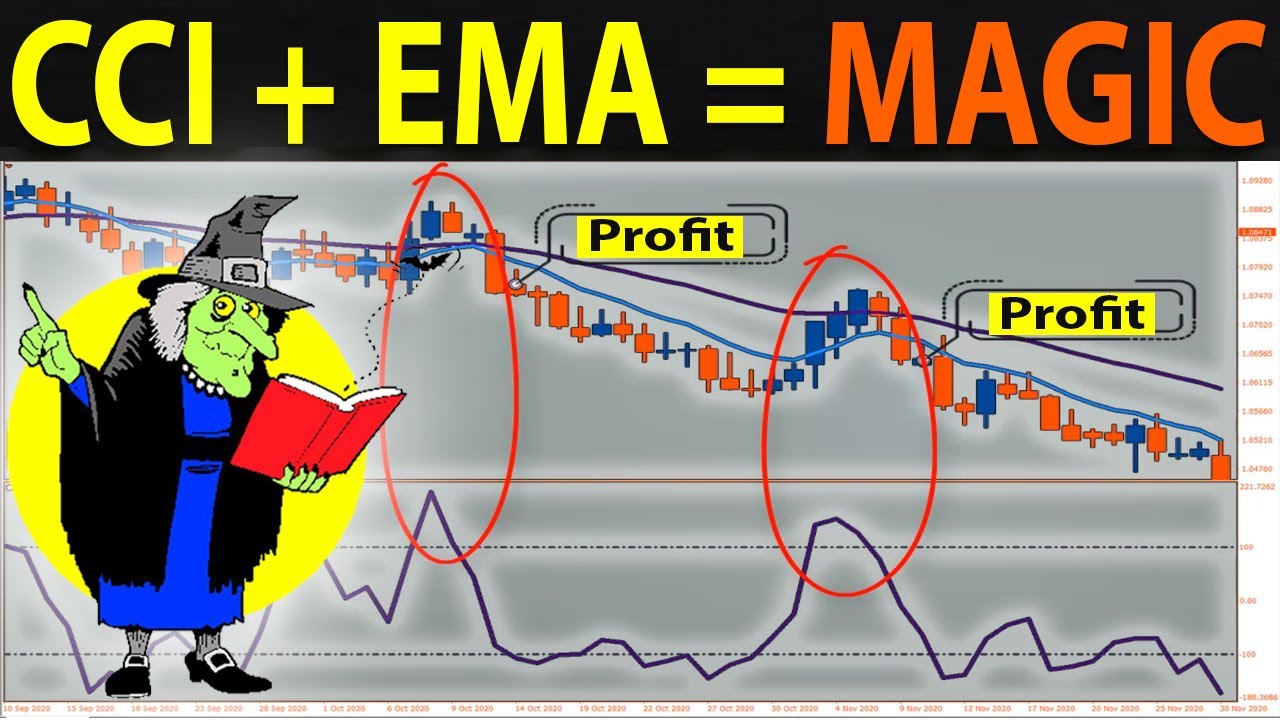

🔴 CCI Indicator Strategy for Winning Trades | Better than RSI..?

Trending clips top searched Stock Prices, Market Trading Systems, Turtle Trading, Trading Rules, and Day Trading Stochastic Settings, 🔴 CCI Indicator Strategy for Winning Trades | Better than RSI..?.

You can use any time frame but consider that amount of noise on lower time frames. Consider using 15 minute charts and above.

Using the cci as a trend indicator can help you to time your entries into a trend.

Instead of buying at the top or selling at the bottom, which usually happens with most traders, the CCI index can signal to you when the best time is to enter a trend.

Day Trading Stochastic Settings, 🔴 CCI Indicator Strategy for Winning Trades | Better than RSI..?.

3 Easiest Ways To Become An Effective Forex Swing Trader Fast

The main purpose of Forex charts is to help making assumptions that will result in much better choice. Yet again, examine your assessments against at least 1 extra indicator.

🔴 CCI Indicator Strategy for Winning Trades | Better than RSI..?, Enjoy interesting updated videos about Day Trading Stochastic Settings.

Forex Trading System – Reputable Trading Ways

Numerous signs are offered in order to recognize the trends of the marketplace. Bollinger bands are based upon standard deviation. Let’s look at the approach and how it works.

Many traders seek to purchase a currency trading system and don’t recognize how easy it is to develop their own. Here we want to take a look at developing a sample trading system for huge revenues.

Rate increases constantly occur and they constantly fall back and the goal of the swing trader is – to sell the spike and make a quick earnings. Now we will look at a basic currency swing Stochastic Trading method you can use right now and if you use it properly, it can make you triple digit gains.

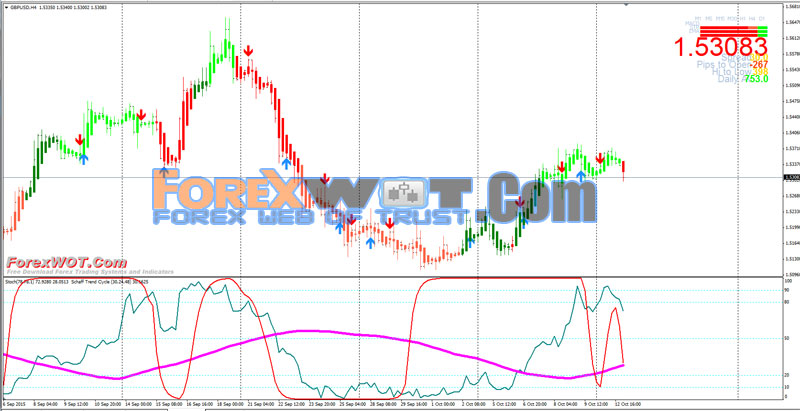

Two of the very best are the stochastic indication and Bollinger band. Utilize these with a breakout technique and they provide you an effective combination for looking for huge gains.

Resistance is the area of the chart where the rate stops increasing. No new highs have been fulfilled in the last couple of Stochastic Trading sessions and the cost is in a sideways direction.

A breakout is likely Stochastic Trading if the support and resistance lines are assembling. In this case you can not assume that the rate will constantly turn. You may prefer to set orders outside the series of the assembling lines to catch a breakout when it takes place. But again, check your conclusions against a minimum of one other indication.

This has actually absolutely been the case for my own trading. When I came to realize the power of trading based on cycles, my trading successes jumped leaps and bounds. In any offered month I average a high portion of winning trades against losing trades, with the couple of losing trades resulting in ridiculously little capital loss. Timing trades with pinpoint precision is empowering, just leaving ones internal mental and psychological luggage to be the only thing that can screw up success. The approach itself is pure.

If the cost goes to a higher pivot level (which can be support or resistance) and the stochastic is high or low for a big time, then a reversal will take place. Then a brand-new trade can be entered accordingly. Hence, in this forex trading strategy, w wait up until the market saturate to low or high and after that offer or purchase depending on the circumstance.

Despite whether the trend of a stock is going up or down, it will always relocate waves. Besides, dealing with a great deal of various currency pairs is confusing and confusion results in errors.

If you are looking unique and entertaining comparisons relevant with Day Trading Stochastic Settings, and Currency Trading Training, Forex Profits, Swing Trading Securities, Forex Trading Tips please join our newsletter for free.