Golden Cross Trading Strategy – Can it really give Golden Win Rate after backtesting 100 TIMES?

Trending complete video about Stock Trading Strategy, Automatic Forex, Currency Trading Training, Trading Currencies, and Stochastic Crossover Alert, Golden Cross Trading Strategy – Can it really give Golden Win Rate after backtesting 100 TIMES?.

Is the famous Golden Cross Trading Strategy profitable in Forex and Stock Market Trading? Will the crossover strategies make money in the long and after backtesting? Why don’t we find out…

Official Trading Rush Website: https://tradingrush.net

Download Official Trading Rush APP (Thanks): https://bit.ly/tradingrushapp

Support the Channel on Patreon (Thanks): https://www.patreon.com/tradingrush

Trading Merch for Best Traders: https://teespring.com/stores/trading-rush

Watch More Videos:

MACD Trading Strategy tested 100 times : https://youtu.be/nmffSjdZbWQ

Trading Strategies Tested 100 Times : https://www.youtube.com/playlist?list=PLuBdu9GKAoP4shAZd6QnM5BJUy1-IcnyD

Trading Strategies : https://www.youtube.com/playlist?list=PLuBdu9GKAoP6MEtX7stfzTGx62M5r3F4Z

Trading Tips and Mistakes : https://www.youtube.com/playlist?list=PLuBdu9GKAoP6lPl2txSXE8AlkhiwgWU2O

Download Excel Sheet for Day Trading : https://youtu.be/fLKd7uKZOvA

Subscribe For More Videos.

Does the famous Golden Cross Trading Strategy work better than the other strategies we have tested so far? You might have noticed that some News Channels like to talk a lot about this Strategy when a stock gives a golden crossover. In this video, I have tested the Golden Cross one hundred times, to see if the Golden Cross Trading Strategy actually works, and if not, what are the disadvantages you will have while using this strategy.

This is the 19th strategy we have tested 100 times in the strategies tested 100 times series. If you are watching this channel for the first time, check out other videos on the channel where we tested different strategies to see if they work or not. Also subscribe to the Trading Rush Channel, because it’s free, and you don’t want to risk your own money on Trading Setups that does not even work.

The idea of the Golden Cross is really simple. Just smooth out the price using two moving averages and buy at the crossover of the moving averages. In a Golden Cross Strategy, a 200 period moving average and a 50 period moving average is used. Here, the 50 moving average is the fast moving average, and 200 is the slow moving average. Usually, these moving averages are simple moving averages, and I have used the same while backtesting it 100 times.

The Golden Cross Trading Strategy goes something like this. When the 50 period moving average, crosses above the 200 period moving average, it’s a long entry signal. Similarly, when the 50 period moving average crosses below the 200 period moving average, it’s a short entry signal.

Now the Golden Cross strategy is more of a buy and hold kind of strategy. It is mostly used on the higher timeframes to hold a stock or forex pair for a long period of time.

Unlike other indicators we have seen on the Trading Rush channel, the Golden Cross Strategy doesn’t tell you where to put the stoploss. But most people like to set the stoploss just below the 200 period moving average. Furthermore, many traders like to trail the stoploss with the 200 period SMA to catch the big move. But as you already know, market is in a range most of the time, so many traders rarely book a very big profit.

Obviously, you can’t take every buy signal given by the golden Cross Trading Strategy, because it will give a lot of false entry signals in a range market. To filter those false signals however, you can modify the strategy and only buy, when the candle is completely above the 200 period moving average when the crossover happens. Similarly, only sell, when the candle is completely below the 200 period moving average when the crossover happens.

So here’s the complete modified Golden Cross Strategy. If the 50 period SMA crosses above the 200 SMA, and if the cross over candle is above the 200 SMA, it’s a buy signal. Stoploss goes below the 200 SMA line.

Similarly, if the 50 SMA crosses below the 200 SMA, and if the crossover candle is below the 200 SMA, it’s a sell signal. The stoploss goes above the 200 SMA line. If you want to trail the stoploss, you can simply trail it above the 200 SMA as it goes down. Some traders also like to exit the position at the next crossover. For example, if you buy when the 50 SMA crosses above the 200 SMA, your exit signal will be when the 50 SMA crosses below the 200 SMA. Similar thing applies to the short setup, just opposite.

Since we tested other strategies 100 times with a fixed reward to risk ratio, and to compare this data with the data we got from other strategies, I have tested the Golden Cross Strategy with fixed reward to risk ratio as well.

So after testing it one hundred times, here’s what happened.

Like the video if you liked it.

Subscribe for more Trading Videos!

Like and Share the Video to see More Stock Market Intraday Trading Strategy and Forex Day Trading Strategies

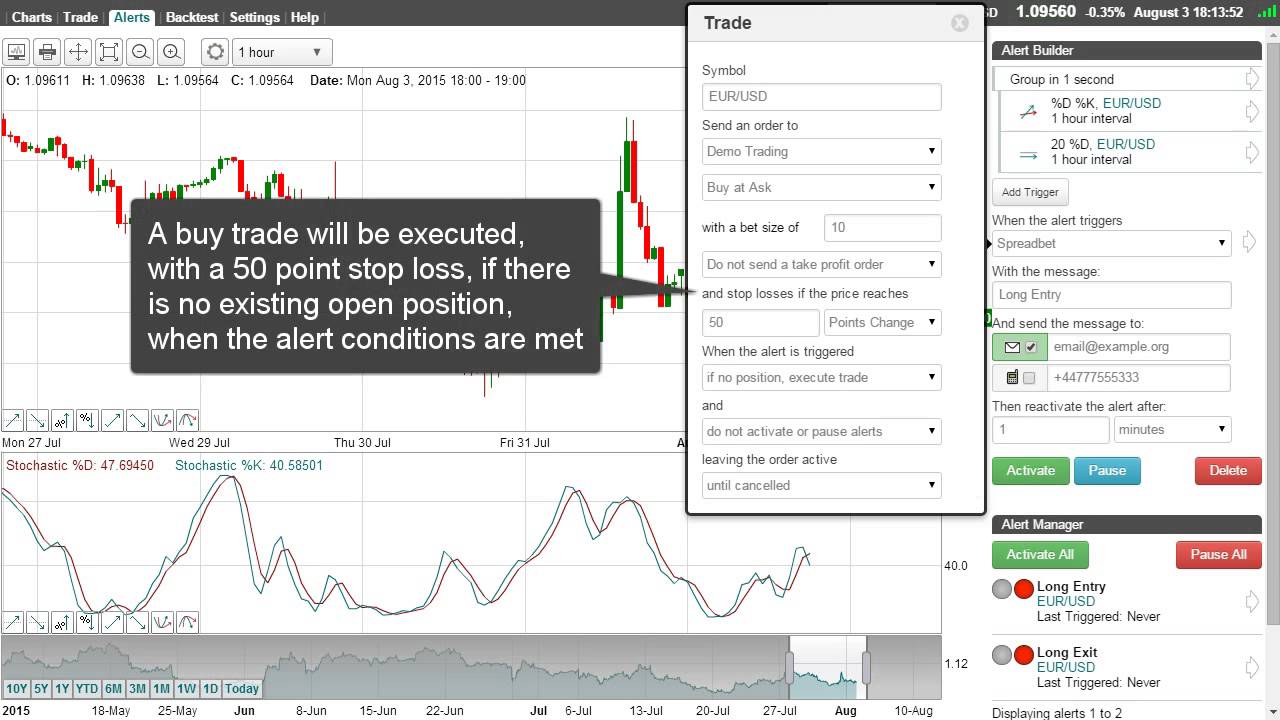

Stochastic Crossover Alert, Golden Cross Trading Strategy – Can it really give Golden Win Rate after backtesting 100 TIMES?.

Best Forex Trading Strategy

A Forex trading system that is effective is likewise easy. Do not expect t be a millionaire over night, because that’s just not reasonable. The next action is to view the momentum of the price shifts.

Golden Cross Trading Strategy – Can it really give Golden Win Rate after backtesting 100 TIMES?, Get popular explained videos related to Stochastic Crossover Alert.

How To End Up Being A Successful Forex Trader

Utilizing the SMA line in the middle of the Bollinger Bands gives us an even better photo. This is a basic Forex trading strategy which is rational, east to discover and is a classic way to generate income.

Here we are going to look at two trading opportunities last week we banked a terrific earnings in the British Pound. Today we are going to look at the United States Dollar V British Pound and Japanese Yen.

You’ll observe that when a stock cost strikes the lower Bollinger Band, it generally tends to rise again. Using the SMA line in the middle of the Bollinger Bands gives Stochastic Trading us an even better picture. Remember, whatever stock symbol you pick from on the NASDAQ 100, you ought to look for any news on it prior to you trade it as any unfavorable news could impact the stock no matter what the Nasdaq efficiency resembles.

A good trader not only thinks about the heights of profits but also contemplates the threat involved. The trader ought to be prepared to acknowledge just how much they are ready to lose. The upper and lower limitation ought to be clear in the trade. The trader must decide how much breathing area he wants to provide to the trade and at the exact same time not risk excessive likewise.

So, here are some useful tips to successfully trade foreign currency exchange in an unpredictable market. Sure enough, you can use these tips while utilizing a demonstration account. After all, using a demonstration account will permit you to practice forex Stochastic Trading and make you gotten ready for the real thing.

Throughout my profession in the forex market, mentor thousands of traders how to benefit, I’ve constantly recommended to start with a pattern following method to Stochastic Trading currencies. I do the exact same thing with my existing customers. Naturally, I’m going to share a pattern following method with you.

The Stochastic Indicator – this has actually been around considering that the 1950’s. It is a momentum sign which determines over purchased (readings above 80) and over sold (readings below 20), it compares today’s closing price of a stocks price range over a recent time period.

I call swing trading “hit and run trading” which’s what your doing – getting high chances established, striking them and then banking revenues, before the position can turn back on you. If you discover and practice the above strategy for a week approximately, you will quickly be confident enough to applly it for long term currency trading success.

Two great momentum indications are – the stochastic and the Relative Strength Index – look them up and utilize them. It is very crucial that the forex trading robotic you choose to purchase has these three things.

If you are searching exclusive entertaining videos related to Stochastic Crossover Alert, and Daily Charts Forex Tradin, Currency Swing Trading System, Forex Tips for Beginners – How to Make Money When There Is No Trend you are requested to list your email address in a valuable complementary news alert service for free.