Forex – How To Trade Divergence On The RSI – Part 1

Popular un-edited videos top searched Forex Trend Following, Forex Tip, and How To Trade Divergence, Forex – How To Trade Divergence On The RSI – Part 1.

Forex – How To Trade Divergence On The RSI – Part 1

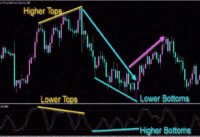

Forex Trading has many ways to conform profitable trades on the charts. Using Divergence is one of the best ways.

In this video, TGP Leader, Joe Giunta is going to give you a sneak peak inside a Trade And Get Paid Team Training Class. You will see how he uses Divergence on the RSI (Relative Strength Index) to execute precise trades that make great profits.

RSI Divergence is a commonly used Forex Strategy that helps Forex Traders all over compound their Trading Accounts.

Learn to use this powerful Forex Strategy to take your Trading to the next level.

MENTORSHIP BY ME: TradeAndGetPaid.com – click Mentorship Tab

EMAIL: jgiunta313@gmail.com

WEBSITE: tradeandgetpaid.com

MY BROKER: https://www.tradersway.com/?ib=1228636

FACEBOOK: https://www.facebook.com/joe.giunta.54

INSTAGRAM: joe.giunta

Forex – How To Trade Divergence On The RSI – Part 1

How To Trade Divergence, Forex – How To Trade Divergence On The RSI – Part 1.

Trading Opportunity – The Euro A Live Example A Trade For Huge Profits

The very best method to time your entry is to search for the break on the cost level. The only thumb-down in this organization is that it is highly dangerous. Many traders like to wait for the pullback but they never ever get in.

Forex – How To Trade Divergence On The RSI – Part 1, Explore popular replays related to How To Trade Divergence.

Get The Best Currency Trading Education By Studying Price Action Patterns

This analysis technique depends on identifying various levels on the graph. This indicates, among other things, only investing what you can manage to lose. Never have a substantial stop loss unless you are doing swing trading.

If you want to win at forex trading and take pleasure in currency trading success perhaps among the easiest methods to accomplish it is to trade high chances breakouts. Here we will look at how you can do this and make huge earnings.

Well, in this brief post I can’t enter into the tactical level – I can’t Stochastic Trading discuss my entry and exit sets off, and trade management methods.Since it’s not simply an easy indication based entry or exit, it would take a whole book. It’s based upon cost action – on an understanding of the nature of motion of cost. That takes a very long time to develop, and it’s something I’ll cover in my site in a lot more detail.

You require less discipline than pattern following, since you don’t have to hold positions for weeks on end which can be hard. Instead, your revenues and losses come quickly and you get plenty of action.

You must not let your orders be open for longer period. Observe the market condition by remaining away from any interruption. The dealings in unpredictable Stochastic Trading market are always short lived. You should get out moment your target is achieved or your stop-loss order is triggered.

A few of the stock signals traders take a look at are: volume, moving averages, MACD, and the Stochastic Trading. They likewise should search for floorings and ceilings in a stock chart. This can show a trader about where to get in and about where to get out. I state “about” because it is pretty tough to think an “specific” bottom or an “exact” top. That is why locking in revenues is so so essential. If you do not lock in earnings you are truly running the threat of making a worthless trade. Some traders become truly greedy and it only harms them.

If you wish to generate income forget “buying low and selling high” – you will miss all the big moves. Rather seek to “purchase high and offer greater” and for this you require to understand breakouts. Breakouts are simply breaks of crucial support or resistance levels on a forex chart. Many traders can’t purchase these breaks.

This forex trading technique shows how focusing on a bearish market can benefit a currency that is overbought. Whether this method is wrong or ideal, it presents a great risk-reward trade off and is well founded on its short position in forex trading.

In summary – they are leading indicators, to evaluate the strength and momentum of rate. Currency trading is a way of generating income but it also depends on the luck element. They are placed side by side (tiled vertically).

If you are finding rare and engaging reviews about How To Trade Divergence, and Trend Detection in Forex Trading, Forex Ambush Review you are requested to subscribe in a valuable complementary news alert service totally free.