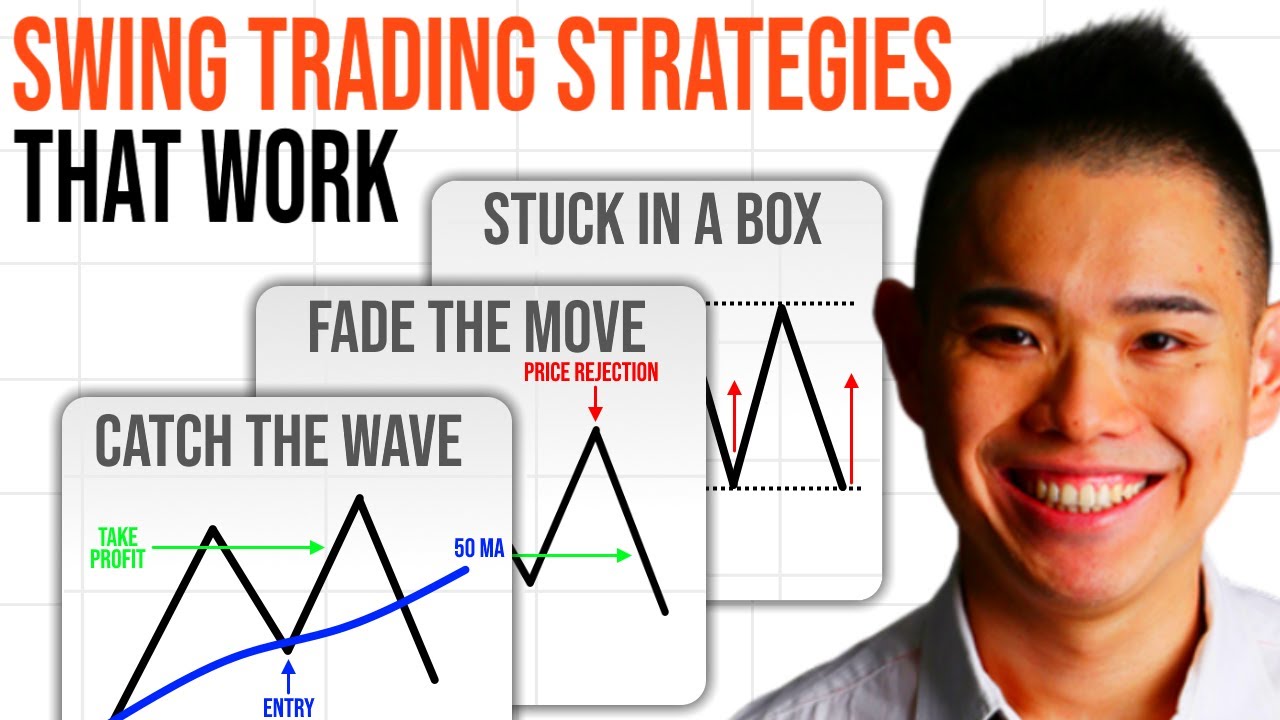

3 Proven Swing Trading Strategies (That Work)

New videos relevant with Successful Swing Trading, Forex Robots, and What’s Swing Trading, 3 Proven Swing Trading Strategies (That Work).

Discover 3 swing trading strategies that work so you can profit in bull & bear markets.

** FREE TRADING STRATEGY GUIDES **

The Ultimate Guide to Price Action Trading: https://www.tradingwithrayner.com/ultimate-guide-price-action-trading/

The Monster Guide to Candlestick Patterns: https://www.tradingwithrayner.com/candlestick-pdf-guide/

** PREMIUM TRAINING **

Pro Traders Edge: https://www.tradingwithrayner.com/pte/

Pullback Stock Trading System: https://pullbackstocktradingsystem.com/

Price Action Trading Secrets: http://priceactiontradingsecrets.com/

0:10 Doesn’t matter whether you’re trading Forex, stocks, whatever, right? These strategies can be applied the same. So are you ready? Then let’s begin. Okay, now, before I begin, right, I want to explain to you what is swing trading because some of you are wondering here Rayner, what is swing trading, alright? So let me explain to you quickly. So swing trading, the idea is to capture one swing in the market.

2:10 Swing Trading Strategy #1: Stuck In A Box

The first one is what I call stuck in a box, where the price is pretty much stuck in a range, stuck in a box, similar to what you’ve seen earlier. So this the core idea here is that the market is in a range, you want to buy low and sell high, so how you go about doing it is to let the price come into an area of value, an area of support, okay?

4:14 Swing Trading Strategy #2: Catch The Wave

So the other one is what I call catch the wave. So this is used when the market is in an uptrend. When the market is trending, you are trying to time your entry and capture just one swing in an uptrend.

6:18 Swing Trading Strategy #3: Fade The Move

So it’s what I call fade the move. So this is a counter-trend trade. So because when the market is trending and if it has traveled quite a long, a distance towards the swings high, towards resistance, there is opportunity for you to take a counter trend trade but I’ll share with you a little bit of how to manage this type of trade.

If you want to learn more about what I do, you can go down to my website over here, tradingwithrayner.com, tradingwithrayner.com, Rayner is my name, you should know that. And you can scroll down a little bit and have a couple of trading guides over here. So one is called The Ultimate Guide to Trend Following where I share with you practical trading techniques on how to ride big trends in the market. And then The Ultimate Price Action, The Ultimate Guide to Price Action Trading on How to Better Time Your Entries and Exits. These two guides, completely free, click the blue button. And I’ll send it to your email address. For free. So with that said, I’ve come to the end of this video, I hope you find insightful. If you did, could you please hit the like button, and subscribe to my YouTube channel. And if there’s anything to ask me or any questions, leave it in the comments section below. And I’ll do my best to help. With that said, I’ll talk to you soon.

** FREE TRADING STRATEGY GUIDES **

The Ultimate Guide to Price Action Trading: https://www.tradingwithrayner.com/ultimate-guide-price-action-trading/

The Monster Guide to Candlestick Patterns: https://www.tradingwithrayner.com/candlestick-pdf-guide/

** PREMIUM TRAINING **

Pro Traders Edge: https://www.tradingwithrayner.com/pte/

Pullback Stock Trading System: https://pullbackstocktradingsystem.com/

Price Action Trading Secrets: https://priceactiontradingsecrets.com/

What’s Swing Trading, 3 Proven Swing Trading Strategies (That Work).

3 Things You Require To Understand About Variety Trading

They will “bring the stocks in” to change their position. The dangerous period are the times at which the rate is fluctuating and challenging to forecast. Establish a trading system that works for you based on your screening results.

3 Proven Swing Trading Strategies (That Work), Watch top full videos about What’s Swing Trading.

Win At Forex – An Easy 3 Step Forex Trading Technique For Huge Gains

Traders wait till the quick one crosses over or below the slower one. More common indicators consist of: stochastic, r.s.i, r.v.i, moving averages, candle light sticks, and so on. Usage another indicator to confirm your conclusions.

Forex swing trading is simple to understand, just requires a basic system, its also interesting and fun to do. Here we will look at how you can end up being a successful swing trader from house and stack up huge earnings in around thirty minutes a day.

Cost spikes always take place and they constantly fall back and the aim of the swing trader is – to offer the spike and make a fast earnings. Now we will look at an easy currency swing Stochastic Trading technique you can use today and if you utilize it properly, it can make you triple digit gains.

Because easy systems are more robust than complex ones in the ruthless world of trading and have less aspects to break. All the top traders use essentially easy currency trading systems and you must to.

A number of traders just wait for the time when the price will reach near the point they are anticipating and think that at that point of time they will enter the trade and hope for Stochastic Trading much better levels of hold.Since it will lead to a quick wipe out and the market will take off your equity and will not offer you any rewards, never ever anticipate anything or think anything.

A breakout is likely Stochastic Trading if the assistance and resistance lines are converging. In this case you can not assume that the cost will always turn. When it happens, you may choose to set orders outside the variety of the converging lines to catch a breakout. However once again, examine your conclusions versus a minimum of another sign.

Based on this info we properly predicted the marketplace was decreasing. Now a lot of you would ask me why not simply get in your trade and ride it down.

Currency trading is a method of making cash however it likewise depends on the luck element. But all is not lost if the traders make guidelines on their own and follow them. This will not only guarantee higher earnings however also reduce the threat of greater losses in trade.

There is much written on this to fill all your peaceful nights in checking out for years. And in a downtrend, connect two greater lows with a straight line. A stock market trend is a force that demands our respect.

If you are looking exclusive exciting videos relevant with What’s Swing Trading, and Online Forex Charting, Trading Rules, Trading Strategies dont forget to signup in email subscription DB for free.