Swing Trading 101: How I Lost $65,000 Before I Hit It Big

Trending vids related to Forex Tips, Back Test Stochasticsnbsp, Currency Trading Method, Automatic Trading System, and What’s Swing Trading, Swing Trading 101: How I Lost $65,000 Before I Hit It Big.

https://www.t3live.com/sami-unsexy-ebook-youtube for Sami’s trend analysis secrets.

Sami Abusaad explains how he lost $65,000 trading before he learned about what it takes to succeed.

Sami shows you:

-How he learned to trade after a big win and a bigger $65,000 loss

-Why he left a lucrative career as a Certified Public Accountant

-Day trading vs. swing trading

-Why swing trading is superior for some people

–How he uses news in trading

-What he learned from Jesse Livermore

-How the life cycle of a stock works

-What he learned from a mega rally in Starbucks (SBUX)

This is an excerpt of a lecture Sami taught in New York City. We may release the full lecture as a paid product in the future.

Sign up for Sami’s eBook to get updated:

https://www.t3live.com/sami-unsexy-ebook-youtube for Sami’s trend analysis secrets.

What’s Swing Trading, Swing Trading 101: How I Lost $65,000 Before I Hit It Big.

Forex Trading System – Trusted Trading Ways

They are the nearest you can get to trading in genuine time with all the pressure of prospective losses. The outer bands can be used for contrary positions or to bank profits. It functions even in unstable market conditions.

Swing Trading 101: How I Lost $65,000 Before I Hit It Big, Find trending high definition online streaming videos related to What’s Swing Trading.

Range Trading Secrets

Forex trading can be found out by anyone and easy forex trading systems are best. The easier your system is, the more earnings it will create on a long term. Do not ever purchase any forex robot that does not have a money-back guarantee.

Let’s look at Fibonacci firstly. This 750 year old “natural order” of numbers shows the birth of bunnies in a field, the number of rinds on a pineapple, the series of sunflower seeds. So how do we apply it to forex trading?

Forex is an acronym of foreign exchange and it is a 24hr market that opens from Sunday evening to Friday evening. It is one of the most traded market in the world with about $3 trillion being traded every day. With this arrangement, you can trade on your own schedule and exploit price Stochastic Trading fluctuations in the market.

Them significant problem for most traders who use forex technical analysis or forex charts is they have no understanding of how to handle volatility from a entry, or stop point of view.

Numerous traders simply wait for the time when the cost will reach near the point they are expecting and believe that at that point of time they will get in the trade and hope for Stochastic Trading much better levels of hold.Never anticipate anything or guess anything due to the fact that it will lead to a quick eliminate and the market will remove your equity and will not provide you any rewards.

Do you have a stop loss or target to leave a trade? One of the greatest mistakes that forex traders made is trading without a stop loss. I have actually stressed lots of times that every position must have a stop loss however till now, there are much of my members still Stochastic Trading without setting a stop. Are you among them?

How do you draw trendlines? In an up pattern, link two lower highs with a line. That’s it! And in a downtrend, connect 2 higher lows with a straight line. Now, the slope of a trendline can inform you a lot about the strength of a pattern. For instance, a steep trendline reveals extreme bullish attitude of the purchasers.

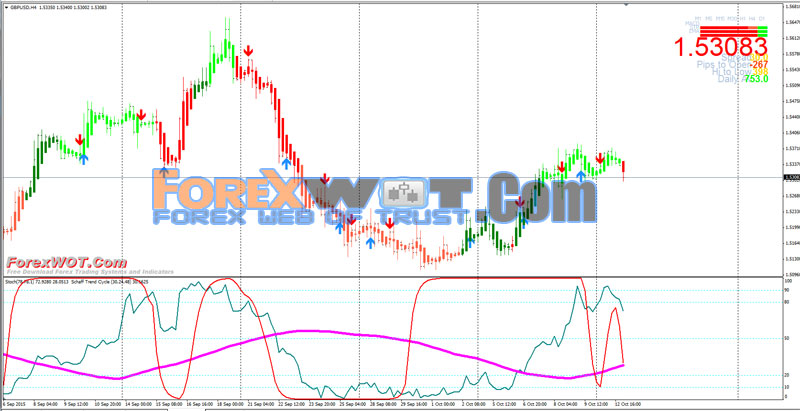

If the cost goes to a higher pivot level (which can be assistance or resistance) and the stochastic is high or low for a big time, then a reversal will occur. Then a new trade can be entered accordingly. Thus, in this forex trading strategy, w wait till the marketplace saturate to high or low and then offer or buy depending upon the circumstance.

Forex trading can be discovered by anybody and simple forex trading systems are best. It is this if one must understand anything about the stock market. It is ruled by feelings. When analysing a stock’s chart, moving averages are crucial.

If you are finding most entertaining comparisons relevant with What’s Swing Trading, and Forex Traders, Stock Market System, Trend Following System, a Great Stock Trading Indicator: Try This Now please subscribe for email alerts service totally free.