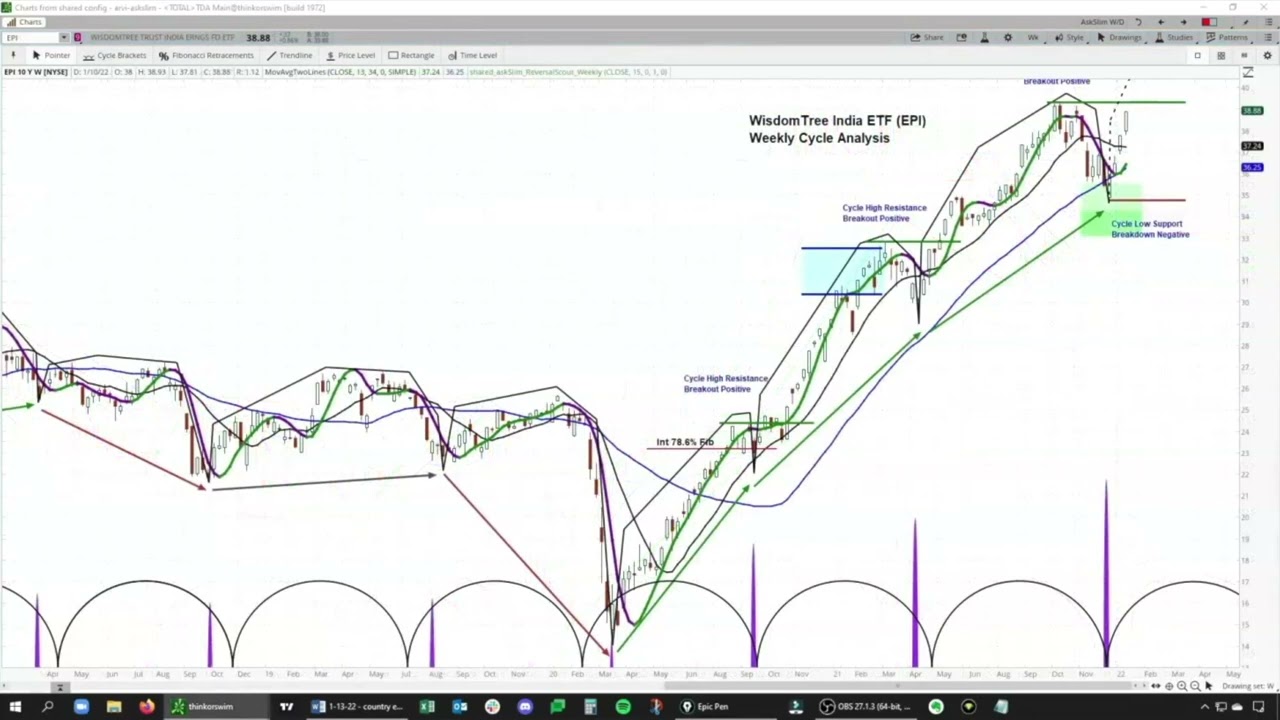

Stock Sectors Member Video Preview | Country ETFs South Korea & India | Chart Review and Projections

Popular updated videos about Forex Swing Traders, Four Tips, Forex Traading System, Daily Charts Forex Strategy, and What’s Swing Trading, Stock Sectors Member Video Preview | Country ETFs South Korea & India | Chart Review and Projections.

See Slim live, Jan 20, 10:00am ET

Sign up for the Wealth365 Event here:

Enjoy a clip from the latest episode of the askSlim Market Week.

Hear 46-year trading pro, Steve Miller, share unique analysis and commentary on the financial markets. Slim looks at 300+ #stocks, #ETFs , #Indexes and #futures. Bull market or bear market, you’ll be amazed at these unique cycle charts, evolved from decades of work.

Become a FREE askSlim member: https://askslim.com/free-account-2019/

Check out premium memberships: https://askslim.com/membership-options/

Check out our YouTube Channel: https://www.youtube.com/channel/UCoAuxtwgh8LSHeMFqEwjgHA

Add me on twitter @askSlim

———————————————————————

Slim’s Background:

#Trader, analyst and mentor, Steve “Slim” Miller is an active trader in index futures, #gold, #silver, #bonds, oil, #dollar, euro, stocks and #options. He is also a trader coach and hedge fund consultant. Slim is a past member of the CBOE, CBOT and Chicago Mercantile Exchange.

Slim looks at things differently than most market analysts. He applies his unique cycle analysis to nearly 400 widely held stocks, futures and ETFs. Learn the most unique style of technical analysis, evolved from the work of JM Hurst’s book, “Profit Magic of Stock Transaction Timing”

For investors and traders with interest in, investing, trading, swing trade, scalping, indextrading, pairs, indexes, treasury, #FOREX, #FX trading, dollar, euro, yen, pound, currency, currencies, Powell, interest rates, Fed, FOMC.

Our interests

Brokers: TDA, TD Ameritrade, thinkorswim, Schwab, Etrade, Fidelity, Tastyworks, robinhood, webull,

Charting: stockcharts, barcharts, tradingview

Strategies: swing #trading, scalping, #investing, investments, fxtrading, fx trading, fx signals, crude oil, bullish, bearish, options, option trading, spreading, pair trading, vertical spreads, butterfly spreads, iron condors, strangles, straddles, diagonal spread, delta, Vega, Gama, theta, option decay, leverage ETF

What’s Swing Trading, Stock Sectors Member Video Preview | Country ETFs South Korea & India | Chart Review and Projections.

Forex Trading – My Day Trading Thoughts

There are many fake breakouts though and hence you desire to trade breakouts on the present pattern.

In swing trading, a trader attempts to ride a trend in the market as long as it lasts.

Stock Sectors Member Video Preview | Country ETFs South Korea & India | Chart Review and Projections, Enjoy latest complete videos related to What’s Swing Trading.

Online Forex Trading – A Basic Effective Technique Making Huge Profits

Dow theory in nutshell states that you can utilize the past cost action to forecast the future rate action. You are trading the reality of rate change and in Forex trading, that’s a timeless way to earn money.

Here we are going to look at two trading opportunities recently we banked a great profit in the British Pound. This week we are going to take a look at the US Dollar V British Pound and Japanese Yen.

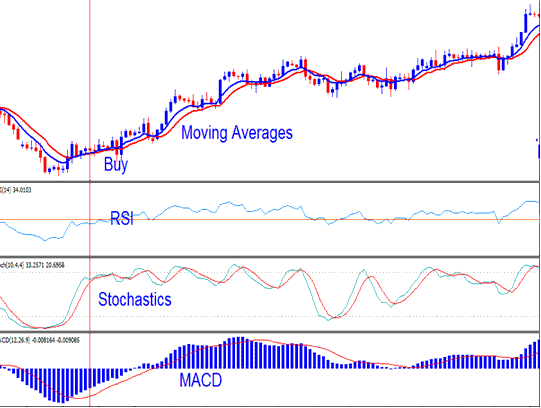

Use another sign to validate your conclusions. If the assistance and the resistancelines are touching, then, there is likely to have a breakout. And if this is the Stochastic Trading circumstance, you will not have the ability to presume that the rate will turn again. So, you might just want to set your orders beyond the stretch ofthe support and the resistance lines in order for you to capture an occurring breakout. However, you must utilize another indicator so you can validate your conclusions.

Your Technique: this suggest the guidelines you utilize to determine the pattern and the how the cash is managed in the forex account. As stated above, it must be basic to ease the usage of it.

Keep in mind, you will never ever cost the specific top due to the fact that no one understands the marketplace for particular. You must keep your winning trades longer. However, if your technical indicators go versus you, and the patterns begin to stop working, that’s when you need to offer your stock and take Stochastic Trading profit.

Technical analysts try to find a trend, and flight that trend until the trend has confirmed a reversal. If an excellent business’s stock is in a downtrend according to its chart, a trader or investor using Technical Analysis will not Stochastic Trading buy the stock till its pattern has reversed and it has been confirmed according to other important technical signs.

Keep your stop well back up until the trend remains in motion. Path your stop up gradually and outside of normal volatility, so you do not get bumped out of the pattern to quickly.

In this article is a trading method revealed that is based on the Bolling Bands and the stochastic signs. The strategy is easy to utilize and could be utilized by day traders that want to trade brief trades like 10 or thirty minutes trades.

As we went over in Part 1 of this series, by now you ought to have an identified trends for the stocks you are seeing. Flatter the assistance and resistance, stronger will be your conviction that the range is genuine.

If you are looking most engaging videos relevant with What’s Swing Trading, and Stock Market Trend, Currency Swing Trading dont forget to list your email address in email subscription DB totally free.