Divergence Trading Strategy – Trend Trading Exit Indicator? – Forex Day Trading

Trending updated videos relevant with Forex Robots, Forex Tips for Beginners – How to Make Money When There Is No Trend, and Hidden Divergence Stochastic, Divergence Trading Strategy – Trend Trading Exit Indicator? – Forex Day Trading.

Can Divergence Trading Strategy be used to find the reversals in the stock market and forex trends?

Official Trading Rush Website: https://tradingrush.net

Download Official Trading Rush APP (Thanks): https://bit.ly/tradingrushapp

Support the Channel on Patreon (Thanks): https://www.patreon.com/tradingrush

Trading Merch for Best Traders: https://teespring.com/stores/trading-rush

Watch More Videos:

MACD Trading Strategy tested 100 times : https://youtu.be/nmffSjdZbWQ

Trading Strategies Tested 100 Times : https://www.youtube.com/playlist?list=PLuBdu9GKAoP4shAZd6QnM5BJUy1-IcnyD

Trading Strategies : https://www.youtube.com/playlist?list=PLuBdu9GKAoP6MEtX7stfzTGx62M5r3F4Z

Trading Tips and Mistakes : https://www.youtube.com/playlist?list=PLuBdu9GKAoP6lPl2txSXE8AlkhiwgWU2O

Download Excel Sheet for Day Trading : https://youtu.be/fLKd7uKZOvA

Subscribe For More Videos.

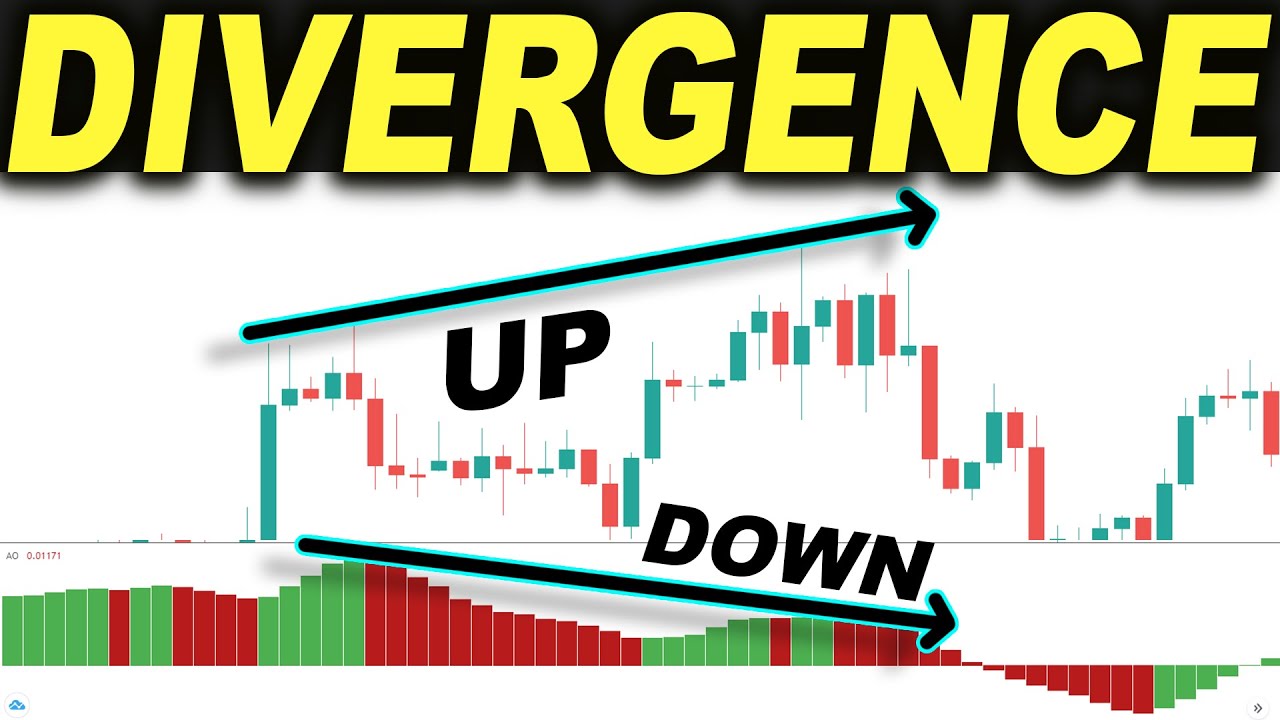

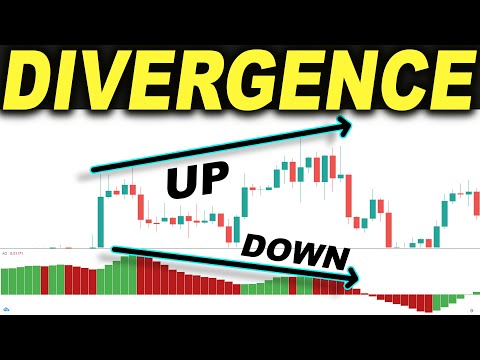

What is Divergence? Can it make you better at trading? If you have been trading for a while, you have probably heard the term divergence. It is not something you will get to see frequently on a trading chart. But if it does appear in front of you, you should be very careful, because it can indicate a possible change in the direction of the current trend. To understand how the divergence can help us in trading, we will first have to understand what divergence is.

The disagreement between an indicator and the price movement is called divergence. In simple words, Divergence occurs, when the price is saying one thing, but the indicator is indicating something else.

Let me explain. Usually, in an uptrend, you will see oscillators and the price indicating the same direction of the trend. You can tell this by connecting the higher highs of the price and the higher highs of the oscillators. On this chart both the indicator and the price, are making higher highs. Or in other words, the oscillator looks very similar to the price movement of the chart.

But sometimes, you will see something like this. Here, if you try to connect the higher highs of the price and the indicator, you will notice that you can successfully connect the higher highs of the price, but the oscillator does not have a higher high. It has made a lower high. It has made a move that is not similar to the movement of the price.

This is what a divergence looks like. Now They are two types of divergence. When price makes higher highs, but an oscillator makes a lower high, it is called a negative divergence.

Similarly, In a down trend, when price makes lower lows, but the oscillator makes higher lows, it is called a positive divergence.

But how can this information be useful? If we see a divergence while trading, what should we do?

Well, here are few things we can do. When divergence occur, there is a chance that the trend can reverse, or go sideways.

In an uptrend, if you see a negative divergence, there is a high chance that the uptrend will turn in a sideways trend, or go in the opposite direction. If you have a position open, you should maybe consider closing it, or setting a stop loss, because there is a chance that the price will stop moving further in your favor. If you were thinking about taking a long position, it is good idea to wait a bit, as price can go lower.

In a downtrend, If you see a positive divergence, there is a high chance that downtrend will end soon, and it will be a start of a new trend. If you are already in a short trade, make sure you watch it closely, and adjust your stop loss carefully, as the price can go in the opposite direction. And if you were thinking about taking any short trades, maybe consider watching the price movement from the sideline, and wait for a better entry condition, where there is no divergence.

Now, a lot of people, will tell you to take trades in the opposite direction of the trend when the divergence occur. I don’t recommend it, because there is a big problem with taking trades like that.

You see, when you spot a divergence, price won’t immediately go in the opposite direction. It can continue to move in the same direction, before finally changing the trend direction. And when it will change the direction, there is no guarantee that it will go in the opposite direction. The price can simply go sideways for a while, and can continue to move in the same direction as it was before.

So, what’s the use of the divergence then?

Well, divergence is not that good when it comes to trade entries, as the exact time of the direction change is difficult to predict. But what you can do when divergence appear, is to avoid taking new trades, and adjust the stop loss of your open trades.

Thanks for Watching!

Like and Share the Video to see More Stock Market Intraday Trading Strategy and Forex Day Trading Strategies

Hidden Divergence Stochastic, Divergence Trading Strategy – Trend Trading Exit Indicator? – Forex Day Trading.

Forex Online Trading – Generating Income In A Week Or Two

They are put side by side (tiled vertically). The best indication that the cost momentum will alter is a stochastic indicator. Yet once again, inspect your examinations versus a minimum of 1 extra sign.

Divergence Trading Strategy – Trend Trading Exit Indicator? – Forex Day Trading, Explore new updated videos about Hidden Divergence Stochastic.

Easy Systems For Trading Forex

This is Costs William’s Accelerator Oscillator (AC) and the Stochastic Oscillator. Sure enough, you can apply these suggestions while utilizing a demonstration account. It works even in volatile market conditions.

Lots of traders aim to purchase a currency trading system and do not recognize how easy it is to develop their own. Here we desire to look at building a sample trading system for huge revenues.

Take a look at assistance and resistance levels and pivot points. In an ideal choppy market the assistance and resistance lines will be parallel and you can expect the marketplace to turn when it approaches them. Examine against another indicator such as the Stochastic Trading oscillator. You have another signal for the trade if it reveals that the cost is in the overbought or oversold range.

Trade the odds and this indicates rate momentum should support your view and validate the trade prior to you enter. 2 terrific momentum signs are – the stochastic and the Relative Strength Index – look them up and use them.

Discipline is the most important part of Stochastic Trading. A trader needs to develop rules for their own selves and ADHERE TO them. This is the necessary secret to an effective system and disciplining yourself to stay with the system is the first action towards an effective trading.

You can invest around 30 minutes a day, trading in this manner with your forex Stochastic Trading method and after that do and go something else. You only need to check the costs when or twice a day and that’s it.

If you wish to make money forget “purchasing low and selling high” – you will miss out on all the huge moves. Instead aim to “buy high and sell greater” and for this you need to understand breakouts. Breakouts are simply breaks of important support or resistance levels on a forex chart. Most traders can’t buy these breaks.

Position the trade at a stop loss of roughly 35 pips and you should apply any of these two methods for the purpose of making earnings. The first is use an excellent threat to a gainful ratio of 1:2 while the next is to utilize assistance and resistance.

And secondly, by utilizing it to assist our trading preferably by means of. sound stock exchange trading system. It is among the easiest tools used in TA. The two lines consist of a slow line and a fast line.

If you are looking more entertaining videos related to Hidden Divergence Stochastic, and Forex Effectively, Range Trading you should signup in email list for free.