Best VWAP Indicator Trading Strategy EVER!!! How to use VWAP Indicator Intraday Trading Strategy

Latest complete video about Trading Forex Online, Forex Strategy, and Stochastic Settings For Day Trading, Best VWAP Indicator Trading Strategy EVER!!! How to use VWAP Indicator Intraday Trading Strategy.

Best way to use VWAP Indicator Trading Strategy!!! A tutorial on How to use VWAP Indicator Intraday Trading Strategy / Day Trading Strategies that will work to make money online in Stock Market

Last video: 5 BIG Moving Average Trading Strategy MISTAKES (MUST KNOW) : https://youtu.be/0hrelQHu_2s

first video: I risked MACD Trading Strategy 100 TIMES Here’s What Happened… : https://youtu.be/nmffSjdZbWQ

SUBSCRIBE for more Videos!

so, in this video, we will show you, our best trading indicator, that is key to our trading success! make sure to hit that subscribe button, and ring that notification bell, to see our future videos.

This indicator, is used by institutional brokers. These are the people with big money, who move the market. If the institutional brokers are using it, it is a good idea, to keep it on your trading chart, to make profit.

So first, what is V WAP, and why people with big money, use it. lets look at an example.

so, here, we have an intraday chart. and, here’s, the first 3 minute candle, of the day.

the blue line, is the V WAP indicator.

to understand why, V WAP works. imagine this.

lets’ say, a broker, wants to buy, some million shares of a stock,

as requested by his client.

the broker won’t chase the market, and buy shares at the top.

his goal, is to buy the shares, at a fair price, so his client will be happy.

remember, V WAP stands for Volume Weighted Average Price! therefore, the client will be most likely happy to buy shares at average price, instead buying at the top.

since, professional brokers, are trading at the V WAP line, it is a good idea, to make use of this indicator in our strategy.

okay! so now we understand how it works. lets see how to use it, to make money as a retail trader.

there are few key things to note, about the V WAP indicator.

number 1. V WAP line, will remain same, on all intra day time frames.

if you switch the chart from, 5 minutes, to 15 minutes, the V WAP line, will stay at the same price. This is a good thing. because everyone who is day trading, will see the V WAP line at the same price, unlike a moving average. this will lead to increase in buying and selling, near the V WAP line. increased volume, will increase the chance of getting your order filled, at your defined price.

number 2. V WAP, only works on intra day time frame, and doesn’t work on daily.

Number 3. If the stock is trading above the V WAP line, it is considered as an uptrend. Similarly, if the Stock is trading below the V WAP, it is considered as down trend.

Number 4. V WAP line can act as a support, or resistance, on a trading chart.

here’s a real life example.

on this stock, look at how it opens with a gap up, then goes up, falls towards the V WAP, and bounces back.

we can see that, V WAP is acting as a support.

and, since market is above the V WAP, we can say, the market is in an up trend.

you can see, how beautifully, price bounced, at the V WAP line, before finally breaking the high of the day.

Obviously, you shouldn’t take trades, everytime price reaches the V WAP line. You should wait for the right entry signal, before risking your money.

In this case, we could have bought some shares, at these buy signals, that are near the V WAP line.

lets see a downtrend example. after that, we will see some complex examples, to make sure, V WAP works as intended, and we understand it properly. after all, we don’t want to risk our money, on something that doesn’t even work!

this stock, opens with a gap up, but was not able to keep the upward momentum.

it finally broke through the V WAP line, starting a good down trend.

then, gave a pullback, but couldn’t cross the V WAP.

Since this is a down trend, V WAP line is acting as a Resistance.

You can see, how the price rallied it’s way down after touching the V WAP.

you could have sold some shares, with some good entry signals.

You can set the stop loss, above the V WAP line, as price can retest the line, few more times, before finally going in your direction. this chart is little bit more complex than the previous two. But lets break it down.

first, the stock, opens with a gap up,

then hovered on the V WAP line. also, if you haven’t noticed it yet, V WAP, is an Intraday Indicator.

therefore, the V WAP line, will start from the body, of the first candle of the day. Okay, let’s focus on the chart. the stock, opens with a gap up, then hovered on the V WAP line. after an upward push, it found support at the V WAP.

once it broke below the line, the V WAP was acting as a resistance, then, price rallied down, starting a clear down trend. gave a pullback, and then found resistance at the V WAP line for the second time. you can see, the V WAP worked perfectly on this day.

Like the video if you liked it. and subscribe for more trading videos. Don’t forget to ring that notification bell as well. see ya!

Like and Share the Video to see More Stock Market Intraday Trading Strategy and Forex Day Trading Strategies

Stochastic Settings For Day Trading, Best VWAP Indicator Trading Strategy EVER!!! How to use VWAP Indicator Intraday Trading Strategy.

A Road Map To Success – A Profitable Trading Plan

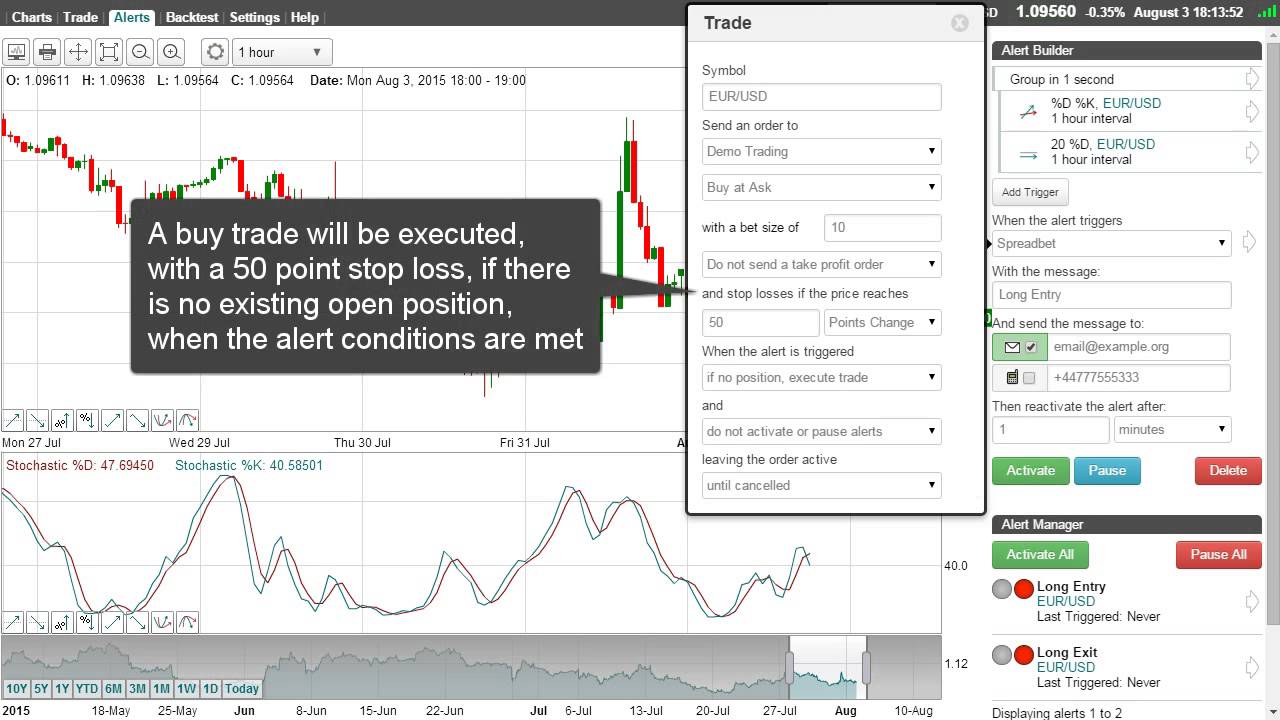

This chart has 2 lines, the crossing of the two lines is a signal of a new pattern. You then need to see if the odds are on your side with the breakout so you examine rate momentum. So how do we respect the trend when day trading?

Best VWAP Indicator Trading Strategy EVER!!! How to use VWAP Indicator Intraday Trading Strategy, Explore popular reviews relevant with Stochastic Settings For Day Trading.

Currency Trading System – A Simple 1 2 3 Action Approach For Huge Gains

Many people have actually thought about purchasing a forex robot too assist them start trading forex. There are lots of types of charts that a person can utilize in TA. I will cover the short-term trading to begin with.

Forex swing trading is easy to comprehend, just requires an easy system, its likewise exciting and enjoyable to do. Here we will take a look at how you can end up being a successful swing trader from home and accumulate huge revenues in around thirty minutes a day.

These are the long term financial investments that you do not hurry Stochastic Trading into. This is where you take your time examining a great spot with resistance and assistance to make a huge slide in earnings.

Evaluating is a procedure and it is a good idea to check different tools during the years. The objective in testing the tools is to discover the ideal trading tool the trader feels comfortable with in different market circumstance however likewise to improve trading abilities and revenue margin.

, if you look at the weekly chart you can clearly Stochastic Trading see resistance to the dollar at 114.. We also have a yen trade that is up with lower highs from the July in a strong trend the mid Bollinger band will serve as resistance or assistance, in this case it acts as resistance and is just above the 114.00 level. Momentum is up at present – will the resistance hold its time to take a look at the everyday chart.

Swing Stochastic Trading systems feature different indicators but the aim is constantly the very same, to benefit from short-term rate spikes, sell or buy them and look for a return to a moving average.

Check some momentum indications, to see how overbought momentum is and a terrific one is the stochastic. We do not have time to discuss it completely detail here so look it up, its a visual indication and will only take thirty minutes or so to find out. Try to find it to end up being overbought and then. just expect the stochastic lines to cross and turn down and get brief.

Position the trade at a stop loss of approximately 35 pips and you ought to use any of these two strategies for the function of making profit. The first is apply a good danger to a gainful ratio of 1:2 while the next is to use support and resistance.

Forex trading can be learned by anybody and basic forex trading systems are best. It is this if one ought to know anything about the stock market. It is ruled by emotions. When analysing a stock’s chart, moving averages are important.

If you are looking most engaging reviews related to Stochastic Settings For Day Trading, and Forex Options Trading, Forex Trading Tips, Free Forex Buy and Sell Signals, Trade Plan please join for subscribers database now.