How Do You Know When Is the Best Time to Exit Your Trades?

Interesting YouTube videos top searched Currency Trading Education, Momentum Trading, How to Trade Support and Resistance, and What’s Swing Trading, How Do You Know When Is the Best Time to Exit Your Trades?.

For free trading education, go to http://www.tradingwithrayner.com

I’ve got a question by Jay who asked…

“How do I know when is the best time to exit a trade?”

Now here’s the thing:

There’s no one size fits all when it comes to exiting your trades.

Rather, it’s a question of what you’re trying to accomplish from trading.

Do you want to generate a consistent income?

Do you want to grow your wealth over time?

Do you want to beat “buy and hold” approach?

And etc.

So in today’s episode, you’ll learn:

• How to exit your trades and improve your trading consistency

• What’s the difference between swing and position trading — and why it matters

• How to ride massive trends in the markets using this dead-simple technique

• And more…

Now…

If you’ve been struggling with your trade exits for the longest time, then go watch today’s episode.

This will make a BIG difference because you’ll finally know how to exit your trades based on objectivity —not emotions.

Do you want to learn more?

Then go read theses posts because it will teach you more techniques to exit your trades.

http://www.tradingwithrayner.com/set-stoploss/

Do you have a question for me?

Just let me know in the comments section below and I’ll do my best to help.

I look forward to hearing from you!

For free trading education, go to http://www.tradingwithrayner.com

Thanks for watching!

FOLLOW ME AT:

Facebook: https://www.facebook.com/groups/forextradingwithrayner

Twitter: http://www.twitter.com/rayner_teo

My YouTube channel: https://www.youtube.com/tradingwithrayner

What’s Swing Trading, How Do You Know When Is the Best Time to Exit Your Trades?.

Cycles Can Leapfrog Your Trading Success

Trading is always short-term while investing is long term. Likewise trade on the period where major markets are open. The concept is “Do not anticipate the marketplace”.

The charts show that the marketplace is moving up once again.

How Do You Know When Is the Best Time to Exit Your Trades?, Explore most searched high definition online streaming videos about What’s Swing Trading.

Who Wishes To Be A Forex Trading Millionaire?

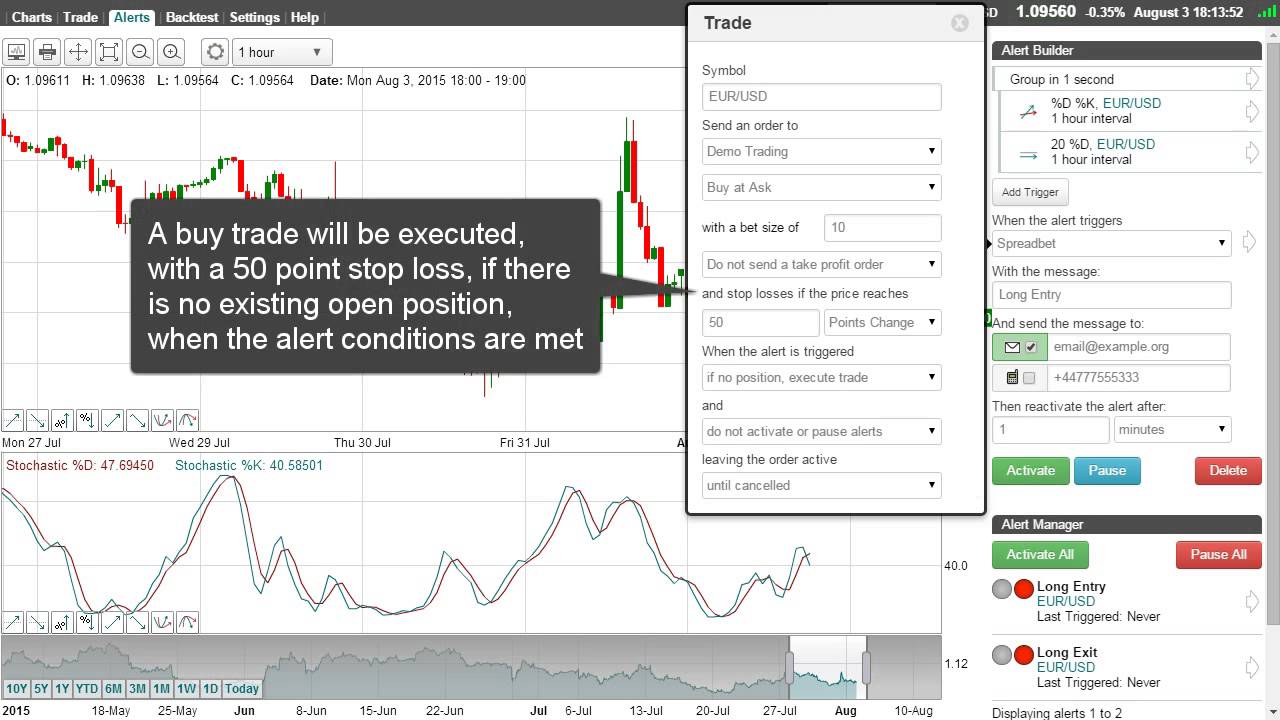

This is Bill William’s Accelerator Oscillator (AC) and the Stochastic Oscillator. Sure enough, you can apply these ideas while using a demonstration account. It operates even in volatile market conditions.

You can so this by utilizing the stochastic momentum indicator (we have actually composed frequently on this and it’s the best indication to time any trade and if you are not farmiliar with it find out about it now) expect the stochastic lines to turn down and cross with bearish divergence and go short.

Look at assistance and resistance levels and pivot points. In a perfect choppy market the assistance and resistance lines will be parallel and you can expect the marketplace to turn when it approaches them. Check versus another indication such as the Stochastic Trading oscillator. You have another signal for the trade if it reveals that the rate is in the overbought or oversold range.

The second sign is the pivot point analysis. This analysis technique depends upon recognizing various levels on the graph. There are three levels that act as resistance levels and other 3 that serve as support levels. The resistance level is a level the price can not exceed it for a big duration. The assistance level is a level the price can not go below it for a large duration.

Now I’m not going to get into the information as to why cycles exist and how they are related to price action. There is much composed on this to fill all your peaceful nights in checking out for years. If you spend simply a little bit of time enjoying a MACD or Stochastic Trading sign on a cost chart, you must currently be convinced that cycles are at work behind the scenes. Just enjoy as they swing up and down in between extremes (overbought and oversold zones) to get a ‘feel’ for the cycle ups and downs of cost action.

Technical experts try to identify a trend, and ride that pattern till the trend has actually verified a turnaround. If a great business’s stock remains in a sag according to its chart, a trader or financier utilizing Technical Analysis will not Stochastic Trading buy the stock up until its pattern has actually reversed and it has actually been validated according to other crucial technical signs.

While these breaks can sometimes be hard to take, if the assistance or resistance is valid, the odds favour a big move – but not all breakouts are created equivalent.

Wait on the indications to indicate the bears are taking control, through the stochastic and RSI and remember the bulls just take charge above January’s highs.

Doing this suggests you know what your optimum loss on any trade will be instead of losing everything. Trading is constantly short term while investing is long term. The 2 charts being the 5 minute and 60 minute EUR/USD.

If you are finding instant exciting reviews about What’s Swing Trading, and Trading 4x Online, E Mini Trading you are requested to signup for subscribers database for free.