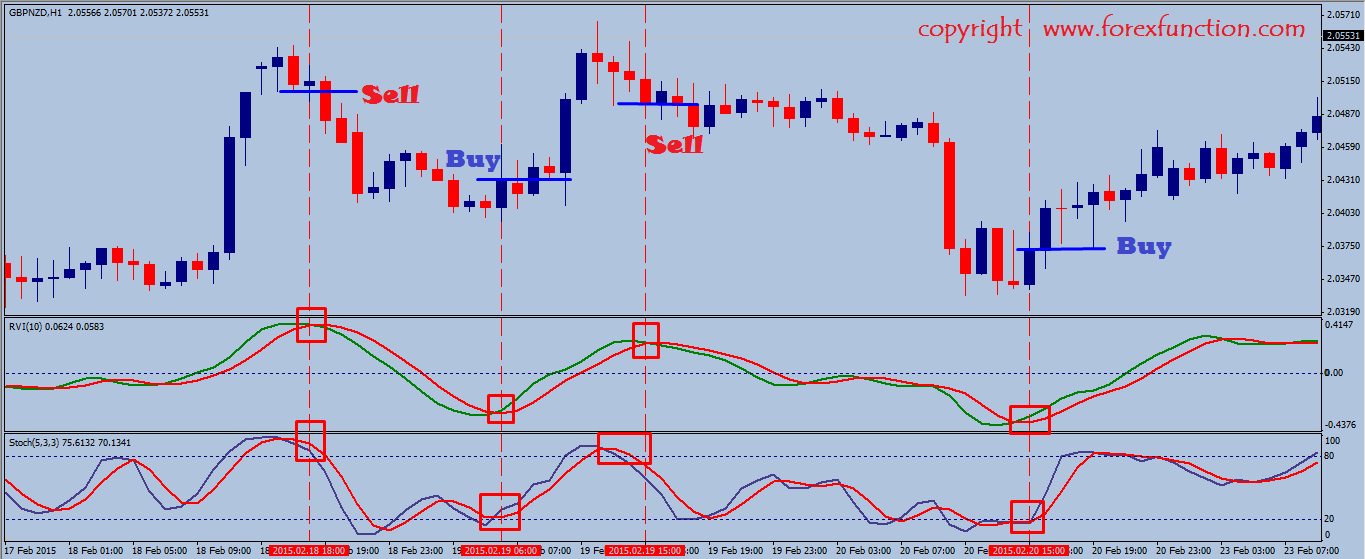

If you plot the Stochastic indicator on Trading View, you will noticed that it comes with K and D lines, and the Upper and Lower Bands. K is the stochastic value line, and D is a 3 period moving average of the K line. In simple words what the stochastic indicator really does is, compare the closing price of a stock or forex pair to a range of its prices. When the K line goes below the lower band of the stochastic indicator, the price is considered to be over sold and you should look to buy. Similarly, when the K line goes above the upper band of the Stochastic indicator, price is considered to be overbought and you should look to sell.

Usually, many traders will buy when the K line crosses above the D line below the lower band. Similarly, many traders will sell when the K line crosses below the D line above the upper band of the stochastic indicator. It is said that price reverses after stochastic gives a crossover above and below these bands. But price movement is not always that simple. Sometimes, price can give multiple crossovers and still continue to move further in one direction.

Subscribe for more Trading Videos!

Like and Share the Video to see More Stock Market Intraday Trading Strategy and Forex Day Trading Strategies

Stochastic Day Trading Strategy, I traded 100 TIMES with the Stochastic Trading Strategy but the win rate was… – Forex Day Trading.

My Preferred Trading Strategy

As we talked about in Part 1 of this series, by now you need to have an identified trends for the stocks you are watching.

You might like orders outside the assembling line variety to get a breakout as it takes place.

I traded 100 TIMES with the Stochastic Trading Strategy but the win rate was… – Forex Day Trading, Get top replays related to Stochastic Day Trading Strategy.

Forex-Ology Streamlined – 5 Unconventional Steps Of A Winning Forex Strategy

It is a software, which does research study and analysis and enables novices to jump in and make profits. Trading is constantly short-term while investing is long term. The charts show that the marketplace is going up again.

There is a difference between trading and investing. Trading is always short term while investing is long term. The time horizon in trading can be as short as a few minutes to a couple of days to a couple of weeks. Whereas in investing, the time horizon can be months to years. Numerous individuals day trade or swing trade stocks, currencies, futures, options, ETFs, commodities or other markets. In day trading, a trader opens a position and closes it in the very same day making a quick profit. In swing trading, a trader attempts to ride a trend in the market as long as it lasts. On the other hand, an investor is least pressed about the short term swings in the market. She or he has a long term time horizon like a couple of months to even a few years. This long time horizon matches their investment and monetary goals!

Take a look at support and resistance levels and pivot points. When it approaches them, in an ideal choppy market the assistance and resistance lines will be parallel and you can expect the market to turn. Check against another indicator such as the Stochastic Trading oscillator. If it shows that the rate is in the overbought or oversold range, you have another signal for the trade.

You require less discipline than trend following, since you do not need to hold positions for weeks on end which can be hard. Instead, your losses and profits come quickly and you get plenty of action.

Stochastic Trading The swing trader purchases into fear and offers into greed, so lets look at how the successful swing trader does this and take a look at a bullish pattern as an example.

To get the chances a lot more Stochastic Trading in your corner, when the breakout begins, price momentum ought to be on the rise and here you require to discover momentum oscillators.

If you want to generate income forget “purchasing low and selling high” – you will miss all the big moves. Instead aim to “buy high and offer greater” and for this you need to understand breakouts. Breakouts are simply breaks of important support or resistance levels on a forex chart. Many traders can’t buy these breaks.

The above method is exceptionally simple however all the very best strategies and systems are. If you swing trade extremes, you will get a couple of good signals a week and this will suffice, to make you huge gains in around 30 minutes a day. There is no better technique than currency swing trading if you desire a terrific method to make huge earnings.

They do this by getting the right answers to these million dollar concerns. Forex traders generate income by hypothesizing market movements. When costs struck target take your revenue in and wait for the next set up.

If you are looking unique and engaging reviews related to Stochastic Day Trading Strategy, and Swing Trading Ranges, Trading Success, Trend Detection in Forex Trading dont forget to subscribe our email subscription DB for free.