How To Combine Trading Indicators Like A Pro (Most Traders Get This Wrong)

Trending YouTube videos related to Forex Trading Strategy, Simple System, and Day Trading Stochastic Settings, How To Combine Trading Indicators Like A Pro (Most Traders Get This Wrong).

Discover how to combine trading indicators so you can better time your entries & exits — even if you are new to trading.

** FREE TRADING STRATEGY GUIDES **

The Ultimate Guide to Price Action Trading: https://www.tradingwithrayner.com/ultimate-guide-price-action-trading/

The Monster Guide to Candlestick Patterns: https://www.tradingwithrayner.com/candlestick-pdf-guide/

** PREMIUM TRAINING **

Pro Traders Edge: https://www.tradingwithrayner.com/pte/

Pullback Stock Trading System: https://pullbackstocktradingsystem.com/

Price Action Trading Secrets: https://priceactiontradingsecrets.com/

Day Trading Stochastic Settings, How To Combine Trading Indicators Like A Pro (Most Traders Get This Wrong).

My Favorite Trading Strategy

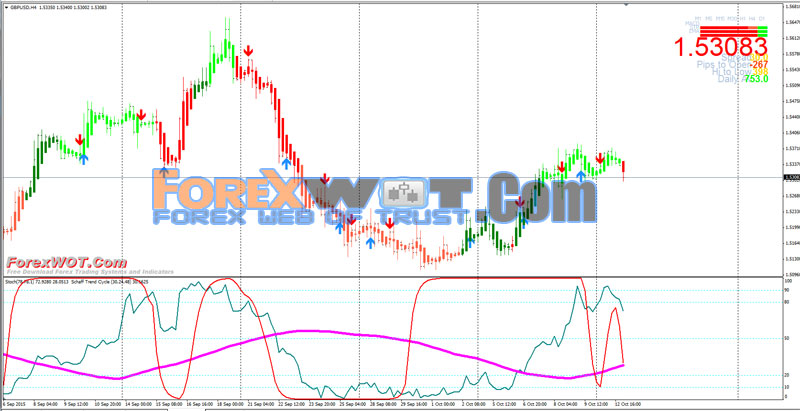

Thankfully you do not need to get down to the fundamentals of ‘why’ cycles exist in order to benefit from them. MACD-stands for Moving Average Convergence-Divergence. The 2 charts being the 5 minute and 60 minute EUR/USD.

How To Combine Trading Indicators Like A Pro (Most Traders Get This Wrong), Play most shared complete videos related to Day Trading Stochastic Settings.

Commodity Trading Systems – This Ones Totally Free And Makes Big Gains!

You’ll see that when a stock rate strikes the lower Bollinger Band, it generally tends to increase again. This can reveal a trader about where to get in and about where to get out. Usage another indicator to verify your conclusions.

You can so this by utilizing the stochastic momentum sign (we have actually composed regularly on this and it’s the finest sign to time any trade and if you are not farmiliar with it find out about it now) expect the stochastic lines to turn down and cross with bearish divergence and go short.

When the relocation is well underway, start to route your stop however hold it outside of everyday volatility (if you do not comprehend Stochastic Trading basic deviation of rate make it part of your forex education now), this indicates routing right back – when the move turns, you are going to return some revenue, that’s ok., if you captured simply 60% of every significant trending move you would be extremely abundant!! , if it’s a big relocation you will have plenty in the bank and you can’t predict where costs go so don’t try..

His primary approaches involve the Dedication of Traders Index, which checks out like a stochastic and the second is Major & Minor Signals, which are based on a fixed jump or decline in the previously mentioned index. His work and research study are very first class and parallel his character as a person. Nevertheless, for any methodology to work, it has to be something the trader is comfortable with.

An important beginning point is sufficient money to get through the preliminary phases. , if you have sufficient money you have the time to find out and enhance your Stochastic Trading until you are making money.. Just how much cash is needed depends upon the number of contracts you wish to trade. For example to trade 1 $100,000 dollar agreement you need between $1000 and $1500 as margin.

The hard part about forex Stochastic Trading is not so much getting a technique – however believing in it and trading it with discipline. , if you do not trade with discipline you will lose and you need to have confidence to obtain discipline..

While these breaks can sometimes be difficult to take, if the assistance or resistance is legitimate, the chances favour a big relocation – however not all breakouts are produced equal.

Rule primary: Cash management is of utmost importance if you remain in for a long period of TF. Adjust to the emerging trading trends. A synergy in between the systems workings and tools and your understanding of them will insure revenues for you. Using an automated system will assist you step up your portfolio or begin developing a successful one. Thoroughly pick the automatic trading system that covers your work action by step and not get duped by a system shown to make the owner cash from selling an inferior item.

It is best to keep updates to the newest trends to keep up the profits. You do require to take the time to find out about technical analysis. The two charts being the 5 minute and 60 minute EUR/USD.

If you are looking rare and entertaining comparisons about Day Trading Stochastic Settings, and Online Forex, Online Forex Training dont forget to list your email address our a valuable complementary news alert service totally free.